- Kenya’s debt repayment in 2023 was majorly from the Consolidated Fund.

- The country has faced liquidity challenges due to uncertainty in accessing funding from global financial markets.

- Analysts, however, maintain that the practice of taking on debt to pay debt is unsustainable.

The National Treasury has revealed that Kenya’s debt repayment surged to $3.69 billion (KSh600.73 billion) by December 2023. Despite an increase in revenue collection, Kenyans found little reason to rejoice as debt consumed 57 per cent of the government’s tax revenues, amounting to $6.14 billion (about KSh1.05 trillion).

Only 43 per cent of the generated revenue remained for development, salaries, and the state’s recurrent expenditure such as paying salaries.

The disclosure, titled “Kenya’s statement of actual revenues & net exchequer issues as of 31st Dec 2023,” signals a need for Kenyans to tighten their belts this year. President William Ruto’s administration anticipates higher repayments due to the devaluation of the Kenyan Shilling.

The exchequer has revised this year’s total public debt obligation upward to $11 billion (KSh1.866 trillion) from the initial estimate of $10.7 billion (KSh1.75 trillion).

During this period, most of the exchequer allocations from the Consolidated Fund were directed towards servicing public debt, constituting 89.9 per cent of the total expenditure.

Pension disbursements amounted to $362.1 million (KSh59 billion), and $51 million (KSh8.3 billion) was allocated for public servants’ salaries and allowances.

Kenya’s debt repayment burden

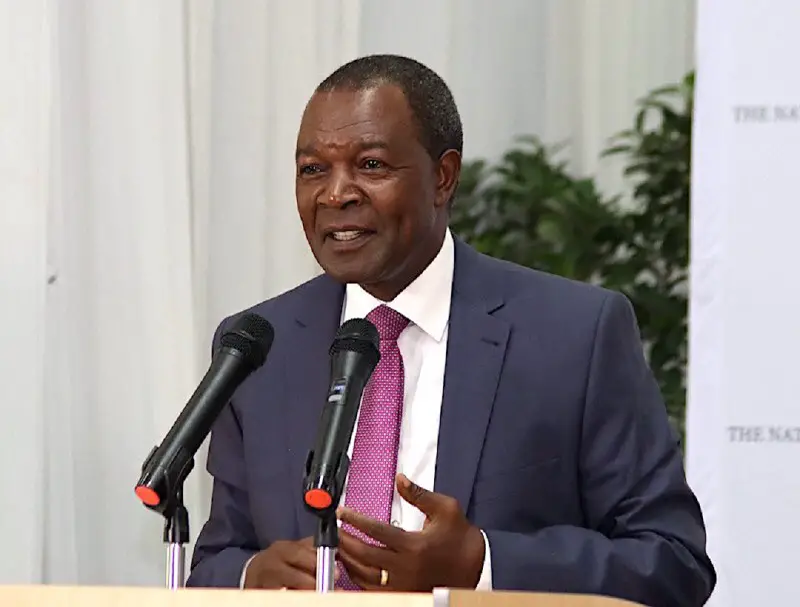

Despite the fiscal challenges, the government plans to secure external financing to alleviate the burden of maturing Eurobond debt. National Treasury Principal Secretary Chris Kiptoo informed MPs that, by February, the World Bank board is expected to provide over $12 billion (Sh1.84 trillion) through a concessional window in the next three years.

“So we expect that by February when the World Bank board will sit down, the country will have all that is required, and then in the next three years, we have over $12 billion (Sh1.84 trillion) available for us through the concessional window of the World Bank,” National Treasury Principal Secretary Chris Kiptoo told MPs last month.

Kenya has been facing liquidity challenges due to uncertainty in accessing funding from financial markets before the $2 billion (Sh306.7 billion) Eurobond matures in June.

The current high utilization of taxes for debt repayment occurs even before Kenya reaches the halfway point of the total $1.866 trillion debts expected to be settled by June 2024, including a $2 billion (Sh300 billion) Eurobond repayment.

Recent $920 million (KSh150 billion) loan to Kenya by the International Monetary Fund (IMF) has instilled confidence among international investors, resulting in a drop in yields for the country’s Eurobond due in June 2024.

The Central Bank of Kenya’s latest weekly bulletin indicates a decline in yields on Kenya’s Eurobonds, marking the first drop since December 13, 2023, when Kenya failed to honour a self-imposed buyback plan related to the $2 billion facility obtained in 2014.

Kenya’s Fitch Ratings

At the end of FY23, domestic accounts payable increased by approximately 12 per cent and 8 per cent, respectively, from the end of FY22 for the federal government and county governments, reaching 1.2 per cent and 4.0 per cent of GDP, respectively for both.

Kenya’s need for external funding is predicted to increase in FY24, mainly due to currency depreciation and a greater principal repayment burden, now anticipated to be roughly 3.5 per cent of GDP as opposed to 3.0 per cent of GDP in the original budget. This total includes the $2 billion Eurobond that matures in June 2024.

The country still enjoys some headroom even as the Kenyan Shilling maintains its downward spiral against the US Dollar. The depreciation is still sustainable and supported by forex reserves, which are fast depleting.

Read also: Kenya’s Ruto lashes out at the West over debt traps in poor states

Depreciation of the Kenyan Shilling

Foreign exchange reserves have fallen below the statutory reserve threshold of 4.0 months of import cover. This growing mismatch between the demand and supply of US dollars is disrupting business and fueling the steady depreciation of the Kenyan Shilling, which lost roughly 20 per cent of its value in 2023.

However, the government does have the IMF program as a crutch to assist with inflows and is actively consulting with lead arrangers to find solutions and timelines for the upcoming maturity.

Analysts, however, maintain that the practice of taking on debt to pay debt is unsustainable. Going forward, Kenya should devise new strategies centred on debt sustainability, especially with Eurobond 2027 and 2028 maturities soon after June 2024.