- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

- Viktoria Ventures honoured for advancing angel investing across Africa

- FSD Africa rolls out $30 million venture fund to speed up insurtech innovation

Author: Joakim Oduor

Income streams for Kenyans have remained constant, against expenditures becoming more inconsistent. Nine out of 10 Kenyan consumers earn less than or the same as before Covid-19. The report further highlights that satisfaction levels with current household income are poor with just one in 10 being satisfied with the exception of higher income earners. Financial distress with declining income streams for Kenyans More people are increasingly foregoing important financial services such as insurance, savings, and short-term investments on the back of stagnated income streams. According to Old Mutual’s inaugural financial services monitor report, a focus on Kenya shows nine out…

Cyber threats increased by 943 per cent in the three months to December 2023, with 123 million cases detected in the previous quarter. In response to these threats, Kenya’s National Cyber Security Centre issued 8.06 million advisories during the period under review. This represented a 44.4 per cent increase compared to the 5.6 million advisories issued between June and September. The Communications Authority of Kenya reports that the number of cyber threats in Kenya increased in the three-month period leading up to December 2023. In its 2023/24 Q2 cyber security report, the regulator notes that the number of cyber threats…

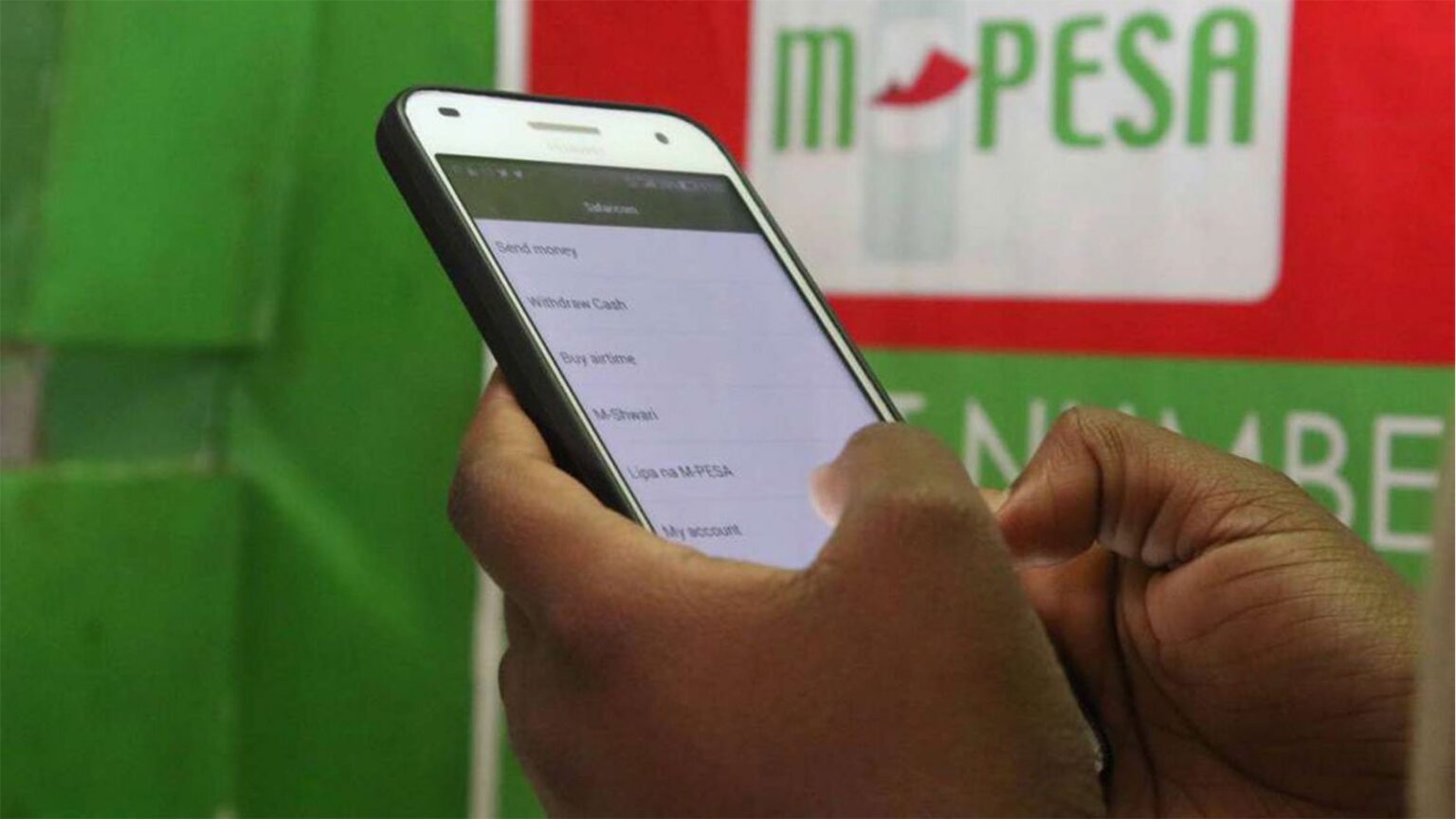

Registered customers for M-Pesa Ethiopia rose to 3.1 million from 1.2 million as of half the Financial Year 2023/2024, transacting worth $115.63 million. Ethiopia’s National Financial Inclusion Strategy 2021–2025 aims to increase financial inclusion from 45 to 70 per cent of all adults by 2025, partly by scaling digital payments through mobile money services. The country also aims to increase the use of digital payments from 20 per cent of all adults in 2020 to 49 per cent by 2025. Revenue growth for M-Pesa Ethiopia Safaricom’s M-Pesa in Ethiopia reported revenue returns of $277,139.43 over the nine months ending in…

Solar energy, alongside wind power, has become the cheapest way to meet the growing demand for electricity, according to the World Bank. World Bank’s Demetrios Papathanasiou says many developing countries have some of the world’s best solar and wind resources. He expresses his optimism about the ability of global countries to tap into advances in solar energy and make dramatic gains. Solar energy is expected to surpass coal as the world’s most available energy source by 2027. The African countries with the most immense global potential are critical drivers of this projection. The World Bank, in its latest energy report…

Ghana’s economy is showing signs of stabilization, which is attributable to the authorities’ steadfast rollout of its IMF-supported economic program. The country’s crises were a result of preexisting vulnerabilities and substantial external shocks. Two years ago, elevated fiscal deficits and public debt levels, together with the combined effects of the COVID-19 pandemic, Russia’s war in Ukraine, and global monetary policy tightening, hit the country hard. Renewed optimism for Ghana’s economy The International Monetary Fund (IMF) has expressed optimism that Ghana is currently making essential inroads to stabilize its economy as continued program implementation beckons a brighter future. This after the…

Glovo has launched the ‘Glovo Africa Graduate Programme,’ an initiative seeking to boost the potential of young Kenyan talent while extending it to other African countries. The initiative is specifically tailored to recruit and develop promising Kenyan and African talent for the job market. Participants can explore roles in operations, quick-commerce, partners & brands, finance & strategy, and brand marketing services. Glovo Africa Graduate Programme Global technology platform for on-demand delivery, Glovo, has launched the ‘Glovo Africa Graduate Program’, an initiative seeking to boost the potential of young Kenyan talent while extending to other countries in Africa. The announcement reiterated…

Italy’s initial pledge of €5.5 billion ($5.95 billion) also includes guarantees, according to Italian Prime Minister Georgia Meloni. AU Commission Chairperson Moussa Faki welcomed the pledge, while noting that prior consultation on the Mattei plan with the African continent would have been desirable. The plan was named after Eni’s founder, Enrico Mattei, the initiative which seemed to be aimed at encouraging a holistic approach to dealing with African countries of interest to Italy. Italy has unveiled a close to $6 billion funding plan to support African development, a move geared towards strengthening bilateral ties. The Italian government noted that the…

With 65% of the global uncultivated arable land located in Africa, AfDB says there is potential for the continent to feed itself and the rest of the world. The lender is now committing to focus on securing long-term financing for research activities and enhancing researcher CGIAR’s effectiveness across the continent. AfDB and CGIAR also anticipate engaging in capacity building for country-based national agricultural research services partners, young scientists, extension workers, and private-sector seed growers to produce certified seeds. The African Development Bank Group (AfDB) and the Consortium of International Agricultural Research Centres (CGIAR) have committed to enhancing food security through…

Cameroon is highly vulnerable to climate change, with risks from recurrent droughts, floods, landslides, and coastal erosion. The funding will play an important role to support the country’s efforts to adapt to and mitigate the impact of climate change and replace more expensive financing. The reform measures under the RSF are also expected to reinforce the growing engagement of development partners and other stakeholders The International Monetary Fund (IMF) has approved an 18-month arrangement worth $183.4 million for Cameroon under the fund’s Resilience and Sustainability Facility. The allocation is equivalent to 50 per cent of quota, with disbursements to start…

Inflation in Kenya slightly increased to 6.9 per cent in January after declining for two consecutive months in November and December. Official statistics show that increases in food, energy, and transportation costs, which together account for about 57 per cent of household budgets, drove up inflation in Kenya. Between December 2023 and January 2024, the prices of Irish potatoes, carrots, oranges, and cabbages increased. In January, inflation in Kenya increased marginally to 6.9 per cent, attributed to a rise in food prices. This comes after a consecutive decline in inflation for two months in November and December, easing below the…