- Choosing the right business structure is a crucial step toward setting up a successful venture in Tanzania, a country with vast natural resources.

- With various options available, it can be overwhelming to determine which one suits your needs and goals best.

- In this article, whether you’re considering a sole proprietorship, a public limited company, or a partnership, we’ve got you covered.

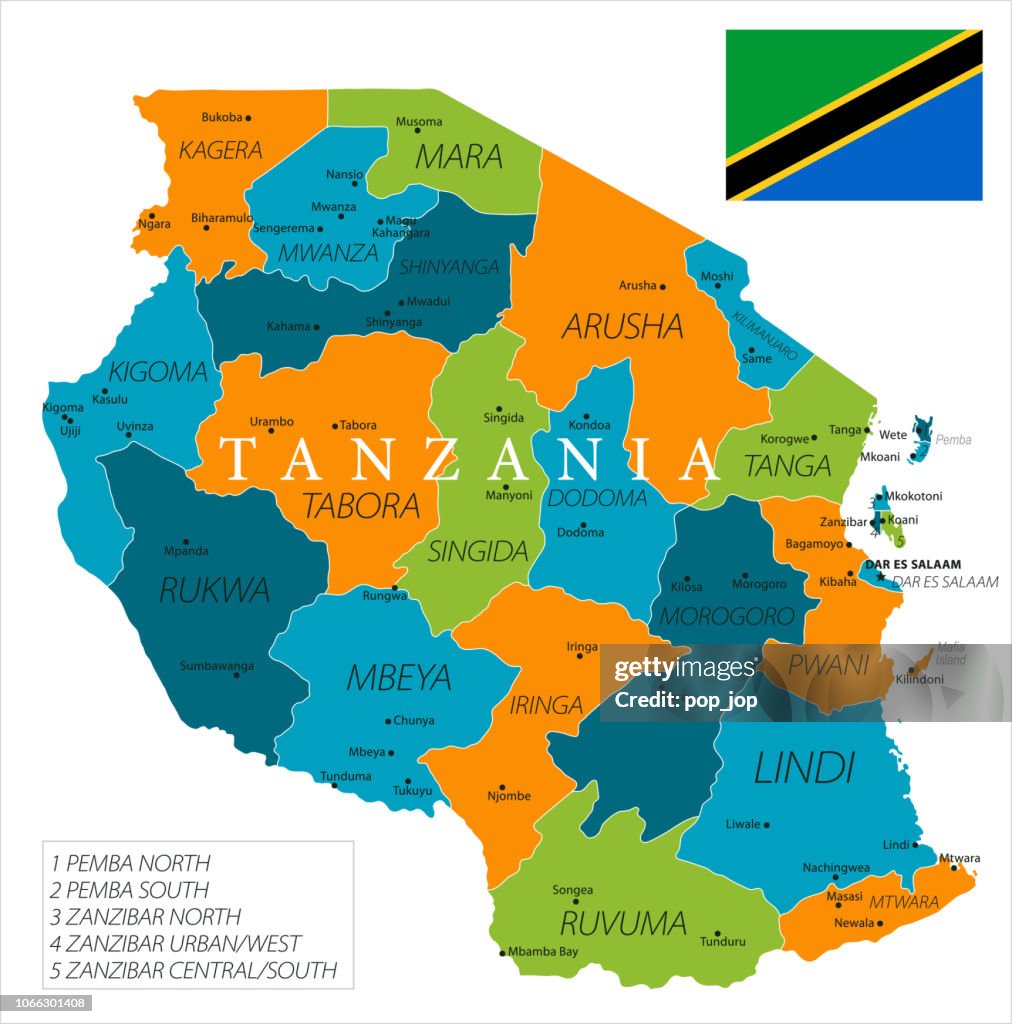

United Republic of Tanzania at a Glance:

2024 Projected Real GDP (% Change): 6.1

2024 Projected Consumer Prices (% Change): 4.

Country Population: 65.231 million

Source: International Monetary Fund (IMF)

Are you an aspiring entrepreneur in Tanzania? If so, choosing the right business structure in Tanzania is a crucial step toward setting up a successful venture. With various options available, it can be overwhelming to determine which one suits your needs and goals best. That’s where this blog comes in.

In this comprehensive guide, we will walk you through the different business structures in Tanzania, highlighting their pros and cons. Whether you’re considering a sole proprietorship, a public limited company, or a partnership, we’ve got you covered. We’ll discuss the legal requirements for each structure, the registration process, and the benefits and limitations of operating under them.

Navigating the business landscape in Tanzania requires knowledge and understanding of the country’s political integrity, infrastructure projects, and foreign direct investment. We will provide you with insights and practical advice to help you make an informed decision.

Join us on this journey as we break down the complexities of business structures and empower you to choose the right one. Get ready to embark on your entrepreneurial adventure in Tanzania!

Introduction to business structures in Tanzania

Choosing the right business structure is a crucial step for entrepreneurs in Tanzania. The business structure not only determines the legal and financial framework of the business but also has a significant impact on its success. Different business structures offer various advantages and disadvantages, making it essential to understand their implications before making a decision.

The chosen business structure affects aspects such as taxation, liability, ownership, and compliance requirements. By selecting an appropriate structure, entrepreneurs can optimize their operational efficiency, protect their personal assets, and access various benefits available for specific structures.

For example, sole proprietorships are the simplest and most common business structure in Tanzania. They offer flexibility and easy decision-making but hold unlimited liability for the owner. On the other hand, a limited liability company (LLC) provides liability protection to its owners while still maintaining relative simplicity in terms of compliance requirements.

It is crucial for aspiring business owners to consider the goals and nature of their entity, the level of shared responsibility, the initial capital required, and the potential for expansion. By understanding these factors, entrepreneurs can make an informed decision about the best legal structure for their business in Tanzania.

In the upcoming sections, we will dive deeper into the different types of business structures available in Tanzania, including sole proprietorships, partnerships, limited liability companies, public limited companies, and branches. We will explore the characteristics, advantages, and disadvantages of each structure to help you make an educated choice for your business in Tanzania.

Types of business structures in Tanzania

In Tanzania, entrepreneurs have several options when it comes to choosing a business structure. Each structure has its own characteristics, advantages, and disadvantages. Understanding these options is crucial for making an informed decision and setting up a successful business. Let’s explore the different types of business structures in Tanzania:

-

Sole Proprietorship

A sole proprietorship is the simplest and most common form of business structure. As the sole owner, you have complete control and make all the decisions. This structure is suitable for small-scale businesses and individuals who want to start their own business without partners or complex legal requirements. It offers flexibility and involves minimal legal formalities.

Advantages:

— Easy and inexpensive to set up

— Complete control over decision-making

— Direct and simple taxation process

— Minimal legal requirements and paperwork

Disadvantages:

— Unlimited personal liability for business debts

— Limited ability to raise capital

— Lack of separation between personal and business assets

— Limited growth potential

-

Partnership

Partnerships are established when two or more individuals come together to start a business. There are two types of partnerships in Tanzania: general partnerships and limited partnerships.

General Partnership:

In a general partnership, all partners share equal responsibility and liability for the business. They contribute capital, make decisions, and share profits or losses according to their agreed-upon terms.

Limited Partnership:

A limited partnership consists of both general partners and limited partners. General partners have unlimited liability and actively participate in the business, while limited partners contribute capital but have limited liability and do not participate in business operations.

Advantages:

— Shared responsibility and expertise

— Shared investment and capital

— Flexibility in profit distribution

— Easier access to funding and resources

Disadvantages:

— Unlimited liability for general partners

— Potential disagreements and conflicts between partners

— Profits are shared among partners

— Limited growth potential

-

Limited Liability Company (LLC)

A limited liability company (LLC) is a popular business structure that combines the benefits of a corporation and a partnership. It offers limited liability protection to its members (owners) and allows for flexibility in management and taxation.

Advantages:

— Limited personal liability for business debts

— Flexibility in management structure

— Pass-through taxation

— Easier transfer of ownership

Disadvantages:

— Compliance with stricter legal requirements

— Higher initial setup costs compared to sole proprietorship or partnership

— Additional paperwork and reporting obligations

— Disruption in case of member changes

-

Public Limited Company (PLC)

A public limited company (PLC) is a legal entity that offers shares to the public and is listed on a stock exchange. It requires compliance with strict regulations and is suitable for larger businesses seeking significant growth and investment opportunities.

Advantages:

— Increased access to capital through public share offerings

— Limited liability for shareholders

— Increased credibility and trust from investors

— Greater growth potential

Disadvantages:

— Complex legal requirements and compliance

— More expensive to set up and maintain

— Extensive reporting and disclosure obligations

— Loss of control due to ownership dispersion

-

Branch

Establishing a branch allows a foreign company to conduct business in Tanzania without creating a separate legal entity. The branch operates as an extension of the parent company.

Advantages:

— Allows foreign companies to expand their operations

— Utilizes the reputation and resources of the parent company

— No requirement to create a separate legal entity

— Simplified reporting and compliance under the parent company’s jurisdiction

Disadvantages:

— The parent company is liable for the branch’s actions and obligations

— Limited decision-making autonomy for the branch

— Subject to local taxation and regulations

— Potential challenges in adapting to the local market

Each business structure has its own merits and considerations. Choosing the most suitable structure depends on your goals, resources, and risk tolerance. Consulting with legal and financial experts is advisable to make an informed decision that aligns with your specific needs and objectives.

Remember, the chosen business structure plays a significant role in navigating legal requirements, taxation, liability, and growth opportunities in Tanzania.

Step-by-step guide to registering a business in Tanzania

Setting up a business in Tanzania involves several important steps. This comprehensive guide will walk you through the process, from choosing the right business structure to obtaining the necessary licenses. Here’s a step-by-step breakdown to help you navigate the registration process successfully:

Step 1: Choosing a business structure

Before registering your business in Tanzania, you need to decide on the most suitable legal structure. The options available include:

Sole Proprietorship: A business owned and operated by a single individual. It offers simplicity and full control over business affairs but comes with unlimited personal liability.

Partnership: A business that involves two or more individuals sharing the profits and losses. Partnerships can be general partnerships or limited partnerships, with different levels of liability for partners.

Limited Liability Company (LLC): A separate legal entity with limited liability for owners. LLCs are popular among businesses looking for flexibility, protection, and ease of operation.

Public Limited Company (PLC): A corporation with shares traded publicly on a stock exchange. PLCs have more extensive reporting and regulation requirements.

Branch: A business extension of a foreign company operating in Tanzania. The branch is not a separate legal entity and is subject to the regulations of the parent company.

Consider the nature of your business, liability exposure, and growth potential when selecting a structure.

Step 2: Reserving a company name

Once you’ve determined your business structure, the next step is to reserve a unique name for your company. The Registrar of Companies in Tanzania requires that every business name be unique and not closely resemble any existing companies’ names. Conduct a thorough search with the Business Registrations and Licensing Authority (BRELA) to ensure availability.

Step 3: Preparation and submission of relevant documents

To proceed with the registration process, certain documents must be prepared and submitted to BRELA. These documents include:

- Memorandum and Articles of Association that outlines the business’s objectives, by-laws, and regulations.

- Application for Registration: Includes information about the business structure, owners, and directors.

- Statement of Nominal Capital: Shows the initial capital invested in the business.

NB: Ensure accurate completion and notarization of the documents before submitting them to BRELA.

Step 4: Corporate bank account opening

Open a corporate bank account for your business to facilitate financial transactions. Choose a reputable bank in Tanzania and gather the required documentation, such as the company’s Memorandum and Articles of Association, company registration certificate, and director’s identification.

Step 5: Registration with tax authorities

Once your business is registered, you need to obtain a Taxpayer Identification Number (TIN) from the Tanzania Revenue Authority (TRA). This number enables you to fulfill your tax obligations and conduct business legally. Register with the TRA and provide the necessary documents, including your company registration certificate and bank account details.

Step 6: Obtaining relevant business licenses

Depending on your business activities, you may need to obtain additional licenses or permits from various government bodies and regulatory authorities. Determine the specific licenses applicable to your business sector and comply with the requirements of the relevant agencies.

Keep in mind that specific considerations might apply to foreign-owned businesses, such as minimum capital requirements or restrictions in certain industries. Conduct thorough research and consult with professionals to ensure compliance with all regulations.

Remember, starting a business in Tanzania requires careful planning and adherence to legal procedures. With this step-by-step guide, you’ll be well-prepared to register your business and embark on a successful entrepreneurial journey in Tanzania.

Conclusion

Registering your business in Tanzania involves a series of steps, from choosing the right legal structure to obtaining the necessary licenses. By following this comprehensive guide, you’ll have a clear understanding of the registration process and be equipped with the knowledge needed to set up a successful business in Tanzania. Remember to consult professionals and maintain compliance with all legal requirements throughout the registration process.

Read also: Rwanda, Tanzania to lead EAC as 2024’s fastest growing economies

Government Assistance for Foreign-owned Businesses in Tanzania

Foreign-owned businesses in Tanzania can benefit from various government assistance programs and incentives aimed at attracting and promoting foreign investment. These measures provide valuable support to entrepreneurs looking to establish a successful business presence in the country.

Tax Breaks and Incentives

The Tanzanian government offers tax incentives to foreign-owned businesses operating within certain sectors or regions. These incentives can include tax holidays, reduced corporate tax rates, and exemptions from import duties on machinery and equipment. By taking advantage of these tax breaks, companies can significantly reduce their operating costs and increase profitability.

Special Economic Zones

Tanzania has established Special Economic Zones (SEZs) that offer a favorable business environment for foreign investors. These zones provide a range of benefits, including simplified procedures for company registration, customs facilitation, and access to world-class infrastructure. Companies operating within SEZs can enjoy lower taxes, easier access to financing, and streamlined regulatory processes.

Investment Guarantees

The Tanzanian government recognizes the importance of protecting foreign investments and offers guarantees against certain risks. These guarantees can include protection against expropriation, compensation for losses resulting from political instability, and the right to repatriate profits and capital. These measures provide foreign investors with a sense of security and confidence in the Tanzanian business environment.

Business Development Services

The government of Tanzania also offers business development services to foreign-owned businesses. These services, provided by organizations like the Tanzania Investment Center (TIC), offer guidance and support throughout the business establishment process. They assist with market research, feasibility studies, and connecting investors with local partners or suppliers, facilitating smooth entry into the Tanzanian market.

In conclusion, foreign-owned businesses in Tanzania can take advantage of various government assistance programs and incentives to ensure their success. Tax breaks, special economic zones, investment guarantees, and business development services are among the valuable resources available. By leveraging these opportunities, entrepreneurs can navigate the complexities of the Tanzanian business landscape and establish thriving ventures.

Remember, when starting a business in Tanzania, it is essential to consult with experts familiar with local regulations and requirements.

How Can Multiplier Help in Setting Up a Business in Tanzania?

Multiplier is your trusted partner in navigating the complex process of setting up a business in Tanzania. With extensive experience and expertise in business registration, Multiplier offers a range of essential services to ensure a seamless and successful setup. Here’s how Multiplier can assist you:

Expert Guidance and Consultation

At Multiplier, we understand that every business is unique and has distinct requirements. Our team of experts will provide personalized guidance and consultation based on your specific needs. We will analyze your business goals, help you choose the most suitable legal structure, and provide valuable insights into the local business landscape.

Company Registration Process

Registering a business in Tanzania involves several steps and legal requirements. Multiplier will simplify the process for you, ensuring all necessary documents are prepared and submitted accurately and efficiently. From the preparation of articles of association to obtaining a tax clearance certificate, we will handle the entire registration process on your behalf, saving you time and effort.

Clear Understanding of Local Laws and Regulations

Navigating the legal framework of Tanzania can be challenging for foreign entrepreneurs. Multiplier stays up-to-date with the latest business laws and regulations to ensure compliance throughout the registration process. Our in-depth knowledge of local laws will help you avoid potential pitfalls and ensure a smooth and hassle-free setup.

Access to Local Contacts and Networks

Establishing a strong network of local contacts is crucial for your business’s success in Tanzania. As a trusted local partner, Multiplier can provide introductions to key stakeholders, potential partners, suppliers, and customers. We will leverage our extensive network to connect you with the right people and help you forge valuable business relationships.

Ongoing Support and Compliance

Once your business is up and running, Multiplier continues to provide ongoing support and assistance. We will ensure that you remain compliant with all legal obligations, such as tax filings and annual returns. Our team will be available to address any concerns or queries you may have, providing peace of mind as you focus on growing your business.

In conclusion, setting up a business in Tanzania can be a complex and daunting process. However, with Multiplier’s comprehensive range of services and expertise, you can navigate through the challenges with ease. Our goal is to empower you to make informed decisions and lay a solid foundation for your business in Tanzania. Contact Multiplier today and let us be your partner in success.

Frequently Asked Questions about Starting a Business in Tanzania

-

Can a Foreigner Start a Business in Tanzania?

Yes, foreigners are allowed to start businesses in Tanzania. The government of Tanzania welcomes foreign direct investment and has implemented measures to facilitate the entry of foreign-owned businesses into the country. However, it is important for foreigners to comply with the relevant laws and regulations, such as obtaining the necessary permits and licenses.

-

What is the Cost of Incorporating a Company in Tanzania?

The cost of incorporating a company in Tanzania depends on various factors, such as the type of company and the services required. The fees typically include the cost of company registration, name reservation, and the preparation of legal documents. Additionally, there may be ongoing expenses such as annual compliance fees and taxes. It is advisable to consult with a business setup consultant or engage the services of a professional firm for accurate cost estimates and guidance throughout the company registration process.

-

How to Choose the Best Business Structure in Tanzania?

Choosing the best business structure in Tanzania depends on various factors, including the nature of your business, the desired level of liability protection, the number of partners involved, and the long-term goals of the entity. It is important to consider the tax implications, legal requirements, and the ease of doing business associated with each business structure.

Consulting with experts such as business setup consultants or legal advisors can provide valuable guidance and ensure that you make an informed decision. Each business structure has its advantages and disadvantages, so it is crucial to consider your specific needs and goals before making a decision.

-

What are the Advantages of a Public Limited Company in Tanzania?

A public limited company in Tanzania offers several advantages. First and foremost, it provides limited liability protection to its shareholders, meaning their personal assets are generally not at risk in the event of the company’s failure or insolvency. Public limited companies also have greater access to capital through the ability to raise funds by issuing shares publicly.

Furthermore, public limited companies often have a higher level of credibility and trust in the market due to their stringent regulatory requirements and transparency. They are also more flexible in terms of transferring ownership and attracting investment. -

What are the Disadvantages of a Sole Proprietorship in Tanzania?

While sole proprietorships are the simplest and least costly business structure, they come with certain disadvantages. One major drawback is the unlimited personal liability of the owner. In a sole proprietorship, the individual is personally responsible for all debts and obligations of the business. This means that their personal assets may be at risk in the event of business failure or legal issues.

Additionally, sole proprietorships may face constraints in terms of access to financing and scalability. The owner’s ability to raise capital is typically limited to their personal funds and loans, making it challenging to expand the business beyond their individual capacity. Remember, the choice of business structure should be made after careful consideration of your specific circumstances and future goals. Consulting with professionals and conducting thorough research will help you make an informed decision.