Over the last three years, the financial health of the average Kenyan has worsened.

For businesses, especially smaller scale, the lack of financing is a consistent constraint to growth slowing down or entirely killing them off.

2019 was the half-way point for the implementation of Kenya’s long-term national development plan Vision 2030. However, much needs to be done to ensure that financial systems develop to benefit the most at need especially those who are financially limited or excluded.

Read: Digital banking key in boosting financial inclusion

According to former FSD Kenya Director, David Ferrand, East Africa’s investment hub has yet to create the financial system it needs to achieve its ambitions for national development over the next decade.

He notes that while gains in financial inclusion have been extraordinary, these have not translated into the developmental impacts originally posited.

“National savings have not reached the levels sought to sustain the required investment for economic transformation,” adds Ferrand.

In his 2019 report, Financing Kenya: 2020 hindsight for Vision 2030, Ferrand says that looking at Kenya’s financial sector today, the standout success has been in expanding financial inclusion.

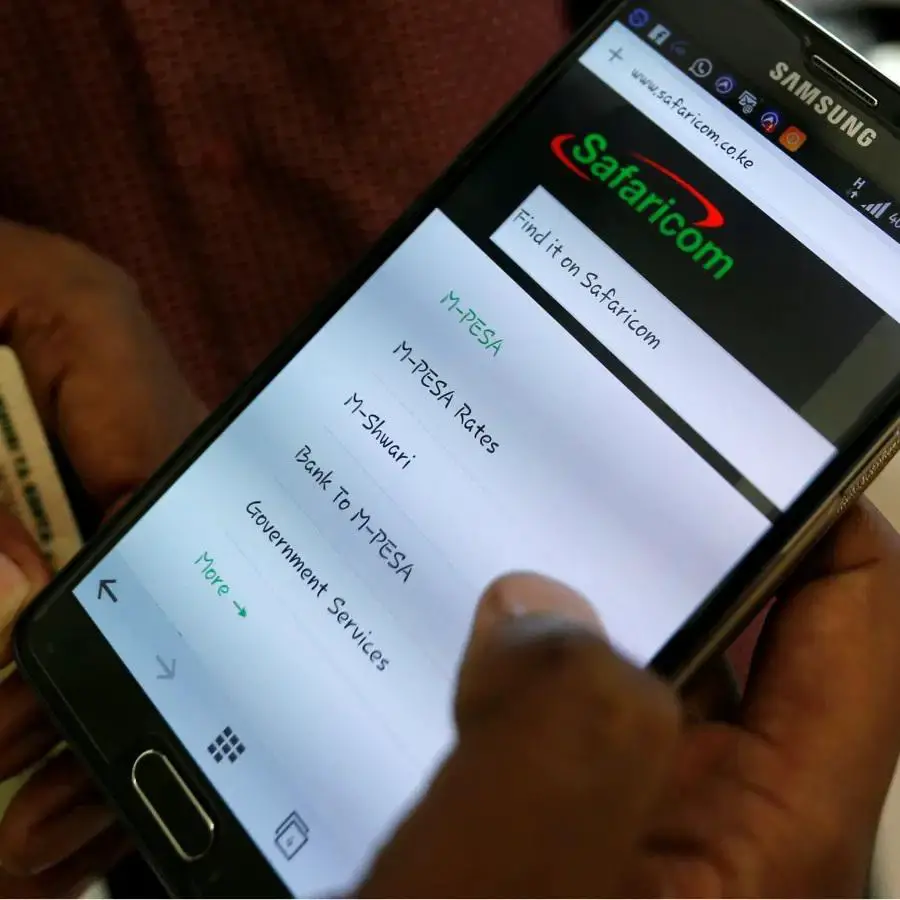

“Revered around the world for the development of mobile financial services, M-Pesa has become a verb in Kenya for payments. Building on this has been a tremendous burst of innovation. We now have many ‘Ms’ building on the mother ‘M-Pesa’ platform. Beyond this Equity Bank has become the exemplar of successful financial inclusion business strategies, Kenya has been among the first markets in Africa to issue green bonds and the Nairobi securities exchange is the fourth largest on the continent. Nairobi already the financial hub for the region is set to establish itself formally as an international financial centre,” he notes.

Alongside this flowery story about M-Pesa, there have been several banking collapses over the last decade – though none in systemically important institutions, notes the report.

There has been widespread public concern over the price of financial services with the banks bearing much of the brunt of the criticism.

Read also: MasterCard, IFC reports 250% increase in Africa financial inclusion

This culminated in parliament re-introducing interest rate controls in 2016, more than 20 years after they were liberalised. These have only just been repealed. Alongside this there have been growing worries over consumer protection heightened by the new threats from the digital age.

Ferrand notes that the potential role of finance in contributing to economic and social empowerment gave rise to the microcredit revolution which has evolved over several decades to what is today referred to as financial inclusion.

While access to credit has been seen as the panacea to protect businesses from failing, research shows that microcredit fell far short of its putative role of a magic bullet which would put poverty into a museum.

“After several million dollars spent on the best economic research money can buy, the conclusion was that access to credit works very well and quite badly for a few, while for the majority it has very modest to no impact (Banerjee, Karlan, & Zinman, 2015). Which was probably what a reasonably straight-talking loan officer from a microfinance institution could have told you twenty years ago,” notes Ferrand.

Ferrand says that to address the challenges in the sector, the financial system needs to solve real-world problems.

In Kenya, Ferrand notes that long-term finance business strategy is about creating value for customers.

Kenya’s poster-child of financial innovation, M-Pesa, was based on solving a real-world problem: enabling Kenyans working away from their families typically in urban areas get money back to support their physically distant relatives still living in rural areas. This is the kind of approach that strategies should work on.

He adds that there is no one-size-fits-all solution adding that diverse problems need diverse solutions.

Lastly, Ferrand adds that the future is open which can be understood in two ways.

The future of the financial system in Kenya can take many paths with one of these being the creation of an open financial system.

Could this happen in Kenya to offer Africans the financial freedom they need? Only time will tell.