- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

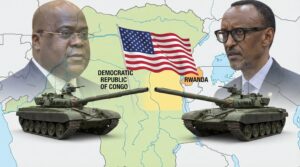

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Browsing: Investing

Financial knowledge remains paramount in an era in which increasingly complex financial products have become readily available to many. Governments in different countries have put more effort into expanding access to financial services. Consequently, the number of individuals with bank accounts and access to credit products is increasing.

Financial literacy remains crucial to personal and economic empowerment, enabling people to make sound financial choices and manage their finances effectively. Africa suffers from a significant shortage of financial literacy, which hinders its economic growth and development.

However, integrating cryptocurrencies with conventional financial systems becomes increasingly essential as they become more commonplace. This presents several obstacles to overcome before cryptocurrencies can realise their full potential. For instance, traditional institutions may be hesitant to work with cryptocurrencies due to concerns about money laundering and other illicit activities. Moreover, the technical difficulty of integrating cryptocurrencies with existing banking systems can prove intimidating.

By listing, the REIT aims to attract focused and permanent capital for the promoter to develop further assets, support the Insurance and Pensions Commission and Ministry of Finance and Economic Development in their efforts to provide liquidity and deepen the savings pool through REIT products and also to provide retail and institutional investors quality and liquid commercial real estate investment vehicle.

Based on the published prospectors, the company said the economic growth of a nation is driven by a vibrant commercial infrastructure both industrial and retail properties to support production and trade.

The development of quality commercial property is more than imperative in the Southern African country as the economy is set for a path of recovery that is expected to revitalize significant economic activity.

“The participation of local beneficiaries in the development and ownership of such property fosters an inclusive capital growth and sources of passive income for average Zimbabweans. This presents a strong case for a well-structured REIT that allows participation of investors with minimum capital requirement, offering value preservation and stable return on capital through income distributions and capital gains.

Riozim Limited the Zimbabwe based, and Zimbabwe Stock Exchange-listed diversified miner, has more going wrong for it than right. For…

The high-interest rates have made the United States dollar more appealing to investors who are piling into the greenback. The value of other currencies has tumbled: the pound, yuan, euro, and the yen. This depreciation in other currencies makes imports for these countries more expensive in United States dollars. The case for a recession caused by a strong dollar is grimmer in Africa where just about every country on the continent is overextended in terms of United States dollar-denominated borrowings.

Repaying loans in hard currency will be more expensive, especially where their currencies are rapidly depreciating.

The strong US dollar according to CNN has a destabilizing effect on Wall Street.

Companies listed on that bourse conduct business internationally, and a strong dollar will negatively impact their earnings. The second marker of the global economic recession is that US economy is slowing down or stalling. The world’s largest economy is driven by consumption.

In terms of foreign exchange reserves, according to HM Treasury, Britain has net official reserves of US$ 114 billion whereas it plans to embark on an economic plan to pull itself out of the stagflation quagmire by spending no less than US$ 173 billion dollars. If Britain were to use all its foreign exchange reserves to meet the cost of its economic plan it would run short of money and still have a deficit of US$ 59 billion dollars before fully implementing its plan.

Fair enough and granted, governments do not always have to spend cash that they have on hand. They can always borrow if they do not have sufficient cash to finance their operations.

Herein is the problem, the current economic environment does not support borrowing either by individuals, households, or governments. The cost of borrowing is just simply too high either by domestic debt or foreign debt. The Bank of England in acting against rising inflation has been raising interest rates. This translates to higher borrowing costs and reduced inflation.

China presently has the largest sum of foreign exchange reserves in the world. When its over US$ 3 trillion in reserves is added to the reserves of the other BRICS member states the questions as to why they cannot issue their own currency start to grow louder.

Talks of a common currency fizzled out as more pressing national and international matters eclipsed the idea. This year 2022 has seen renewed calls for a common reserve currency emerge once again. This time Russia is leading the call for the creation of a reserve currency that will be an alternative to the United States dollar as a mechanism for the settlement of international transactions.

Russia’s motive for making such a call is obvious, the country has been at war with Ukraine since February 2022. This aggression against Ukraine has earned Russia some of the most stringent economic sanctions in history. What has been the greatest pain point is that Russia has lost access to at least half of its foreign exchange reserves since the beginning of its war with Ukraine.

The ZSE’s 2020 research found that individual Zimbabweans made a meagre amount of contributions to the regional capital market. A few of the obstacles mentioned are a lack of understanding of the investment process and the notion that it is the realm and preservation of the wealthy in society.

According to an article by Mail and Guardian published May 25, 2022, this survey prompted the bourse to launch ZSE Direct, a product that would make access to the market straightforward even for first-time investors.

In terms of the economic outlook for India, opinions are divided given the headwinds facing the global economy presently, like the cost-push inflation from increases in food prices and soaring energy costs brought on by the Russia-Ukraine conflict. Deloitte, the global consulting and accounting firm, is optimistic about the economic growth prospects of India. It is projected that the Asian country will remain the fastest growing economy in the world, with growth projected to come in at between 7.1% to 7.6% in the years 2022 to 2023 and 6% to 6.7% in the years 2023 to 2024.

How has India managed to bullet-proof its economy to the extent that it has managed to register economic growth within a context of slowing global economic growth? According to Deloitte, India is primarily a domestic demand-driven economy, with consumption and investments contributing to 70% of the economic activity.

According to the Reserve Bank of India (RBI) analysis of 10,000 listed companies, businesses have seen a steady net profit-to-sales growth over the past year and are sitting on piles of cash. This fact highlighted by the global accounting firm is a key contrast with African economies, which tend to be driven by factors other than domestic demand. African economies generally suffer from a disproportionate dependence on foreign demand to drive economic growth.

The Central African Republic was the 186th largest exporter in the world in 2020 with a total export value of US$127 million. The country’s exports decreased by US$26.1 million over the past five reported years, from US$153 million in 2015 to US$127 million in 2020.

Rough wood which contributed US$51.9 million in export earnings, gold (US$34.7 million), diamonds (US$14.7 million), sawn wood (US$9.55 million) and refined copper (US$6.66 million) are the most recent export leaders. China (US$50.8 million), the United Arab Emirates (US$37.3 million), Italy (US$12.2 million), Belgium (US$6.84 million), and France (US$4.5 million) are the Central African Republic’s top export markets.