- Launch Africa has been the most active investor in African startups according to research firm Africa: The Big Deal.

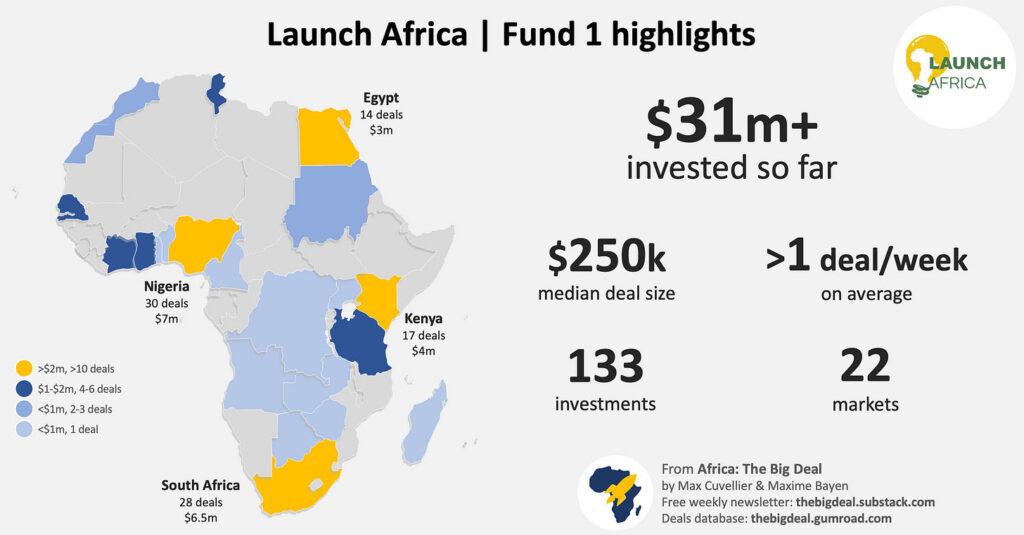

- Since its launch in mid-2020, the firm has invested over $31 million through 133 deals, at a rate of more than a deal a week on average. All but four of these deals (97 percent) were between $100,000 and $300,000, with a median cheque of $250,000.

- Launch Africa has been investing heavily in fintech with 42 deals (32 percent) totaling $11 million across 13 markets, including 13 fintech transactions in Nigeria alone.

Launch Africa has been the most active investor in African startups according to research firm Africa: The Big Deal.

Since their launch in mid-2020, the company has invested over $31 million through 133 deals, at a rate of more than a deal a week on average. All but four of these deals (97 percent) were between $100,000 and $300,000, with a median cheque of $250,000. Three quarters were in the $200,000-$300,000 range.

Overall, Launch Africa has invested in start-ups spread across 22 markets. In more than half of them (12/22), they were involved in multiple deals with the The ‘Big Four’ representing two thirds of the deals and capital invested through Fund 1 (89 deals, $21 million); Nigeria and South Africa are neck and neck, followed at a distance by Kenya and Egypt.

“Five other markets attracted more than $1 million from Fund 1: Ghana, Senegal and Côte d’Ivoire in West Africa, Tanzania, and Tunisia. The investment team also went off the beaten tracks, identifying investments in often-overlooked countries such as Togo, Sudan or Angola,” the report states.

According to the report, Launch Africa has been investing in fintech through Fund 1, with 42 deals (32 percent) totaling $11 million (36 percent) across 13 markets in total, and including 13 fintech transactions in Nigeria alone.

Read: Global mobile money transaction value up 22pc to $1.26 trillion

However, four other sectors have also seen significant deal activity (more than 10 percent, that is, between $3 million and $4 million and 15-20 deals): Marketplaces, Logistics, Big Data and HealthTech. Deals in these categories were spread across 10 markets each, except for HealthTech with deals spanning ‘only’ 5 markets, including 7 deals in South Africa (the second largest country/sector combination after Nigeria/Fintech).

“The top four sectors by invested value make up 70 percent of the portfolio, with the remaining 30 percent spread across 11 other sectors. Yet within the top four sectors multiple business models are represented along the different value chains, ensuring that no one use case dominates,” the report indicates.

For instance, there are six verticals within the Fintech sector, including credit (both B2C and B2B), remittances, payment, digital banking (both enterprise & consumer) and financial infrastructure (APIs). Geographically as well, the portfolio covers various verticals in each of the portfolio sectors.

In Francophone Africa as an example, the $4 million invested in the region have been allocated to start-ups in logistics marketplace, P2P APIs, health insuretech, agri marketplace or e-commerce. As a result, there is now a very healthy portfolio of companies for later-stage investors to look into for follow-on investments.

Launch Africa is currently raising its second seed stage fund in order to service the ever-increasing need for capital in the African start-up space.

The competition for this funding will certainly be tough: for the current fund, they received over 2,000 pitches! With this new fund, potential LPs will once again have the opportunity to work alongside one of the continent’s most prolific venture capital funds.