- McKinsey report found that fintech in Africa is the fastest-growing startup industry, raising over US$1.3 billion in 2021

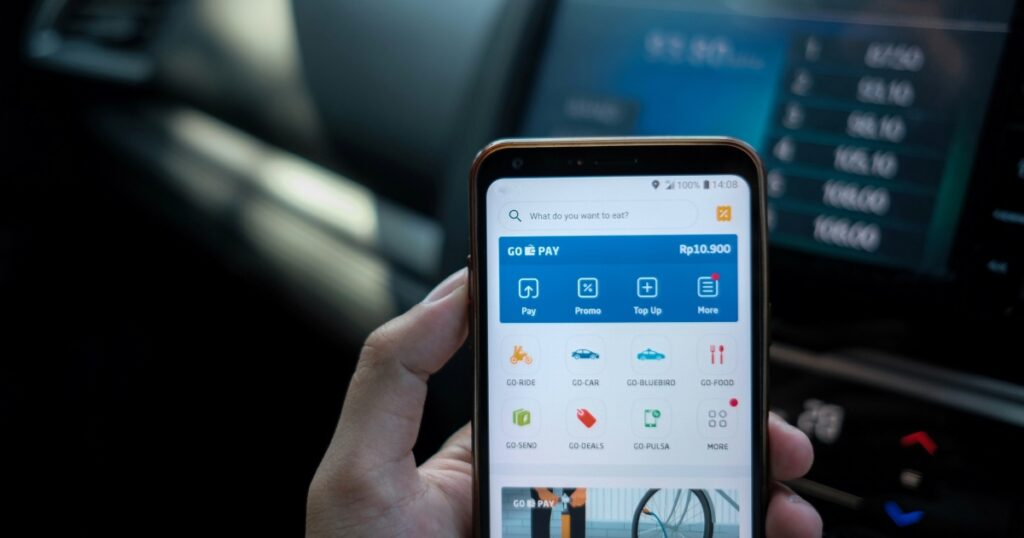

- The industry is being supported by several trends, including smartphone ownership, declining internet costs, and a young, fast-growing, and rapidly urbanising population

- Cash is still used in around 90% of transactions in Africa, which means that fintech revenues have huge potential to grow

- The top challenges that fintech may face include reaching scale and profitability, navigating an uncertain regulatory environment, managing scarcity, and building robust corporate governance foundations

A new finding named fintech in Africa as the fastest-growing startup industry, raising over US$1.3 billion in 2021.

McKinsey & Company found that the industry is being supported by several trends, including smartphone ownership, declining internet costs, expanded network coverage, and a young, fast-growing, and rapidly urbanizing population. Further, the COVID-19 pandemic has also accelerated existing trends toward digitalization and created a fertile environment for new technology players.

The research firm found that African fintech is emerging as a hotbed for investment, with average deal sizes growing. They also found that the proportion of fintech funding in Africa increased over the past year, bringing jobs and growth to African economies.

“As fintech in Africa matures, financial services on the continent are at an inflection point, and several African countries have an important opportunity to capitalise on the momentum of recent years to unlock further potential in the sector,” the report noted.

Opportunities for growth of fintech in Africa

Further, McKinsey observed that despite a slowdown in funding in line with global trends, they expect significant growth and value creation to lie ahead for the fintech industry in Africa. The research firm said that this would be supported by the fact that cash is still used in around 90% of transactions in Africa, which means that fintech revenues have huge potential to grow.

“If the sector overall can reach similar levels of penetration to those seen in Kenya, a country with one of the highest levels of fintech penetration in the world, we estimate that African fintech revenues could reach eight times their current value by 2025,” the report said.

As such, the company estimates that the continent’s financial-services market could grow at about 10% per annum, reaching about $230 billion in revenues by 2025 ($150 billion excluding South Africa, which is the largest and most mature market on the continent).

McKinsey said their analysis showed that fintech players deliver significant value to their customers, with their transactional solutions estimated at up to 80% cheaper.

Kenya, Nigeria, SA lead fintech growth in Africa as sector sees massive expansion

“Taken together with an influx of funding and increasingly supportive regulatory frameworks, these factors could signify that African fintech markets are at the beginning of a period of exponential growth if, as expected, they follow the trajectory of more mature markets such as Vietnam, Indonesia, and India.”

African countries leading in fintech

The lion’s share of value in the market, at approximately 40%, is currently concentrated in South Africa, which has the most mature banking system on the continent.

Ghana and francophone West Africa are expected to show the fastest growth, at 15% and 13% per annum respectively, until 2025.

Nigeria and Egypt follow, each with an expected growth rate of 12% per annum over the same period.

Overall, McKinsey said it anticipates that the growth opportunity in fintech is likely to be concentrated in 11 key markets namely Cameroon, Côte d’Ivoire, Egypt, Ghana, Kenya, Morocco, Nigeria, Senegal, South Africa, Tanzania, and Uganda, which together account for 70% of Africa’s GDP and half of its population.

“Given the varying levels of digital maturity across these countries, the opportunities in each market will be different. Economies with more mature financial systems and digital infrastructures, such as South Africa and Nigeria, are likely to see more innovation in advanced financial services,” the company said.

Challenges fintechs in Africa may face

However, McKinsey warned that fintech start-ups in Africa face four key challenges on the road to sustainability: reaching scale and profitability, navigating an uncertain regulatory environment, managing scarcity, and building robust corporate governance foundations.