- The government of Kenya is deploying measures to protect local industries from the onslaught of cheap imports.

- Kenya’s $26.4 billion FY2023/24 budget is an increase from $23.6 billion plan for the fiscal year ending June 30.

- The country is, however, facing high inflation, ballooning debt, and a high rate of joblessness.

President William Ruto’s first $26.4 billion budget for the FY2023/24 starting July 1st seeks to boost job creation, power growth of industries, and reduce borrowing.

Kenya’s $26.4 billion FY2023/24 budget is an increase from the $23.6 billion plan for the fiscal year ending June 30. East Africa’s economic powerhouse, Kenya, continues to struggle with growing inflation, skyrocketing debt, and a high unemployment rate.

Job creation targets Kenya’s youth

The lack of enough jobs is disproportionately affecting the country’s young people. The economy is also struggling from the impact of external shocks. For instance, Kenya is hurting from the Russia-Ukraine war, which has affected the global supply chain. The US Fed’s rate hikes, which have devalued the shilling, and high fuel prices pushing up inflation.

However, Dr Ruto’s administration is eager to revive the economy—but at the expense of taxpayers, who will likely have to make further financial sacrifices.

A higher target of $18.4 billion has been set for the Kenya Revenue Authority (KRA) up from $15.2 billion in the current fiscal year. KRA is charged with assessing, collecting, and accounting for all revenues.

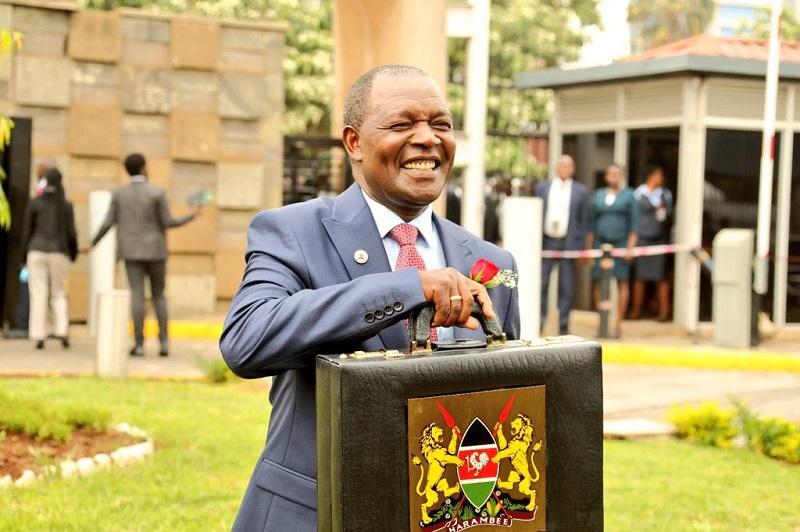

“Supported by tax policy reforms and administration measures, we project total revenue collection, including appropriation-in-aid and grants for the Financial Year 2023/24 budget to be Ksh2.96 trillion ($21.2 billion),” National Treasury and Economic Planning Cabinet Secretary, Prof. Njuguna Ndung’u, told Parliament on June 15.

This is the same as 18.2 per cent of the GDP. Grants are expected to total $301.5 million, while ministerial appropriations-in-aid are expected to total $2.5 billion.

Budget to spur growth of industries

The largest recipients of government spending will be education, national security, transportation, and health.

To improve education outcomes in Kenya, the Treasury has proposed to the National Assembly to effect budget allocations of $4.5 billion to the sector.

This will be split into catering for free primary education, and free day secondary education. The funds will offer learners insurance under NHIF for secondary school students, and junior secondary school capitation. Besides supporting examinations fee waivers the giant allocation will support the recruitment of 20,000 intern teachers.

Treasury has allocated $2.5 billion towards security. The money will be used to support the National Police Service, Prison Services, National Intelligence Service, and Kenya Defense Forces.

The health industry has received at least $1 billion in funding. This budget will promote numerous initiatives that aid universal health coverage.

Equitable share to County Governments is projected at $2.8 billion. Another significant amount, $1.7 billion, will be used to build new roads and bridges and renovate and maintain existing ones.

In addition, the government will make significant investments in poverty reduction, and agriculture for job creation. Priority also goes to transportation, social protection, manufacturing and growth of industries, sports, and tourism sectors.

How Kenya’s budget will be funded

Given the projected revenue and grants against the projected expenditure, Kenya’s fiscal deficit will decline to $5.1 billion. This is equivalent to 4.4 percent of GDP in the financial year 2023/24. And it is based on the estimated $6 billion, or 5.8 per cent of GDP, for the current fiscal year.

Kenya intends to generate $4.2 billion in revenue from the domestic market. The shortfall, $939.6 million, will be realised by borrowing from international markets.

Read also: Diesel turns Saudi Arabia Kenya’s top source of imports

Kenya’s public debt is still manageable, but there are increased risks of financial distress on account of ongoing global shocks. The cost of debt servicing has increased due to the depreciation of the Kenya Shilling against major currencies. The increase in interest rates globally is weighing heavily on the local unit.

Furthermore, because half of the public debt is in foreign currencies, the devaluation of the currency has increased Kenya’s debt.

Data from the Central Bank of Kenya show that as of March 2023, Kenya’s debt was $67.1 billion.

Bottom-Up Economic Transformation

President Ruto’s budget is christened “Bottom-Up Economic Transformation and Climate Change Mitigation/Adaptation for Improved Livelihoods of Kenyans”.

Consistent with this goal, the government plans to scale up the implementation of policy priorities and structural reforms under the Bottom–Up Economic Transformation Agenda.

This will serve as a roadmap for achieving the nation’s development goals and advancing the Sustainable Development Goals and Kenya Vision 2030.

As a starting point, the approach will comprise expanding investments in five strategic areas. These have been identified to have the greatest influence and connections to the economy and on household welfare.

These include the transformation of agriculture and the micro, small, and medium-sized enterprise economy. Housing and settlement, healthcare, and the creative and digital industries were identified as priority areas. And they will be critical in job creation and powering the growth of industries.

“Special focus will be placed on the interventions that reduce the cost of living, create jobs, achieve more equitable distribution of income, enhance social security, expand tax base for more revenues to finance development and increase foreign exchange earnings,” CS Ndung’u said.

Over 2.97 million Kenyans were unemployed in the three months ending in December 2022. This was attributable to low agricultural activity and rising inflation.

New tax measures in Kenya

Kenyan households anticipate lower cooking gas prices as a result of the government’s decision to eliminate the VAT on LPG. According to Prof. Ndung’u, this will assist in reducing the usage of firewood and charcoal, which has a negative impact on the forest cover.

Additionally, the nation has suggested eliminating the current 16 percent VAT on exported taxable services. “This has caused an increase in the cost of exported services hence affecting the competitiveness of our services in the global market,” Prof. Ndung’u noted.

National Treasury wants the VAT on tea acquired from factories or tea auction centers for value addition and subsequent export to be eliminated in order to boost the tea industry. The move will promote local value addition and improve tea exporters’ cash flow.

Additionally, it requests that the National Assembly abolish VAT on all aircraft, pilot training simulators, and aircraft spare parts. This will attract investors and boost job creation. The yearly inflation adjustment will likewise be eliminated. It will curb the annual increase in commodity prices, bringing certainty and stability to the market, and benefiting both investors and consumers.

The plans to raise the current 8 percent VAT on petroleum goods to 16 percent VAT are anticipated to have an impact on the cost of living.

Additionally, the National Assembly has been asked to repeal the exemption from the VAT that applies to taxable services provided for the development of specialized hospitals and commodities and services for the development of tourist facilities.

Also to benefit are goods worth over $14.2 million purchased by manufacturers; as well as plant, machinery and equipment used in the construction of plastic recycling plants.

Gamblers in Kenya hit

The Excise Duty Act provides for the remittance of excise duty to KRA by 20th day of the following month.

However, the CS has claimed that there is no valid reason to hold off on reporting transactions to the KRA for 20 days in the current technological climate.

He has recommended to the National Assembly that the Act be amended to require the return of the excise duty on betting and gaming within 24 hours of the closing of transactions by the betting and gaming enterprises in order to remedy the delay.

Additionally, he mentioned how gambling, prize competitions, and lotteries are all addicting and have bad socioeconomic repercussions on society.

The CS has recommended raising the excise duty rate on betting, prize competitions, and lotteries from 7.5 percent to 12.5 percent. This is in order to deter Kenyans from participating in the activities, particularly school-age children.

As Kenya moves to impose excise duty at a rate of 15 per cent of the excisable value, on fees charged on advertisements by all televisions, print media, billboards, and radio stations in promotion of alcohol, gambling, gaming, lottery, and prize competitions, the media industry has also been impacted.

Treasury has however proposed a reduction on excise duty from 20 percent to 15 percent in respect of fees charged for telephone and internet data services. Fees charged for money transfer services by banks, money transfer agencies, and other financial service providers will be cut by the same margin.

It has also been suggested to lower the excise charge on mobile money transfers from 12 to 10 percent. This, according to Treasury, will encourage retail transactions and boost MSMEs’ economic activities.

Protecting local industries for job creation

Meanwhile, Dr Ruto’s government is keen to protect the growth of industries based in Kenya under favourable tax measures. Among them is the fishing industry, which is experiencing an increased onslaught from imports. By protecting fish industry, Kenya hopes the industry would lead to job creation in the sector’s value chain.

To promote the local fish industry, the CS has proposed to introduce excise duty on imported fish. Importers will pay $714 per metric tonne or 10 percent of the excisable value, whichever is higher.

Other sectors that are being protected by the government include cement manufacturing, metal, and allied companies. The sugar industry, juice manufacturers, furniture, especially office furniture, paints, varnishes and lacquers will pay higher duty on imports.

Kenya’s debt mount

Despite the nation’s ambitious development in income collection, debt repayment is still a challenge. To pay off its debt, Kenya must spend more than 48 per cent of its revenue on paying loans.

Public debt servicing is projected to increase by 34 per cent in 2023 from $6.6 billion to $8.9 billion. Kenya’s public debt remains sustainable but with elevated risks of debt distress due to persistent global shocks.

Read also: A huge task awaits Kamau Thugge at the Central Bank of Kenya

The cost of servicing debt is increasing in Kenya. This is largely due to the depreciation of the Kenya Shilling against major currencies and an increase in interest rates.

Furthermore, because half of the public debt is denominated in foreign currencies, the devaluing shilling has led to an increase in the stock of public debt.

Kenya pledges to honor her public debt obligations when they become due, notwithstanding the fact that the debt has increased.

“Over the medium term, the revenue-driven fiscal consolidation policy stance is expected to improve further the country’s debt sustainability ratios and debt carrying capacity,” the CS said.