- The IMF loan to Kenya provides a much-needed shot in the arm as it navigates debt repayments, including the $2.0 billion Eurobond maturing in June this year.

- The country is expected to repay Eurobond debts of $1.96 billion in 2024, $880 million in 2027, and $978 million in 2028.

- Debt repayment has pressured Kenya as it consumes more of forex reserves and ordinary revenues, wiping out gains in diaspora remittances and tourism earnings.

The IMF loan to Kenya

The International Monetary Fund (IMF) has approved a $684.7 million loan facility for Kenya, giving the East African country the much-needed support to navigate financial pressures amid a maturing Eurobond.

The funds are part of the $941.2 million Extended Fund Facility (EFF) and Extended Credit Facility (ECF) program approved in April 2021 and extended by 10 months in July 2023 to April 2025.

The first review under the 20-month Resilience and Sustainability Facility (RSF) arrangement was approved in July 2023.

The IMF board’s decision allows for the immediate disbursement of $624.5 million under the EFF/ECF arrangements – which includes an augmentation of access of $310.6 million and brings total disbursements under the EFF/ECF arrangements to about $2.6 billion.

The decision also allows for an immediate disbursement of $60.2 million) under the RSF arrangement.

The funds now give Kenya a much-needed shot in the arm as it navigates debt repayments, including the $2.0 billion Eurobond maturing in June this year, amid low revenues with Kenya Revenue Authority missing its target.

According to the National Treasury Principal Secretary Chris Kiptoo, the international sovereign bond issued in 2014 will fall due during the 2023/24 financial year, which ends in June.

The country is expected to repay Eurobond debts of $1.96 billion in 2024, $880 million in 2027, and $978 million in 2028.

Debt repayment has pressured Kenya in recent months as it consumes more of its forex reserves and ordinary revenues, wiping out gains made in diaspora remittances and earnings from the recovering tourism industry.

Remittances totaled $4.2 billion from 12 months to October 2023, which were 4.2 per cent higher than in 2022.

Usable foreign exchange reserves are $6.8 billion (3.7 months of import cover), even as the Central Bank of Kenya endeavours to maintain at least four months of import cover.

The country’s total debt stood at $65.4 billion as of September last year, official data shows, with new loans in December into this year pushing up the figure.

Of this, $34.4 billion was external debt, while $30.4 billion were loans borrowed from the domestic market, including bonds and treasury bills.

Read also: Depreciating shilling worsens Kenya’s debt and economic struggles

Kenya’s economy

“The economy expanded by 5.6 percent year-on-year in the first nine months of 2023, driven by a strong recovery in agriculture which also helped lower both overall and food inflation,” IMF said in a statement.

Non-agricultural growth, however, slowed amid tighter policies.

Fiscal consolidation continued, delivering a stronger primary balance than originally envisaged in the financial year 2022/23, while monetary policy was tightened by 375 basis points in 2023.

IMF noted that exports and remittances remained resilient, while foreign exchange reserves remained adequate despite declining in the second half of 2023 amid debt service payments and limited external financing inflows.

The near-term outlook is one of continued resilience, with growth projected at around five per cent in 2024, amid ongoing adjustments in the fiscal policy and external accounts.

Inflation is expected to inch up in the first half of 2024, driven primarily by global oil price volatility and exchange rate pass-through, but to remain contained due to the recent monetary policy tightening and as the authorities strive to deliver a stronger fiscal consolidation to stabilise the overall public debt to GDP in 2024.

Debt to the GDP is expected to increase slightly to 73.3 per cent, up from 73.2 per cent last year, as the country continues to rely on borrowing to bridge its budget deficit.

The revised budget currently stands at $ 24.2 billion (Ksh3.9 trillion), up from $22.9 billion ( Ksh3.7 trillion), with recurrent expenditure set to consume the lion’s share amid reduced spending on development.

“Notwithstanding the elevated downside risks in the near term, the authorities should be resolute in their actions to help keep confidence anchored,” IMF noted.

It said Kenya’s medium-term prospects are positive and could be buttressed by improving competitiveness and inclusivity and enhancing governance and anti-corruption framework to support a vibrant and market-driven economy.

Progress on the authorities’ climate agenda, including RSF-supported reforms, will prepare the country well against future climate shocks and help attract climate finance to support these further efforts.

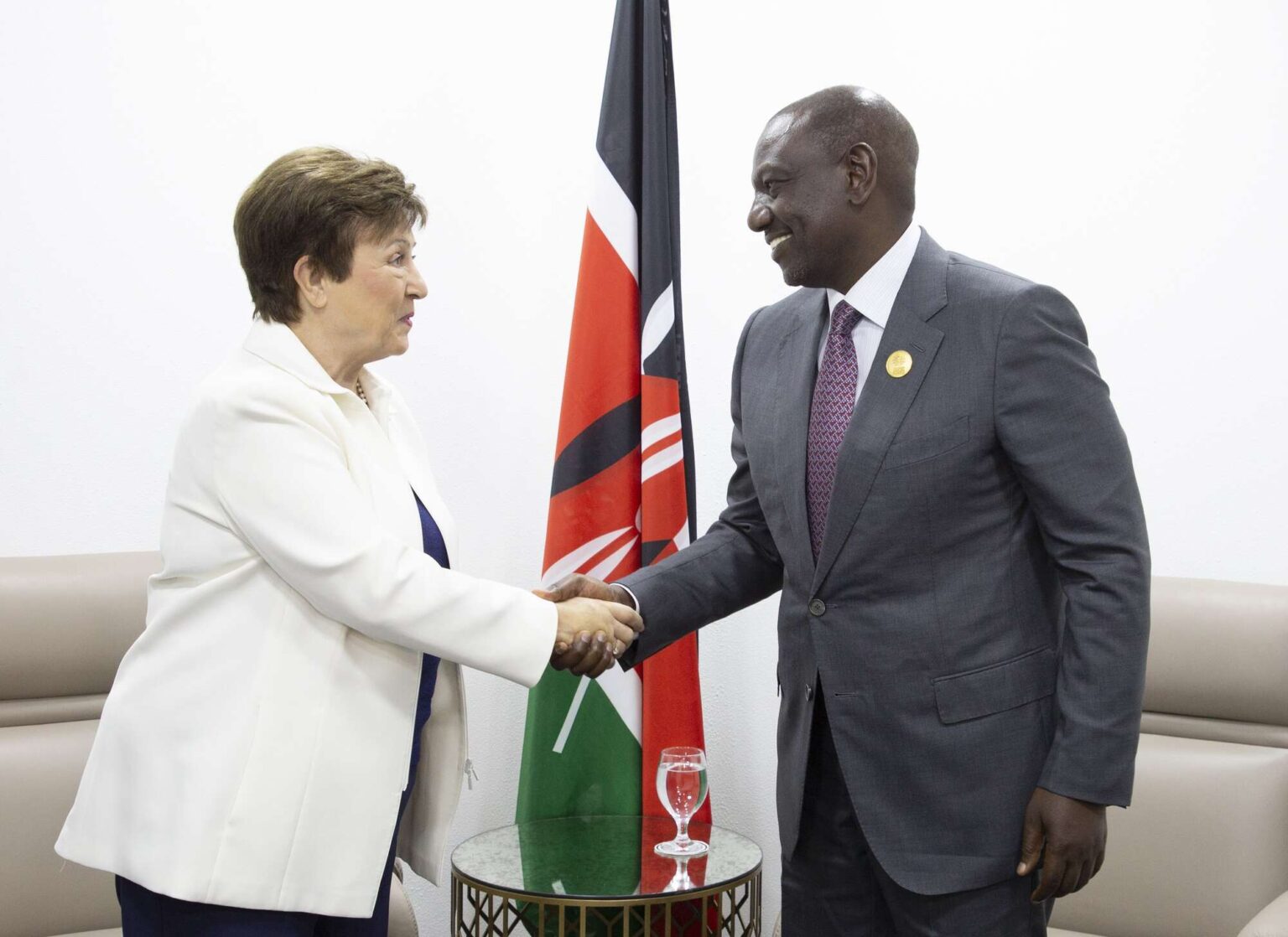

After the Executive Board’s discussion, Ms Antoinette Sayeh, Deputy Managing Director and acting chairperson, said Kenya’s growth remained resilient despite increasing external and domestic challenges.

“The EFF/ECF and RSF arrangements continue to support the authorities’ efforts to sustain macroeconomic stability, strengthen policy frameworks, withstand external shocks, push forward key reforms, and promote more inclusive and green growth,” she said.

According to Sayeh, Kenya’s performance under the ECF/EFF arrangements has been mixed, with adherence to quantitative targets being broadly satisfactory.

The authorities have welcomed progress in key areas, including governance and public financial management.

She noted that continued implementation of corrective measures to address missed targets and accelerated reforms will be important.

“The authorities’ commitment to fiscal consolidation while protecting essential social and developmental spending should support efforts to bring down the debt burden toward the new debt anchor of 55 percent of GDP in present value terms by 2029,” she said.

Read also: Job creation, growth of industries key pillars in Kenya’s $26.4Bn budget

Revenue Strategy

It will also create more space for spending to improve public services.

According to the global lender, risks to planned fiscal consolidation should be monitored, and contingency plans should be promptly activated as needed.

Effective communication of fiscal policy objectives would support efforts at easing financing pressures.

“Monetary policy has demonstrated its ability to react to inflation shocks and anchor expectations. The Central Bank of Kenya should continue to act decisively to ensure that inflation converges firmly to the target,” Sayeh said.

Kenya has also been urged to strengthen the monetary policy framework to support price stability and external sustainability.

The exchange rate should be allowed to respond flexibly to market conditions.

Recent measures at facilitating greater exchange rate flexibility are expected to help ease the forex market dysfunction and support a buildup of forex reserves.

The banking system is generally sound, but emerging vulnerabilities need close monitoring, IMF said.

Unlocking Kenya’s potential and realising its positive medium-term prospects will require resolute efforts to sustain structural reforms to support more job creation poverty reduction, and making the economy greener and more resilient.

To this end, boosting export competitiveness and addressing weaknesses in governance and the anti-corruption framework, including AML/CFT (Anti-Money Laundering / Countering the Financing of Terrorism), remain important.

Other key measures include improving resilience to climate shocks by further strengthening Kenya’s track record in promoting climate risk considerations in fiscal planning and the investment framework, improving disaster risk management, and attracting more climate finance.

Read also: Kenya’s economy strengthened in 2023, forecast to grow by 5.2% this year — World Bank