The South African Revenue Service (SARS) has committed to achieving higher revenue estimates, underpinned by data science and technology.

This comes after South Africa’s Finance Minister Enoch Godongwana tabled the Medium Term Budget Policy Statement (MTBPS) in Cape Town on Wednesday.

- The South African Revenue Service (SARS) has accepted the challenge the minister of finance put forward in his latest Medium-Term Budget Policy Statement to collect even more taxes.

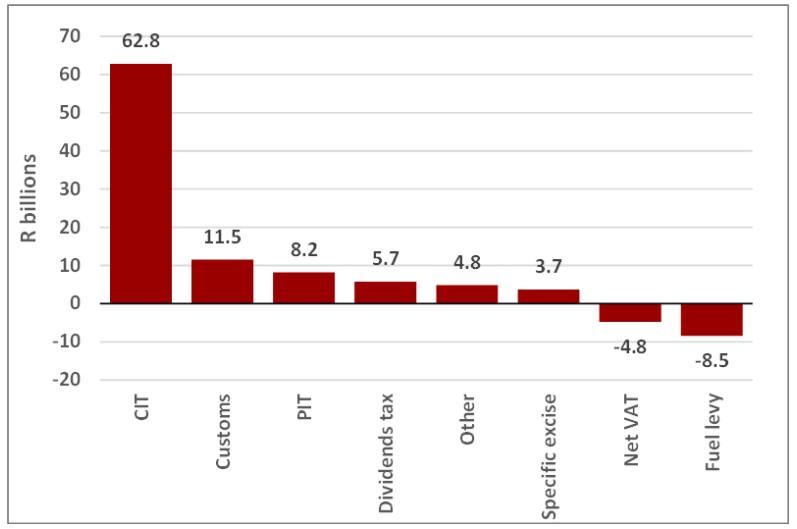

- Gross tax revenues are expected to exceed the estimates presented at the time of the 2022 Budget by R83.5 billion in 2022/23, of which corporate income tax is expected to account for R62.8 billion.

The Minister’s policy message focused on strengthening South Africa’s fiscal integrity over the medium term by managing the country’s finances with prudence.

Delivering the Medium-Term Budget Policy Statement (MTBPS), the Minister increased the revenue collection estimate that SARS must collect to R1.682 trillion from R1.598 trillion.

SARS is central to tax revenue collections in the country and allows for adequate fiscal space to attend to social and investment spending priorities while keeping an eye on debt service costs. It provides about 90 per cent of all government revenue, which makes this increase in the revenue to be collected by SARS very significant.

The South African Revenue Service (SARS) has welcomed Finance Minister Enoch Godongwa’s emphasis on ensuring that government finances are spent in an equitable, efficient and flexible manner to support South Africa’s development objectives.

“As SARS, we accept the challenge of the revised higher revenue estimate. While the revised revenue estimate is steep, we are committed to acting according to what is permissible in law to meet this challenge.

“The rebuilding of SARS is evident in improved revenue collection. We are laying a firm foundation for this new environment, which is the synthesis of data-driven insights, enabling information and technology infrastructure and employing skilled staff, which are indispensable for this modernisation journey’s success. We are equally committed to countering criminal and illicit activity.

“SARS has largely implemented the Nugent Commission recommendations, while outstanding recommendations are currently being aligned with those of the Zondo Commission on state capture,” SARS Commissioner Edward Kieswetter said.

Revenue collections over the first half of 2022/23 were 9 per cent higher than last year’s. The positive impact of high commodity prices continued, and while dissipating, a more broad-based corporate tax recovery improved the near-term revenue outlook. Compared to the 2022 Budget, the gross tax revenue estimate for 2022/23 is projected to be R83.5 billion higher.

VAT refund payments by SARS are expected to exceed pre-COVID levels significantly, while import and domestic VAT collections are projected to perform better than the 2022 budget.

Fuel levy collections are expected to be below 2022 Budget estimates due to the tax relief provided between April and July 2022.

Downside economic risks to the revenue projections are significant and could lead to lower-than-projected outcomes should they materialise.

Gross tax revenues are expected to exceed the estimates presented at the time of the 2022 Budget by R83.5 billion in 2022/23, of which corporate income tax is expected to account for R62.8 billion.

SARS said stronger personal income tax collections are expected to bring in an additional R8.2 billion relative to the 2022 Budget Review projections.

South Africa’s gross domestic product (GDP) is expected to grow by 1.9 per cent in 2022 from 4.9 per cent in 2021. Revenue collections, as at September 30, 2022, amounted to R784.8 billion, yielding growth of R64.7 billion (9.0 per cent) against prior year collections of R751.0 billion.

“All collections against the previous year showed an upward trend except for the fuel levy, which recorded a contraction of R9.1 billion (-20.9 per cent). The year-to-date growth was partially offset by the total refunds paid out, which were R32.5 billion (20.9 per cent) higher than the previous year, with VAT refunds R26.2 billion (21.0 per cent) higher in the first half of the year.

“At budget in February 2022, tax revenues were expected to grow by 3.3 per cent (R1547 billion to R1598 billion). SARS is continuing to improve the efficiency in tax revenue administration through targeted strategic compliance and enforcement interventions to achieve higher taxpayer compliance ratios.”

Kieswetter added that while the performance of the economy is important for revenue collection, “SARS initiatives have counterbalanced the negative impact of the local and global economy”.

“SARS compliance efforts have contributed 12 per cent to the net revenues collected. This is in line with our revenue management philosophy, which has seen our efforts result in an additional R92.5 billion that has been added to the total revenue of R784 billion collected to date.

“Included in the compliance efforts are areas that relate to debt cash collections, curbing impermissible and fraudulent refunds claims, voluntary disclosure management, countering syndicated tax and customs crimes as well as valuation fraud and Customs seizures.”

Customs valuation fraud, excise under-declaration, and syndicated tax crimes, including illicit activities and interventions linked to cases relating to state capture, will remain major areas of focus.

As an illustration to the point, the Commissioner said that SARS’ administrative efforts undertaken in the current financial year to drive compliance revenue include:

831 797 debt cases and 186 691 final demands being issued and successfully pursued, resulting in R 35.2 billion being collected. SARS also prevented the processing of R28 billion of impermissible and fraudulent refund claims.

The setting up of specialised teams that assessed the accuracy of provisional tax payments resulted in R8.4 billion being collected. Over 2,675 Customs interventions resulted in R1.2 billion being collected. SARS’ work in the areas of syndicated tax and Customs crimes is gaining traction, resulting in R1.9 billion being collected. One preservation order was obtained for the value of R150 million.

The estimated value of assets under preservation orders is about R2.9 billion. The liquidation and sequestration of assets to the value of about R2.3 billion has been carried out. SARS also conducted 478 illicit trade interventions, resulting in 403 detentions and 252 seizures.

SARS encouraged taxpayers to use the voluntary disclosure programme to regularise their tax affairs. However, taxpayers must voluntarily disclose any irregularities to SARS, as the programme will not be available once SARS discovers on its own such non-compliance.