- Kenya’s economic resurgence in 2024 proving a reality following a notable upturn in recent months, marked by positive indicators across sectors.

- According to CBK, leading indicators point to the continued strong performance of the Kenyan economy in the first quarter of 2024.

- According to the World Bank, Kenya’s economic growth is projected to be 5.2 per cent, boosted by increased investment in the private sector as the government reduces its activities in the domestic credit market.

A strong rebound

Kenya’s economic prospects are looking brighter, attributed to the interventions by the World Bank and the International Monetary Fund, which have played a massive role in easing volatility witnessed less than three months ago.

Major economic indicators in the country show that confidence is slowly creeping back after the government secured the International Monetary Fund’s facility to pay back the Eurobond.

The repayments had triggered volatility in financial markets, including the stock and bond markets, as investors had become more cautious, leading to fluctuations in asset prices.

However, Kenya’s economic landscape has witnessed a notable upturn in recent months, marked by positive indicators across sectors.

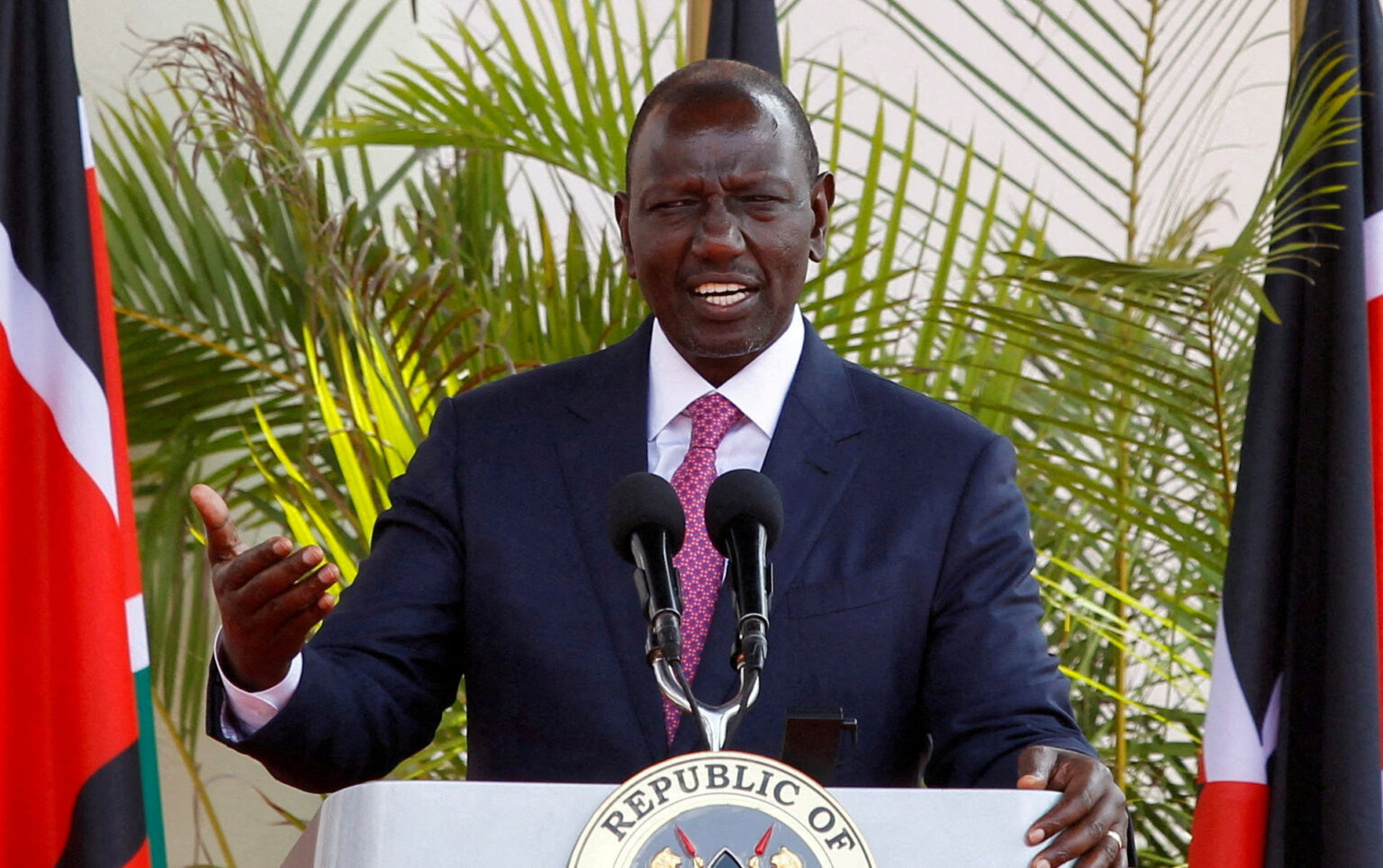

Policymakers have welcomed these improvements, signaling a potential resurgence in the country’s economic growth trajectory.

Eurobond, inflation, prices of food, fuel and energy

In February, Kenya successfully issued a new Eurobond worth $1.5 billion to buy back the inaugural one due in June 2024.

The directive was meant to ease the cash flow crisis and boost Kenya’s dwindling foreign exchange reserves that had taken a hit from the weakening shilling.

Following the move, key indicators such as GDP growth, inflation rates, and foreign investment inflows have all displayed encouraging trends, bolstering confidence among investors and policymakers.

The rollover effect saw a decline in food, fuel, and electricity prices in March, bringing inflation to 5.7 per cent, a record last set in December 2021.

Maize flour and sugar prices dropped by 9.6 and 5.3 per cent, respectively, between February 2024 and March 2024, according to a recent report by the Kenya National Bureau of Statistics (KNBS). A notable drop is being experienced in April.

According to CBK, leading indicators point to the continued strong performance of the Kenyan economy in the first quarter of 2024, reflecting robust activity in the agriculture and service sectors, particularly accommodation and food services and information and communication.

The local economy remains very promising, albeit affected by higher public debt and heavy taxation that will impact disposable income.

Drivers for Kenya’s economic resurgence in 2024

In its capacity, the Central Bank of Kenya continues implementing various monetary policies geared towards stabilizing prices, the forex market, and overall inflation. At its recent meeting, the Monetary Policy Committee (MPC) hiked its lending rate by 50bps to 13.0 per cent, the highest since November 2012.

The introduction of an interest rate corridor of 250bps ± around the Central bank continues to anchor the interbank rate on the upper lower limit of the CBR rate, which had skyrocketed above 17 per cent on tight liquidity. The interbank rate has averaged 13.53 per cent and 12.24 per cent since the policy review on 9 August 2023.

Overall, private sector credit remains upward, with high growths above 20 per cent in the manufacturing, transport, and telecommunications sectors. A reverse Exchange rate depreciation impacts overall private sector credit, which will grow at almost the same rate as the projected credit growth rate adjusted for exchange rate depreciation.

Read Also: Kenya’s economic growth to average 5.2% in 2023-24 on credit growth

Tourism, agriculture, and strengthening of the Kenyan shilling

Kenya’s tourism sector has offered hope for recovery to pre-COVID-19 levels. Tourist arrivals improved by 34.1 per cent in the 12 months to October 2023, compared to a similar period in 2022. In the first quarter of 2024, tourism has experienced immense growth.

Improvement in receipts from tea and manufactured exports. Receipts from chemicals and manufactured exports increased by 5.1 per cent and 13.9 per cent, respectively. The increase in manufactured export receipts reflects regional solid demand.

The optimism further arises from easing inflation to a low of 5.7 percent in March and suitable weather conditions supporting agricultural activities.

Consequently, the Kenya shilling has strengthened to a year-high against the US dollar, rising to as high as 127, compared to more than 160 in January.

The Central Bank expects further strengthening of the shilling to the 120 mark, which will boost Kenya’s economy by lowering the cost of imports such as oil.

Furthermore, Kenya is experiencing heavy rains, a few months after the country experienced El Nino rains in December 2023. The current deluge is expected to boost agricultural production.

Crunches in Kenya’s economic resurgence in 2024

Despite these positive developments, Kenya needs help with petrifying challenges that could impede its growth trajectory.

High public debt emerges as a significant concern, with greater fiscal and external vulnerabilities looming.

External shocks like the war in Ukraine and conflict in Israel, which are hindering importation through the Red Sea, are some factors dragging economic growth in many countries globally, and Kenya is being greatly affected.

Economic Prospects for Kenya 2024

According to the World Bank, Kenya’s economic growth is projected to be 5.2 per cent, boosted by increased investment in the private sector as the government reduces its activities in the domestic credit market.

Net domestic borrowing by the Kenyan government in the fiscal year starting in July 2024 is expected to reduce to 2.1 per cent of the gross domestic product, making space for increased lending by the private sector.

Kenya has portrayed a robust economic rebound, and with the right policies in place, public and private investments, and government-inclusive growth, the country is poised to continue on an upstream trajectory.