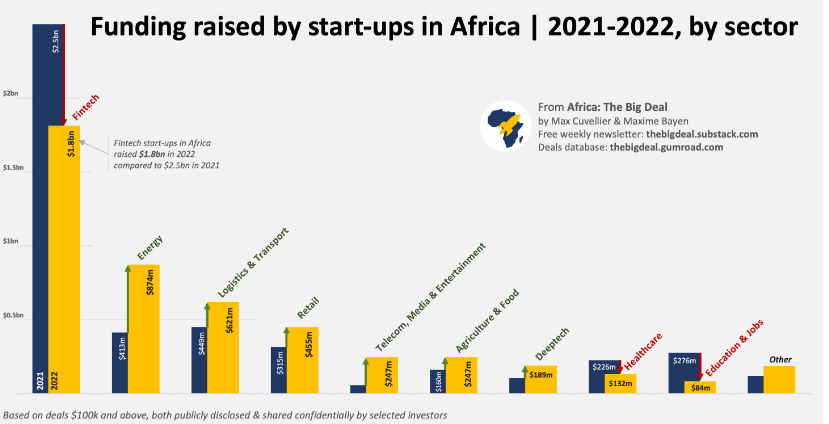

- Investment in African startups in the energy sector more than doubled in 2022 to hit $874 million compared to $413 million in 2021 making it the biggest winner in 2022.

- The energy sector was followed closely by the logistic & transport sector which experienced year on year growth of 38 percent, surpassing Fintech in Q4.

- Retail came next at $455m in investment, while other significant sectors growing year on year included Telecom, Media & Entertainment, Agriculture & Food and Deeptech.

Investment in African startups in the energy sector more than doubled in 2022 to hit $874 million compared to $413 million in 2021 making it the biggest winner in 2022.

This is according to latest data from The Big Deal which attributes the growth to two huge investments made in the region during the period under review that includes PEG Africa’s acquisition by Bboxx estimated at $200m and Sun King’s $260m Series D -, making it the second largest sector in 2022 after Fintech.

Fintech has been taking the lion’s share since 2019 but other sectors have shown marked investor interest.

“Back in 2021 fintech represented the majority of funding raised on the continent, with a share in constant progression. Yet in 2022, the amount invested in fintech start-ups in Africa decreased ($1.8bn, down from $2.5bn i.e. -28% YoY), and so did its share of funding raised (37%, -17pp). Still, the sector claimed the largest number of $100m+ transactions aka ‘mega deals’ though (4 out of 9): Flutterwave, MNT-Halan, Interswitch, and MFS Africa,” the report states.

The energy sector was followed closely by Logistic & Transport which experienced year on year growth of 38 percent, surpassing Fintech in Q4.

Some of the deals that made this possible include Yassir’s $150m Series B funding.

Retail came next at $455m in investment, falling short of the podium like it had in 2021; Wasoko’s $125m Series B round was the largest transaction of the sector.

Other significant sectors growing year on year included Telecom, Media & Entertainment , Agriculture & Food and Deeptech with the $100m Series B of InstaDeep (which was acquired by BioNTech last week for ~$440m (with potentially ~$240m more in the future)).

“Interestingly, if you group Energy & Water, Agri & Food, as well as Waste Management start-ups, the investments in these “Climate & Environment” sectors has doubled Year on Year $580m in 2021 to $1.2bn in 2022,” the report indicates.

According to the report, only two other sectors have seen a decrease in funding raised, relatively even more dramatically than fintech.

Funding in Healthcare went down by 41 percent from $226m to $132m and while Education and Job sectors decreased by 69 percent from $276m to $84m, largely due to the fact that Andela had raised a $200m Series E back in 2021 while no large deals in the space were raised in 2022, beside’s Ubongo’s $27.5m LEGO Foundation grant.

African startups attracted about $4.8 billion dollars in investment in 2022, with about 1,000+ deals of $100k or more announced in the period under review. This is an 11 percent increase year on year , especially in a bear market.

In the period under review, Africa also attracted more interest than ever before: 1,000+ unique investors have participated in at least one deal on the continent in 2022, representing a 15 percent increase compared to 2021.

The “Big Four” usual suspects Nigeria, Kenya, South Africa, and Egypt dominated the charts with 80 percent of the total funding raised on the continent.

Eastern Africa startups raised $1.2 billion in 2022 a 115 percent increase compared to 2021 where startups raised $600 million.

Western Africa, despite a small decrease in funding in the period under review, remains firmly in the lead in the continent. The region’s startups received funding worth $1.8 billion in 2022 from $2 billion in 2021.

Northern Africa had the highest increase in the period under review receiving $1.1 billion startup funding, crossing the $1bn mark for the first time. This represents a 62 percent increase from the previous year where startups got $700 million funding in 2021.