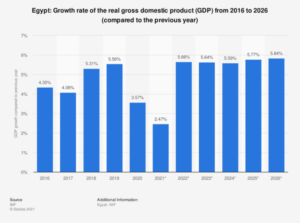

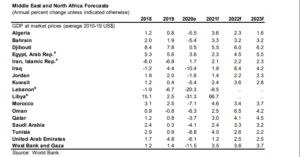

Egypt’s economy is expected to grow by 2.3 percent in the 2020/2021 fiscal year from the previous project of 3.7 percent in January 2021 according to the World Bank’s Economic Prospects report June 2021.

According to the report, In the 2021/2022 fiscal year Egypt is expected to see further growth rise to 4.5 per cent down from 5.8 percent in the January report, which is a decrease of 1.3percent. In the Fiscal year 2022/2023, the report projects a growth rise of 5.5 percent.

According to the World Bank, in the first half of 2021 Egypt’s economy remained sluggish despite the relaxation of lockdown restrictions. Following unprecedented support in 2020, fiscal policy is expected to be less accommodative in 2021 while the average primary fiscal deficit is expected to be about 4 percent of GDP which is about two thirds its level in 2020.

“The scope for further financial support is limited by vulnerabilities related to rising debt from already high levels in a number of economies, including Bahrain, Egypt, Lebanon, Morocco, Oman, and Tunisia, and buffers used up following the oil price collapse of 2015,” the report added.

According to the Bank, Egypt’s real growth declined from 5.6 percent in FY 2018/19 to 3.6 percent during 2019/20 FY and due to the pandemic, the country experienced a 1.7 percent year on year contraction between April and June.

In Q2 of 2020/2021 FY, unemployment declined to 7.2 percent while key sectors such as tourism, manufacturing, oil and gas extractives continued to be affected by the restrictions on international supply and disruption in supply and trade.

According to the bank, in order to create better employment opportunities and improve livelihood, Egypt needs to come up with reforms designed to improve private sector activity and address the country’s long-standing structural challenges.

In its policy steps to address the impact of the pandemic, Egypt raised the minimum wage for public employees, undertook further measures to boost lending and extended a moratorium on charges on most financial transactions.

“International reserves remain relatively ample, at US$40.1 billion at end-January 2021, although still below their pre-crisis peak of US$45.5 billion. External accounts were still bolstered by remittances, rebounding foreign portfolio inflows, and external financing, notably from the IMF, Eurobond issuances, and an innovative Green-bond.” World Bank noted.

The Middle East and North Africa (MENA) region is expected to grow by 2.4 percent in 2021 supported by the recent rebound in oil prices, stronger external demand and fewer economic disruptions from the pandemic.

Growth is expected to further accelerate to 3.5 percent in 2022 due to the increase in vaccination, improvement in oil production and ease in restriction. The outlook is heavily dependent on the course of the pandemic, vaccination availability and rollout.

“The pandemic is expected to continue to be a drag on economic growth among oil-importing economies. In Egypt, growth is forecast to slow to 2.3 percent in FY2020/21, reflecting damage to tourism, manufacturing, and oil and gas extractives from the pandemic, before strengthening again in FY 2021/22. In Morocco, the output is expected to rebound to 4.6 percent in 2021 as drought conditions fade, the policy remains accommodative, and domestic mobility restrictions ease.” The report read in part.

The resurgence of covid-19 cases, weak oil prices in the context of limited economic diversification, conflict and social unrest, delays in vaccination rollout, higher agricultural prices and food insecurity could present risks to the outlook according to World Bank.

Oil demand is expected to remain below pre-pandemic levels through 2023 as limited economic diversification continues to present risks.

Political risk, fragility and conflict, the intersection of higher food prices and the resurgent outbreak of the pandemic pose significant social and economic risks to the region.

Other countries in the region also have a positive growth rate with Libya expected to experience the highest growth rate of 66.7 percent, Algeria a growth of 3.6 per cent in 2021 and decline to 2.3 percent in 2022, Djibouti a growth rise of 5.5 per cent in 2021 and 6.0 per cent in 2022 and Morocco a growth rise by 4.6 percent in 2021 and decline to 3.4 percent in 2022.