- Kenyan Farmers Receive $2M Boost from Africa Fertiliser Financing Mechanism

- Brace for High Interest Rates for a Longer Period World Bank Warns Kenya

- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

Browsing: Central Bank of Kenya (CBK)

- The IMF loan to Kenya provides a much-needed shot in the arm as it navigates debt repayments, including the $2.0 billion Eurobond maturing in June this year.

- The country is expected to repay Eurobond debts of $1.96 billion in 2024, $880 million in 2027, and $978 million in 2028.

- Debt repayment has pressured Kenya as it consumes more of forex reserves and ordinary revenues, wiping out gains in diaspora remittances and tourism earnings.

The IMF loan to Kenya

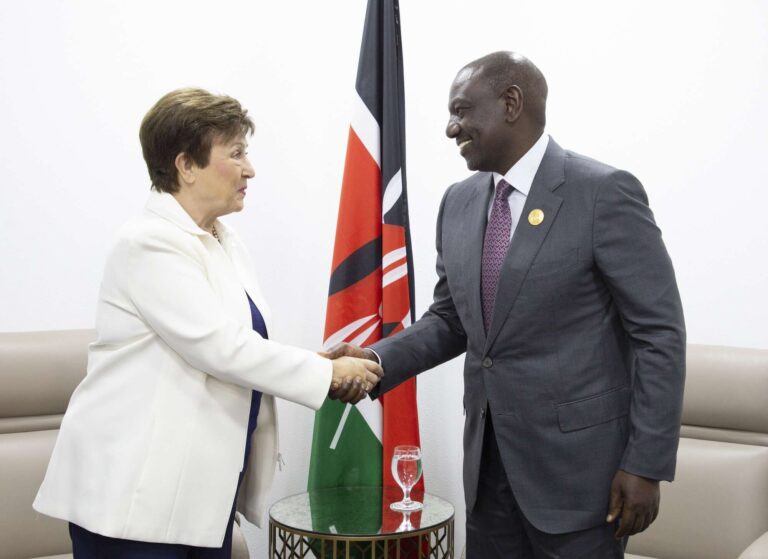

The International Monetary Fund (IMF) has approved a $684.7 million loan facility for Kenya, giving the East African country the much-needed support to navigate financial pressures amid a maturing Eurobond.

The funds are part of the $941.2 million Extended Fund Facility (EFF) and Extended Credit Facility (ECF) program approved in April 2021 and extended by 10 months in July 2023 to April 2025.

The first review under the 20-month Resilience and Sustainability …

Business conditions in Kenya remained in a steep decline halfway through the final quarter of the year, according to the latest Purchasing Managers’ Index (PMI) by S&P Global.

This comes amid sizeable falls in output, new orders, and employment in November, as indicated by the PMI, which closely monitors market-moving economic indicators, covering more than 30 advanced and emerging economies worldwide.…

- The Central Bank of Kenya benchmark rate has gone up to 12.5 per cent from 10.5 per cent.

- Developing economies including Kenya are paying dearly for geopolitical tensions.

- The current US policy rate at 5.25 per cent -5.5 per cent is the highest in 22 years, exerting pressure on economies.

Borrowers in Kenya are facing the prospect of more expensive loans following the country’s central bank’s decision to raise its base lending rate to a near 11-year high of 12.50 per cent. This marks an increase from the 10.50 per cent rate that has been in place since June this year, when it rose from 9.50 per cent due to a rise in non-performing loans in the banking sector.

The hike in rates occurs as Kenya, along with other economies in the region, continues to grapple with the impact of global factors, including elevated interest rates in the United States. …

Nairobi will continue purchasing fuel on credit from three state-owned Gulf oil marketers until December 2024 in a plan the government is banking on to ease piling pressure on Kenya’s forex reserves.

The move comes in the wake of high expenditure on oil imports even as Kenya remains a net importer grappling with a widening trade deficit that hit $10.8 billion last year. Last year, Kenya’s expenditure on imports rose by 17.5 per cent to $16.9 billion (KSh2.5 trillion), despite growing export volumes.…

- The Kenyan shilling has fallen to a new low of 140.04 against the US dollar.

- Central Bank of Kenya data shows the unit is also losing to other major currencies including British Pound and Euro.

- Last year, the Kenyan shilling depreciated by about 7.5 per cent against the US dollar, the UAE dirham (7.5%), Saudi Riyal (7.4%) and the Chinese Yuan (3.1%), the Kenya Economic Survey 2023 shows.

As developing market currencies continue to suffer from the worldwide increase in interest rates, which is being spearheaded by the US Federal Reserve, the Kenyan Shilling has dropped to a historic low in relation to the US Dollar.

The Fed has increased the benchmark rate ten times in a row, or a total of five percentage points, since March of last year. In the last 40 years, these increases are the most abrupt. In an effort to combat US inflation, interest rates …

- The government of Kenya is deploying measures to protect local industries from the onslaught of cheap imports.

- Kenya’s $26.4 billion FY2023/24 budget is an increase from $23.6 billion plan for the fiscal year ending June 30.

- The country is, however, facing high inflation, ballooning debt, and a high rate of joblessness.

President William Ruto’s first $26.4 billion budget for the FY2023/24 starting July 1st seeks to boost job creation, power growth of industries, and reduce borrowing.

Kenya’s $26.4 billion FY2023/24 budget is an increase from the $23.6 billion plan for the fiscal year ending June 30. East Africa’s economic powerhouse, Kenya, continues to struggle with growing inflation, skyrocketing debt, and a high unemployment rate.

Job creation targets Kenya’s youth

The lack of enough jobs is disproportionately affecting the country’s young people. The economy is also struggling from the impact of external shocks. For instance, Kenya is hurting from the Russia-Ukraine …

- Kenya’s forex reserves dipped to $6.2 billion on May 19, an eight-year low, before a slight improvement to $6.4 billion on May 26.

- At $6.4 billion, Kenya’s reserves are just 3.60 months of import cover, which is below the Central Bank of Kenya’s desired target.

- What’s more, the reserves are below the East Africa Community preferred threshold of 4.5 months of import cover, hence exposing the country to high volatilities in the global market.

A dip in export earnings, coupled with reducing diaspora inflows at a time of huge debt repayments have left Kenya grappling with low forex reserves, raising concerns on the health of East Africa’s economic powerhouse.

The low forex reserves are further compounding the dollar shortage problem that has been gripping importers for months. Importers, mainly in the manufacturing and the energy sectors, have been struggling to secure the greenback to replenish their suppliers.

Kenya’s forex reserves

…- The acquisition by Shorecap III, LP of 20 percent shareholding in Credit Bank has been approved by Central Bank of Kenya.

- Credit Bank was licensed by CBK as a non-banking financial institution in 1986 under the name Credit Kenya Limited. It converted to a fully-fledged commercial bank in 1995.

- Credit Bank specializes in provision of banking services to small corporates and Micro, Small and Medium-sized Enterprises (MSMEs). It has a market share of 0.5 percent as at March this year.

Mauritian private equity fund Shorecap III, LP has received the nod to acquire a 20 percent stake in Kenyan tier three lender, Credit Bank, in the latest mergers and acquisitions in the country.

The industry regulator, Central Bank of Kenya (CBK), announced the acquisition on Monday, with an effective date of June 15, this year.

This follows CBK’s approval on April 24, 2023, under Section 13(4) of the Banking …

- Dr Kamau Thugge, who is President Ruto’s advisor on fiscal affairs, is set to take over from Dr Patrick Njoroge.

- Previously, Dr Thugge served as the Permanent Secretary at Kenya’s National Treasury between 2013 and 2019.

- Prior to his nomination as Principal Secretary, he worked as a senior economic adviser in the Ministry of Finance since 2010.

President William Ruto has nominated former IMF economist Dr Kamau Thugge for appointment to head the Central Bank of Kenya. Dr Ruto picked Dr Thugge out of a list of six candidates who were interviewed on May 9th for the job that helps define Kenya’s fiscal policy.

Dr Thugge is not a stranger at Kenya’s financial industry. For close to 10 years, between 2013 and 2019, he served as the Principal Secretary, National Treasury under former President Uhuru Kenyatta. He was, however, hounded out of office over allegations of corruption. The scandal, which …

- Governor Patrick Njoroge has written to Janet Yellen seeking audience with her during this year’s Spring Meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF).

- The meetings are set to take place in Washington DC from April 10 –16.

- In January, the World Bank revised downwards Kenya’s growth projection for 2023 to five per cent from 5.2 per cent.

The Central Bank of Kenya (CBK) governor is keen to meet the US Secretary of the Treasury, as the East African country navigates through tough economic times occasioned by both global and domestic factors.

Governor Patrick Njoroge has written to Janet Yellen seeking audience with her during this year’s Spring Meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF), set to take place in Washington DC from April 10 –16.

This is after failing to meet Yellen last October.

“I would greatly appreciate …