- This milestone is, however, delayed given that startup funding hit $1 billion in April 2023, as early as February in 2022 and May in 2021.

- One of the outstanding investments were d.light’s new $176 million securitization deal to enhance the uptake of solar powered equipment in Kenya, Uganda and Tanzania.

- Another record was Egypt-based MNT-Halan’s $157.5 million raise to fuel their expansion.

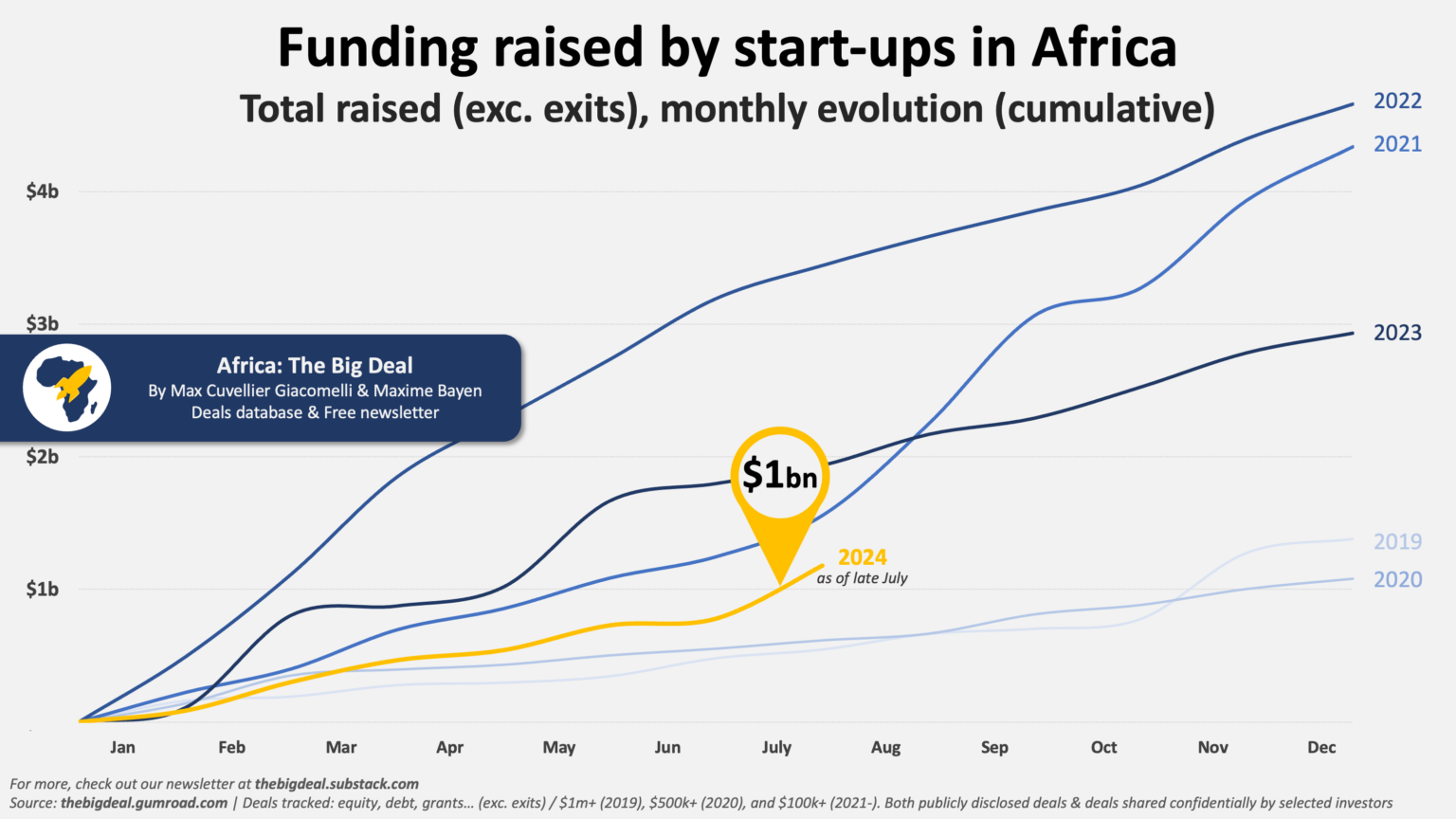

With five months to go to the end of 2024, the state of startup funding in Africa looks promising with new businesses attracting over $1 billion by the end of July. According to the startup funding tracker, Africa: The Big Deal, July was “the most successful month in terms of fundraising in Africa in more than a year, and represents what was raised in the whole of Q2 2024.”

This milestone, however, appears to have delayed when one compares when the sector crossed the $1 billion mark in the previous years. In 2023 for instance, startup funding in Africa hit the $1 billion mark in April, and as early as February in 2022. In 2021, startup funding crossed the $1 billion mark in May.

Deals that powered startup funding to $1 billion mark

Some of the outstanding investments that powered startup funding in Africa in July were d.light’s new $176 million securitization deal to enhance the uptake of solar powered equipment in Kenya, Uganda and Tanzania.

In July, San Franncisco-based d.light announced a new $176 million financing backed by social impact-focused asset management company African Frontier Capital.

d.light said the new facility would go a long way in enhancing the firm’s PayGo consumer finance offering, effectively making solar powered products easily available to an increased number of low-income households and communities that do not enjoy access to the main grid in Tanzania, Uganda and Kenya.

d.light CEO Nedjip Tozun said, “This new facility is another landmark step in d.light’s mission to provide people with affordable energy that is also clean, safe and sustainable. It lets us expand our reach so that millions of off-grid families across Kenya, Tanzania, and Uganda can experience the benefits of solar energy.

“Facilities like this make possible our pioneering PayGo consumer financing model with which we are able to offer solar home systems and high-efficiency appliances to the people that need them most in a way that is affordable and sustainable.”

Another startup financing agreement that pushing overall funding to cross the $1 billion mark was Egypt’s MNT-Halan’s $157.5 million raise to fuel their expansion.

In July, fintech MNT-Halan announced it has raised $157.5 million in funding, which included roughly $40 million from the International Finance Corporation (IFC), with the balance coming from a number of partners, including Development Partners International (DPI), Lorax Capital Partners, funds managed by Apis Partners LLP, Lunate, and GB Corp.

Founded in 2017 by Mounir Nakhla, fintech MNT-Halan has a range of services both financial and non-financial services ranging from offering credit, buy now pay later systems, e-commerce, payments, and mobility to on-demand logistics.

“While Egypt remains our primary market, we are committed to revolutionising access to financial services through technology beyond Egypt’s borders. Our M&A strategy capitalises on our technology and industry expertise while leveraging our partners’ local knowledge, management capabilities, and licences. We are happy to have the IFC on board and to see the continued confidence from our current shareholders through their participation in this round,” explained Mounir Nakhla, founder and CEO of MNT-Halan.

2024 startup funding higher than 2020 record

Although hitting the $1 billion mark in 2024 appears delayed, observers at Africa: The Big Deal noted that “this is encouraging as it shows that 2024 might in the end deliver stronger results than 2029 and 2020.”

“In fact, start-ups in Africa have already raised more funding than they had in 2020.”

In the six months to June 2024, climate tech startups garnered substantial attention, with startup funding reaching an all-time high of $325 million, which is 45 percent of the total startup financing announced in Africa in the half.

Analysis shows that the climate tech industry covers a wide range of applications, from renewable energy and water management to sustainable agriculture and logistics. It is this diversity that is attracting investors from various backgrounds, contributing to the industry’s robust growth.

For instance, investments in Africa’s energy and water projects have been gaining strong traction, highlighting the critical need for sustainable resource management solutions as effects of climate change hit.

This year, the energy and water industry attracted 18 percent of the total startup funding, equivalent to $132 million, further shining the spotlight on the importance of these areas in the broader climate tech scene.

d.light has been a main player in startup funding in Africa since its set up in 2010. It has previously set up four facilities, beginning in 2020 and including two in Kenya and one each in Nigeria and Tanzania.

The combined purchasing value of these existing facilities plus the new facility is USD$718 million. Earlier this year, in February, d.light announced that its $110 million securitization facility, Brighter Life Kenya 1 Limited (BLK1) successfully repaid its entire senior debt in full and ahead of schedule from internally generated cash flows – the first facility in the off-grid solar sector to do so.

Read also: Capital crunch: African startups reel from 27 per cent drop in Q1 2024 funding