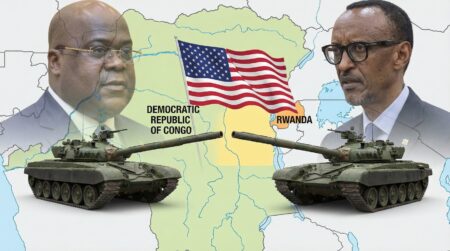

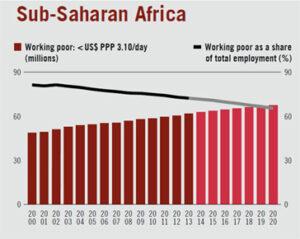

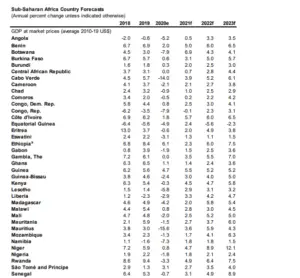

The Sub-Saharan Africa economic growth is forecast to resume to 2.8 percent in 2021 and further rise to 3.3 percent in 2022 according to World Bank.

The growth is due to higher commodity prices, containment of the pandemic, and stronger external demand mostly from the United States and China.

According to the recently updated report from World Bank, despite the provision of vaccines by COVAX, procurements, and logistics challenges are expected to continue to affect the rollout of the vaccination. In the Central African Republic, Kenya, Niger, and Equatorial Guinea delays in major investments in extractives and infrastructure due to policy uncertainty and the existing effects of the pandemic will affect the recovery of the economies.

“Per capita income levels in 2022 are expected to be 4% lower on average than in 2019. Conditions in the region’s fragile and conflict-affected countries are expected to be particularly challenging; their average output level in 2022 is forecast to be 5.3% below its size in 2019.” World Bank said.

In 2021, growth in Nigeria is expected to resume at 1.8 percent and rise to 2.1 per cent in 2022 assuming structural oil sector reforms, higher oil prices, and market-based flexible exchange rate management. Angola on the other hand is expected to grow to 0.5 percent in 2021 and rise to 3.3 per cent in 2022 due to stronger oil prices and government consumption. South Africa is expected to grow to 3.5 percent in 2021 and to 2.1 percent in 2022. According to the bank, weak public investment growth and fiscal pressure hinder the country’s near-term growth prospects while its structural impediments to potential growth remain.

In 2021/22, growth in industrial commodity exporters excluding Nigeria, South Africa, and Angola is expected to pick to 2.4 per cent while in agricultural commodity exporters grow this expected to resume at a faster pace of 4.5 per cent a year on average in the same period.

For some oil exporters in the region, an oil price drop could affect their revenues while a stronger than expected rally in metal and oil prices could boost revenues.

According to the report, while countries like South Africa, Nigeria, and Ghana are upgrading national distribution of vaccines, logistical and procurement, challenges in many countries in the region could further slow the vaccination rollout.

The world Bank noted that food insecurity still remains a key risk as food prices rose to more than 20 percent in 2021 in Ethiopia, Angola, and Nigeria.

“Flood and drought could also destroy crops, exacerbate food price inflation, and further weigh on household consumption. Rising conflicts could weaken recoveries. A sudden rise in sovereign borrowing costs could instigate financial pressures in some countries and high debt burdens and fiscal pressures could become more acute. At the same time, the pace of vaccinations could surpass expectations, restoring consumer and business confidence and strengthening the recovery.” Said World Bank.

In 2020, the region’s output shrank to 2.4 percent to a milder than expected recession due to the pandemic. In 2021, growth has resumed gradually reflecting a growing global economic activity from higher oil and metal prices and progress in containing the pandemic especially in Central and West Africa.

The risk of debt distress in some countries has increased due to the wider budget deficits and increase in government debt.

Sub-Saharan Africa’s biggest economies Nigeria, South Africa, and Angola partially recovered while countries that export industrial and agricultural commodities experienced deep contractions in 2020.

‘In tourism-reliant countries, international arrivals have been at a near-halt, and tourism is likely to remain slow until wider vaccination permits safe reopening to international travel. Despite improvement, COVID-19 has continued to have adverse impacts on health, schooling, investment, and economic growth.” World Bank noted.

In some countries like Nigeria and Angola, inflation has been stoked by currency depreciation, rising food and energy prices as well as accommodative monetary and fiscal policies. In Kenya and South Africa, inflation has been kept in check by subdued demand.

According to World Bank, foreign direct investments in the region have been resilient, taking about nine-tenths of their pre-covid levels, and also remittances to the region held up better than expected.