- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Browsing: Diaspora Remittances

- Kenyans in the diaspora increased the money they sent back home for the 12 months ending in December 2023 by $0.16 billion, reaching $4.19 billion.

- Inflows for December 2023 increased by 5 percent to $372.6 million from $355.0 million in November.

- December marked the second month, after July, to record the highest amount sent back home by Kenyans during the year.

Kenyans living and working abroad increased the money they sent back home for the 12 months ending in December 2023 by $0.16 billion, reaching $4.19 billion. This marked a 4.0 percent increase from the $4.03 billion remitted in 2022.

The rise in remittances could be attributed to the weakening shilling, as projected by Western Union. In its inaugural Global Money Transfer Index in March of the previous year, the corporation had anticipated an upswing in remittances, driven by the weakening shilling, which has now surpassed the 160 mark against …

- Kenyans in the diaspora sent home $4.19 billion in 2023 as remittance inflows to the East African country hit an all-time high.

- The high numbers signal that Kenyans living and working in the diaspora defied the inflationary pressures they still experienced to send more money back home.

- Since the height of the COVID-19 pandemic, many Kenyans in the diaspora have had to cut spending to navigate inflationary pressures and afford to send money back home.

Kenyans in the diaspora sent home $4.19 billion in 2023 as remittance inflows to the East African country hit an all-time high, boosting foreign exchange reserves and support for families in the wake of tough economic times.

According to the Central Bank of Kenya (CBK), the figures are up by four per cent compared to the $4.02 billion sent in 2022.

“The inflows were strong in December 2023 at $372.6 million compared to $355.0 million …

- For millions of households in Uganda, remittances play a vital role in safeguarding food security, healthcare, savings and investment opportunities.

- IFAD data shows 75% of money sent to Uganda is used to fight poverty and improve access to nutrition, health, housing and education.

- The remaining 25 percent is used to support small businesses and facilitate access to financial products.

The UN’s International Fund for Agricultural Development (IFAD) has partnered with Stanbic Bank Uganda (SBU) in a plan to reduce the cost incurred by Ugandans sending money back home by half through a digital payment platform dubbed FlexiPay.

The partnership will also provide remittance recipients, especially in rural areas, with digital and financial training to promote the savings culture and foster digital finance uptake among these communities.

Cost of remittances in Uganda

At the moment, the average cost of sending money back home for Uganda’s migrant workers is 11.3 per cent, …

- Equity Group grew the volume of diaspora remittances it processed by 39 per cent in 2021 compared to the corresponding period in 2020

- The lender handled Ksh383.5 billion in remittances in the 12 months to December, up from Ksh279.4 billion in 2021

- Equity Group CEO James Mwangi attributed this to linkage with multiple digital platforms, which have helped widen the geographical reach in the remittances segment

Equity Group grew the volume of diaspora remittances it processed by 39 per cent in 2021 compared to the corresponding period in 2020, leveraging on the growing popularity of digital channels for sending money home from abroad.

The lender handled Ksh383.5 billion in remittances in the 12 months to December, up from Ksh279.4 billion in 2021.

The Group’s Chief Executive Officer and Managing Director, James Mwangi attributed this to linkage with multiple digital platforms, which have helped widen the geographical reach in the remittances …

- Kenyan women living in the diaspora send more money home for household activities and needs than men

- They also tend to prioritize money for household needs has been attributed to the desire to meet the various needs of families back at home

- There remains a high appetite for investment opportunities in Africa from the diaspora with nearly 56 per cent who had never invested in Africa in the past being interested to start and receive more information about investing

A new study has revealed that Kenyan women living in the diaspora send more money home for household activities and needs than men.

The report, which was submitted to Pangea Trust by Samawati Capital Partners and Blue Inventure Limited and was conducted in the period of April-June 2021, reveals that on the other hand, men send funds home for investment purposes.

“We see the diaspora as a largely untapped resource in …

The Covid-19 pandemic continues to rage. African countries have so far recorded fewer cases than most other continents. However, a new, more infectious variant of the virus has surfaced in South Africa. This new strain is a significant threat to continental health. Given that the bulk of African countries’ health systems leave a lot to be desired, this is a heavy blow.

That said, the effects of Covid-19 on African economies extend beyond the immediate impact on health. It goes to the effects of lockdown measures, interference with external trade as well as interruption of foreign inflows particularly, remittances from the diaspora, that have a considerable effect on most economies.

Diaspora remittances to Africa

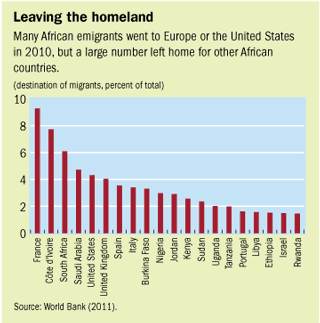

Driven by economic and other challenges, a sizeable number of Africans are living and working in different countries across the world. According to research by the Pew Research Center, over 25 million sub-Saharan Africans were living …

Africa has had a dark past and specifically the four century long blot of human slavery climaxing in the 17th and 18th century. However, some of the descendants of the slaves have gone on to make great businessmen with great influence in the world.

Ghana has realized the potential such a group of people pose to the African economy and has launched several drives to make the African Diaspora return to the continent and invest in projects of their choice.

The Ghana Diaspora Celebration & Homecoming Summit 2019 (GDHS’19) is a four-day event recognizing and celebrating the immense contributions to nation building by the Ghanaian Diaspora.

The event will not only highlight past contributions but will focus on present contributions as well, whiles furthering the advocacy for political, economic, and all other systems and policies that would facilitate future contributions by the Ghanaian Diaspora.

Ghana’s president Nana Akufo-Addo in October …