- Jubilee Health has partnered with M-TIBA & Solution Sacco to launch a comprehensive and affordable health insurance cover dubbed “Solution Afya medical scheme”

- The partnership will enable over 25,000 SACCO members and community-based organisations to benefit from the medical scheme through an extensive network of service providers across Kenya

- The medical scheme will enable users to sign up and manage their health policies through M-TIBA’s mobile platform

Jubilee Health has partnered with M-TIBA & Solution Sacco to launch a comprehensive and affordable health insurance cover dubbed “Solution Afya medical scheme”.

The Nairobi-headquartered insurer said the partnership will enable over 25,000 SACCO members and community-based organisations to benefit from the medical scheme through an extensive network of service providers across the country.

The medical scheme will enable users to sign up and manage their health policies through M-TIBA’s mobile platform.

The health cover, with a minimum premium of as little as KSh 4,265 annually, comes with an inbuilt maternity cover, final expense, and personal accident cover.

Solution Afya members will also access periodic medical checkups, health and wellness programs, and training geared towards disease prevention to contribute to their socio-economic empowerment.

Jubilee Insurance Group Chief Executive Officer Dr Julius Kipngetich noted that embracing digitisation will lower insurance product costs and enable consumers to meet their health needs.

“The pandemic resulted in a priority reset with most individuals focusing on spending habits, health, and wellness. Despite the changing priorities, consumers worldwide are under financial pressure because of the increased cost of living. Ensuring health insurance is affordable and accessible is a high priority for Jubilee Health. Solution Afya medical scheme will enable members to actualise their health priorities by giving them access to quality and affordable health cover,” Dr Kipngetich said.

Research by Jubilee indicates that most healthcare expenses are paid out-of-pocket in Kenya, hindering access to quality care and exposing households to poverty in cases of increased medical bills.

Financial constraints and lack of knowledge of insurance products are the most significant barriers to insurance uptake. The firm noted that utilising digital platforms is critical in understanding and increasing insurance uptake.

Commenting on the same, M-TIBA Managing Director Moses Kuria said that with the significant digital shift in the recent past, it is only correct that they bring affordable insurance solutions closer to the fingertips of their customers.

“Accessing Solution Afya cover through the M-TIBA platform will see members view the cover details, purchase, and track their insurance spend through their mobile devices, bringing convenience and affordable healthcare solutions closer to Kenyans. Continued collaborations between different healthcare players will ensure more people are granted access to effective, reliable, and affordable insurance solutions across the board,” Kuria noted.

Jubilee Holdings posts Sh5.2bn net profit in six months to June

The partnership comes when shareholders of Jubilee Holdings Limited have approved a final dividend of KSh 13.0 per share, bringing the total dividend payout to KSh 14.0 (including a special dividend of KSh 5.0).

The payout follows the exceptional results posted in 2021, where the gross profit hit KSh 8.4 billion, after increasing by 66% from the KSh 5.1 billion reported in 2020.

According to the regional insurer, the performance was despite the increase of medical and life claims relating to COVID-19 cases, which was partly driven by the gain on the sale of controlling interests in the general businesses in Kenya and Uganda, transactions that were completed last year. The company retains a 34 per cent interest in both companies.

During the review period, Jubilee’s Gross Written Premium reached KSh 38.8 billion, an increase of KSh 825 million. The growth, despite the loss of the general insurance business in Kenya and Uganda, was driven by the good performance in the health and life insurance business, which grew by KSh 1.4 billion and KSj 1.2 billion, respectively.

The group’s total assets increased by KSh 9 billion to KSh 155 billion from KSh 146 billion in 2020, the largest in the industry.

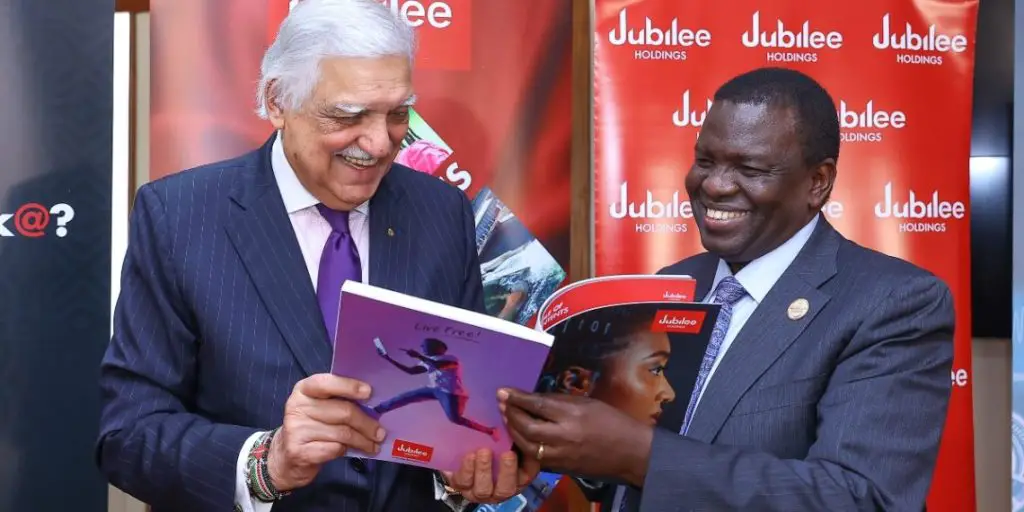

During the company’s annual general meeting, Jubilee Holdings Limited Chairman Nizar Juma said the performance was backed by tight expense control measures and improved return on investments. This allowed Jubilee to reinforce its leadership position in the industry.