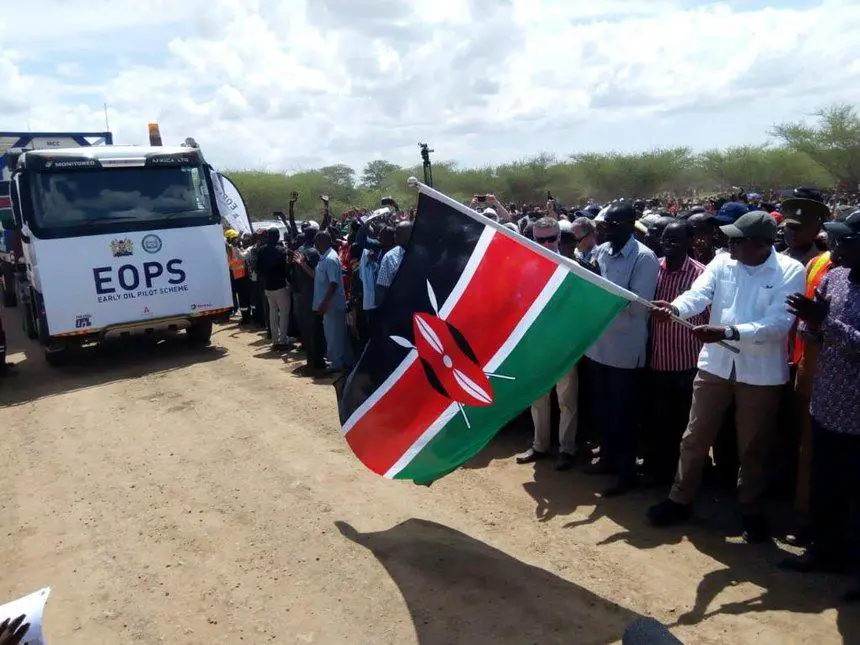

The first batch is intended to test the international markets

Kenyan crude oil could test the global markets before the end of this year, latest developments indicate, as stocks of the commodity continue to pile up at a storage facility in the port city of Mombasa.

In its latest operational update for the period January 1-April 25, 2019, British firm-Tullow Oil plc (Tullow), says the first export cargo is expected in the third quarter of 2019, even as exploration and drilling intensifies in the Turkana region.

This comes as the Early Oil Pilot Scheme continues to truck 600 barrels of oil per day (bopd) to Mombasa, where 80,000 barrels of oil are being stored ahead of export.

READ:Kenya oil exports gains momentum as Tullow bounces back to profitability

The crude oil from the Turkana oil fields is being stored at the defunct Kenya Petroleum Refineries Ltd (KPRL) (refinery) facility at Changamwe, Mombasa.

“Following receipt of regulatory authority approval, which is expected shortly, production will be increased to 2,000 bopd, with the first export cargo expected in the third quarter of 2019,” the firm notes.

Tullow has been searching for buyers of Kenya’s small-scale crude petroleum exports since last year ahead of the first shipment, with a number of unnamed potential buyers said to have expressed interest.

“Tullow has begun to market Kenya’s low-sulphur oil ahead of the first lifting with initial market reactions being very positive,” Tullow said in a recent statement.

Petroleum Principal Secretary Andrew Kamau had earlier revealed that buyers from Europe, India and China had expressed interest Kenya’s crude oil, though the government remains mum on the exact potential buyers.

Sources within government revealed to The Exchange that the country has reached out to at least 18 global oil refinery firms for uptake of its first crude oil.

According to the government, the first batch is intended to test the international markets’ reception to the country’s crude oil before commercial production picks. Tullow plans to commit to commercial oil production later this year.

“Tullow continues to target a Final Investment Decision (FID) in Kenya by year-end although this remains an ambitious target,” the management said this week.

The firm is finalising its Front End Engineering Design (Feed) studies for the planned construction of a crude oil pipeline from Turkana to Lamu, where the country is developing its second major sea port.

“Tullow is finalising its FEED studies for both the upstream and midstream, and both the upstream and midstream ESIAs (Environmental and Social Impact Assessments) remain on track for submission to the National Environmental Management Agency at the end of the second quarter,” CEO Paul MCDADE said.

“The government of Kenya, via the National Land Commission, has gazetted the land required for the upstream development in Turkana and, so far, approximately two-thirds of the pipeline. Discussions with government regarding key commercial agreements are making steady progress. A late 2019 FID remains contingent on these key government of Kenya deliverables,” the management notes in its update.

Oil pipeline

Kenya is looking forward to the development of an 892-kilometre crude oil pipeline from the oil fields in the Northern region of Turkana to the Coastal County of Lamu.

Last year, Tullow hired Wood Group (Plc) to design the pipeline needed to pump crude from the Lokichar fields to Lamu, with commercial production and exports anticipated for 2021/2022.

The cost of the pipeline is estimated at USD1.1 billion (Ksh111.6 billion), with a further USD2.9 billion (Ksh 294.1 billion) needed for upstream operations.

Other investors in the country’s oil projects include Canada’s Africa Oil and France’s Total. Kenya’s government is expected to take a stake through the state-owned National Oil Corporation of Kenya (NOCK).

Australia’s Worley Parsons has been tasked as the engineers for Tullow’s oil blocks.

According to Tullow, the Amosing and Ngamia fields have estimated contingent resources of about 560 million barrels, with plateau production potentially reaching 100,000 barrels per day.

Tullow and its joint venture partners have proposed to the Kenyan government that the Amosing, Ngamia and Twiga fields be developed as the foundation-stage of the South Lokichar Development.

This foundation stage includes a 60,000 to 80,000 bopd central processing facility and the export pipeline to Lamu.

The installed infrastructure from this initial phase is expected to be utilised for the optimisation of the remaining South Lokichar oil fields and future oil discoveries, allowing the incremental development of these fields to be completed at a lower unit cost post the first oil production.

Total gross capex associated with the foundation stage is expected to be approximately USD3 billion (Ksh304.3 billion).

Last year, Tullow had earmarked USD70 million (Ksh7.1billion) for investment in its Kenyan operations.

The company has spent more than US$1 billion (Ksh101.4 billion) to prospect for oil and develop of wells in the country.

Kenya’s readiness

In March this year, President Uhuru Kenyatta signed into law a Bill outlining how oil revenues will be shared between the national government, counties and local the communities.

Under the new Petroleum Act, county government from where oil is produced will enjoy 20 per cent of revenue from petroleum operations, while five per cent will go to local communities living around the oil fields.

The national government will retain a bigger chunk which is 75 per cent of the revenue.

The law is expected to address concerns mainly by locals who last year paralysed the pilot evacuation of the commodity by road to Mombasa.

READ:Tullow Oil suspends operations in Turkana citing insecurity

The new law however halves the 10 per cent earlier awarded to locals in a previous bill passed by Parliament ( in 2016), which went unsigned by the President.

On safeguarding and managing resources from oil and other natural resources, the government is working on a Sovereign Wealth Fund, expected to be in place before the country becomes a net oil exporter.

During his State of the Nation address on April 4, the President said his administration will be presenting the Sovereign Wealth Fund Bill during the current session of parliament, a move that could see the fund created before the end of his second term (2022).

The bill proposes creation of a Fund and provides a legal framework to guide the investment of revenues from oil, gas, mineral and other natural resources.

The Fund, as proposed in the bill, comprises three critical parts which include a Stabilization Fund, an Infrastructure and Development fund; and a Future Generation Fund.

“We are a country blessed with natural resources, which, if properly managed, will transform in a big way our nation and the welfare of our people,” the President said, “It must be our solemn duty as a State to manage those resources sustainably for the fair and equitable benefit of both present and future generations.”

Sovereign Wealth Funds are state-owned investment fund’s whose source of revenue is most often balance of payments surpluses, fiscal surpluses and in particular resource revenues.

In February, the National Treasury invited Kenyans to give views on the draft Sovereign Wealth Fund Bill, 2019 and on Kenya’s draft Sovereign Wealth Fund Policy.

If implemented, Kenya will join the likes of Angola, Rwanda, Libya, Morocco, Nigeria and Botswana, African states which have establishing wealth funds in their respective countries.

Globally, Norwegian Sovereign Wealth Fund remains one of the best examples with a value of more than $1 trillion (about Ksh101.4 trillion).

Data by the Sovereign Wealth Fund Institute shows over 65 economies, majority of them resource-rich countries, own at least one wealth fund.

Lack of proper management of oil and mineral proceeds have been blamed for the never-ending resource-linked conflicts in Africa, with the resources being viewed as a curse rather than a blessing as millions lurch in poverty despite the continent being resource rich.

Multinationals and their respective countries have been accused of reaping billions by repatriating profits and raw commodity, with little benefit going to local communities and host nations.

ALSO READ:Rights bodies calls for greater scrutiny of Kenya’s Turkana oil revenues