Tigere Property Fund is set to become Zimbabwe’s first listed Real Estate Investment Trust (REIT) following the publication of its prospectus and announcement of listing dates to the public last week on Friday, October 28.

This comes after the Securities and Exchange Commission approved Tigere REIT in July this year.

The REIT is duly licenced by the Securities and Exchange Commission of Zimbabwe in terms of the Collective investments Schemes Act (Chapter 24:19). In a letter dated October 21, 2022, the Listings Committee of the Zimbabwe Stock Exchange (ZSE) approved the listing of Tigere REIT on the ZSE.

- Tigere Real Estate Investment Trust is set to list on the ZSE in November, a development expected to build a strong real estate sector and stimulate economic growth through infrastructure development.

- The Tigere REIT will be listed under the symbol TIGZ. According to the firm’s prospectus published on Friday, listing is scheduled for November 23, 2022. (vivanteliving.com)

The Promoter (Frontier Real Estate) intends to sell a total of 255,323,000 REIT units in Tigere Property Fund at an Offer Price of ZWL 28.00 per unit by way of an offer for units to the investing public. At the conclusion of the Initial Public Offer (IPO), it is envisaged that the entire issued Units of 719,323,000 will be listed on the ZSE.

According to the published prospectus, the total Initial Estimated Expenses associated with the Listing of Tigere REIT on the ZSE are expected to amount to approximately US$770 902 which relates to professional fees as well as regulatory, advertising, printing and postage charges. The costs also include stamp duties related to the property transfers into the REIT.

Read: REITs to add depth to Zimbabwean Capital Market

Following regulatory approval in 2021, the listing of Tigere will be a significant milestone for the Ministry of Finance, the Zimbabwe Stock Exchange (ZSE), and the broader investor community as it brings more investor options to the table.

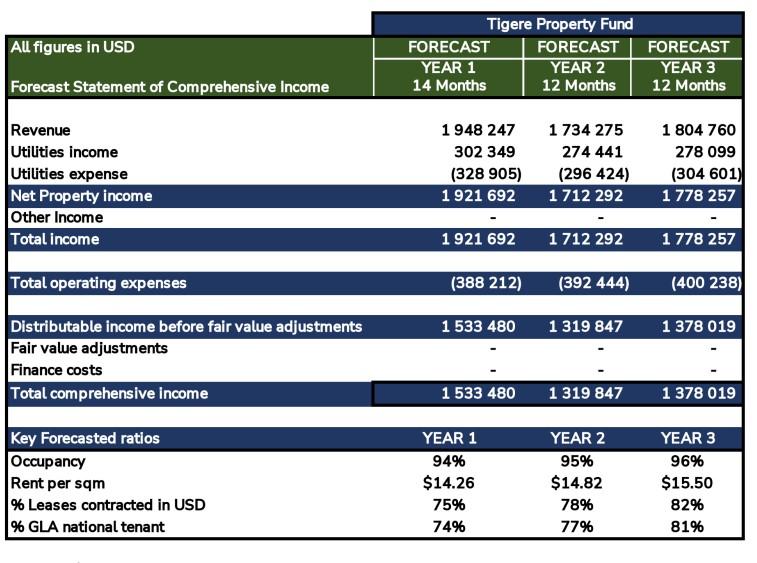

“We are delighted to announce the listing of the Tigere REIT, which is an important step in developing and strengthening the capital markets, as well as building a strong real estate sector within Zimbabwe. Our seed assets are already performing exceptionally well, with income and occupancy levels trading ahead of initial expectations.” commented Brett Abrahamse of Terrace Africa Asset Management.

The Tigere REIT will be listed on the Zimbabwe Stock Exchange under the symbol TIGZ and will provide an opportunity for investors to own a stake in high quality commercial property through a highly regulated financial structure.

Commenting on the new development ZSE CEO, Justin Bgoni, said: “The listing of the Tigere Property Fund is an exciting moment in the history of Zimbabwe’s property sector and the broader economy. It is a culmination of years of work and policy driven by the Minister of Finance and Economic Development, Mthuli Ncube to grow and deepen capital markets that has led to the formation of REITs in Zimbabwe.

Read: Technology to attract youthful investors to Zimbabwe’s capital markets

“As the ZSE, we are indebted to the ministry’s support and believe this listing is a symbol of progress and that Zimbabwe is open for business. We look forward to seeing more REITs list in the near future and congratulate the Tigere team on their achievement and unlocking more value for investors and facilitating economic growth in the country.”

- The REIT is duly licenced by the Securities and Exchange Commission of Zimbabwe in terms of the Collective investments Schemes Act (Chapter 24:19).

- According to the prospectus, REIT has been seeded with newly completed retail property assets in line with the Finance (No. 2) Act of 2020’s qualifying requirement for tax exemption status to REITs. The two properties that will be seeded to the Fund are Highland Park (Phase 1) and Chinamano Corner, both properties located in Harare.

By listing, the REIT aims to attract focused and permanent capital for the promoter to develop further assets, support the Insurance and Pensions Commission and Ministry of Finance and Economic Development in their efforts to provide liquidity and deepen the savings pool through REIT products and also to provide retail and institutional investors quality and liquid commercial real estate investment vehicle.

Based on the published prospectors, the company said the economic growth of a nation is driven by a vibrant commercial infrastructure both industrial and retail properties to support production and trade.

The development of quality commercial property is more than imperative in the Southern African country as the economy is set for a path of recovery that is expected to revitalize significant economic activity.

“The participation of local beneficiaries in the development and ownership of such property fosters an inclusive capital growth and sources of passive income for average Zimbabweans. This presents a strong case for a well-structured REIT that allows participation of investors with minimum capital requirement, offering value preservation and stable return on capital through income distributions and capital gains.

“The Tigere REIT will offer a unique opportunity to investors by giving them exposure to high quality retail property assets in strategic locations with growing demand across Zimbabwe. The Fund will target to achieve a minimum income yield, which will be backed by a diversified tenant mix of quality tenants and active asset management,” read the prospectus.

According to the prospectus, REIT has been seeded with newly completed retail property assets in line with the Finance (No. 2) Act of 2020’s qualifying requirement for tax exemption status to REITs. The two properties that will be seeded to the Fund are Highland Park (Phase 1) and Chinamano Corner, both properties located in Harare.

According to Abrahamse, the Tigere REIT has been seeded with two new commercial retail assets, which together have a combined total of 41 retail tenants.

Highland Park – “The Property is situated in Highlands with its formal address being 1 Arcturus Road, Highlands, Harare with consolidated stand number 1006 of Highlands. The development, with a gross lettable area of approximately 6,704 square meters with 221 parking spaces, comprises 27 Retail tenants including a fuel station.”

Chinamano Corner – “The Property is situated at the corner of J. Chinamano Avenue and Sam Nujoma leading directly out of the Harare CBD with its formal address being 23 J. Chinamano Avenue. The tenant mix consists of 13 shops which includes a pharmacy, convenience retail, florist and multiple food tenants. A Puma fuel station acts as a key attraction to the site allowing for a steady stream of clientele throughout the day,” read the prospectus.

Read: 2022 a defining year for Zimbabwe’s capital markets