- East Africa banks on youth-led innovation to transform food systems sector

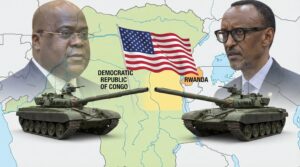

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

- Viktoria Ventures honoured for advancing angel investing across Africa

Author: Wanjiku Njugunah

Wanjiku Njuguna is a Kenyan-based business reporter with experience of more than eight years.

A finding by online marketplace Airduka has found that small-scale sellers in Kenya are optimistic that the business environment will remain stable in 2023 The study found that 75% of small scale sellers expect the trading environment to be calm over the next twelve months now that risks associated with threats such as COVID-19 and the general elections have settled As per the finding, 60% of sellers said they expect their revenues to remain steady in the first half of the year, with growth expected in the second half Small-scale sellers in Kenya are optimistic that the business environment will…

American investment bank Goldman Sachs plans to lay off 3,200 employees this week Goldman Sachs typically trims about one to five per cent of its employees each year and targets underperforming staff The upcoming trim is expected to be deeper than usual in light of the uncertain economic outlook Major U.S. banks, manufacturers and tech companies announced significant corporate layoffs in 2022, amid high inflation, and five rounds of interest rate hikes sparked fears of a recession New data has revealed that American investment bank Goldman Sachs plans to lay off thousands of employees this week. Multiple sources, including Capital…

Kenya’s Cake City has been named East Africa’s leading cake shop in this year’s Pacesetters Awards The Pacesetters Awards is an annual industry leadership recognition programme organised by the Jubilant Stewards of Africa (JSA), a Non-Governmental Organisation Cake City emerged as the winner of the hotly contested Pacesetter in Cake Shop of the Year 2022, following an intensive survey conducted by JSA across East Africa Kenya’s Cake City has been named East Africa’s leading cake shop in this year’s Pacesetters Awards (PSA). The Pacesetters Awards is an annual industry leadership recognition programme organised by the Jubilant Stewards of Africa (JSA),…

A survey by the European Investment Bank has revealed that most Kenyans believe climate change and environmental damage have affected their income or source of livelihood Losses associated with climate change in Kenya include severe drought, rising sea levels or coastal erosion, or extreme weather events such as floods or hurricanes The survey also found that most Kenyans, at 81%, said that investing in renewable energy should be prioritised A new survey now shows that most Kenyans, at 97%, say climate change is already affecting their everyday lives. The first edition of the European Investment Bank’s 2022 Climate Survey found…

Safaricom has reduced paybill charges and business-to-customer tariffs The company said they had reduced bank to M-PESA charges by an average of 61% Safaricom has also reduced M-PESA to Bank charges by an average of 47% Safaricom has reduced paybill charges and business-to-customer tariffs. On December 16, 2022, the Kenyan telecommunication company said they had reduced bank to M-PESA charges by an average of 61%. Safaricom has also reduced M-PESA to Bank charges by an average of 47%, and is applicable to customers making M-PESA to bank transactions. Transactions below KSh 100 remain zero-rated. The reduced M-PESA to Bank tariff…

Visa policies in Africa have improved, with Africans now being able to travel more easily across countries than it was before the COVID-19 pandemic Three countries, namely, Benin, The Gambia and Seychelles, offer visa-free entry to Africans from all other countries this year. In 2016 and 2017, only one country did so The vast majority of African countries – 48 out of 54 – now offer visa-free travel to the nationals of at least one other African country A new report has shown that visa policies in Africa have improved, with Africans now being able to travel more easily across…

KCB Group Plc has acquired Trust Merchant Bank SA (TMB) after receiving all the regulatory approvals The regional lender now owns 85% stake in the Democratic Republic of Congo (DRC) based lender The acquisition of TMB would positively contribute towards KCB’s increased scale of operations by establishing its presence in new markets KCB Group Plc has acquired Trust Merchant Bank SA (TMB) after receiving all the regulatory approvals. The regional lender now owns 85% stake in the Democratic Republic of Congo (DRC) based lender. KCB Group obtained the regulatory green light in Kenya, the Democratic Republic of Congo and COMESA Competition…

Kenya’s economic growth will average 5.2% in 2023 and 2024, notwithstanding current global and domestic shocks The World Bank said the baseline assumes a robust growth of credit to the private sector, continued low COVID-19 infection rates and a near-term recovery in agricultural production The report also noted that the country’s economy continued to rebound from the pandemic in 2022, with the real gross domestic product (GDP) increasing by 6% year-on-year in the first half of 2022 A new report has revealed that Kenya’s economic growth will average 5.2% in 2023 and 2024, notwithstanding current global and domestic shocks. In…

Four feasible value chains, namely pharmaceuticals, cars, cotton apparel and baby food, could drive intra-Africa trade A new report said the four areas link at least five African countries from different regions and have the potential to add value, reduce imports, lift trade and diversify economies for women and youth Despite the potential, several challenges stand in the way of using the four areas to boost intra-Africa trade, including lack of trust in product quality New research has shortlisted four feasible value chains that could drive intra-Africa trade out of more than 415 possibilities. According to the ‘Made by Africa:…

Banks expect an increase in the growth of loans to businesses in Kenya for the rest of the year, supported by an increase in demand to meet business and personal needs A Central Bank of Kenya survey found that loans to businesses in Kenya would grow as businesses start capital expenditures and the environment continues to improve post-Covid and post-elections 43% of non-bank private firms said they expected the demand for loans to increase in November and December as they sought to boost business finance and working capital requirements Banks expect an increase in the growth of loans to businesses…