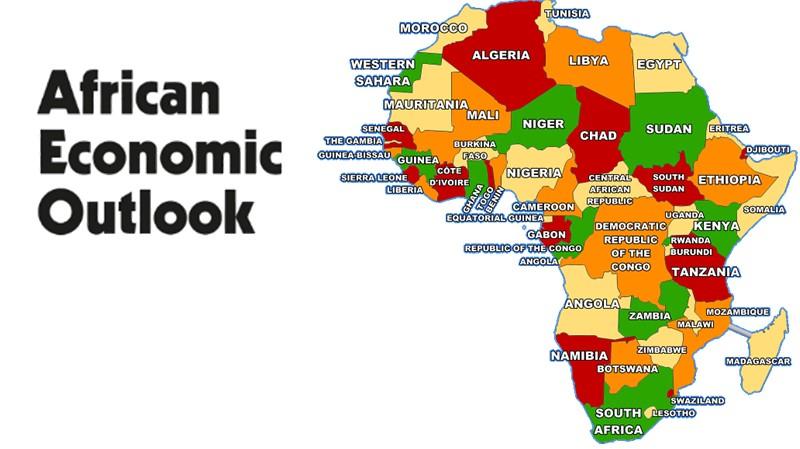

Sub-Saharan Africa and its northern counterpart hold great economic promise.

Africa’s investment case remains a compelling proposition. The continent is home to some of the fastest growing economies in the world; think of Botswana and South Africa.

The continent is home to the youngest population in the world that is moving up the social strata. This means that the population of Africa will demand goods and services that foreign companies will happily supply. The continent, until recently, has attracted record amounts of foreign direct investment as capital made a beeline from developed economies whose returns were marginal at best and lethargic at worst. Returns on investments in Africa have been among some of the highest in the world.

- Sub-Saharan Africa is set to enjoy slower economic and income growth, according to a report by the World Bank.

- The Global Economic Prospects is an annual report produced and published by the World Bank Group and offers the multilateral financial institution’s outlook on various regions of the world, given current developments.

- Africa, which includes Sub-Saharan Africa, has immense potential for economic growth and has a strong investment case. However, the World Bank projects that the region’s economic growth will slow to 3.7%, down from their initial projection of 4.1% in 2021.

The continent in the near future will have the largest population in the world. The population of Africa is urbanizing as citizens of the nations of the continent migrate from rural to urban areas.

This addition to its vast natural resources is a potent combination for its rapid economic expansion. The world witnessed first-hand the economic miracle where China transformed itself from a rural backwater in 1949 when the modern Chinese state was founded to an economic and military superpower by 2019. The year 2019 is significant to China because the country celebrated 70 years of its founding as a communist state, and the Asian country gained worldwide recognition as a military superpower.

China put on a military parade that displayed a weapons arsenal that made the United States sit up and take notice. How was this possible? China’s economic transformation was because of several factors. One of the most important factors was and remains the rapid urbanization of its population, driven by the migration of millions of Chinese citizens from the rural areas to the booming metropolises. This urbanization increased the demand for natural resources and commodities needed to construct cities, roads, and infrastructure needed to support a rapidly expanding economy.

Africa is at the same point in its economic journey.

The continent is also starting to experience mass urbanization as identifiable middle classes emerge in economies that have grown consistently. Despite the immense potential and promise for economic growth and progress, rating agencies and multilateral institutions have downgraded Africa’s projected economic growth rate. This is in the face of slowing global economic growth in the most advanced of economies like China and the United States. The United States registered to slow economic growth because of increases in interest rates by the Federal Reserve to quell growing inflation.

In China, the economy slowed because of the country’s remaining COVID restrictions and zero tolerance for infections. This kept the Asian giant from fully opening up after the rest of the world had done away with COVID restrictions. This delay in opening up caused further global supply chain disruptions.

Granted, because of globalization, the world is increasingly interdependent. This means that countries of the world are susceptible and vulnerable to disturbances and shocks that are far beyond the vicinity of their immediate geographical region. The war between Russia and Ukraine has proven this beyond any doubt. The World Bank Group published its annual Global Economic Prospects Report in June 2022, describing the multilateral institution’s outlook on the global economy, given current events and developments.

The World Bank projects that economic growth in Sub-Saharan Africa will slow to 3.7%, consistent with the downgrades of at least 60 regional economies. Sub-Saharan Africa is projected to have income per capita growth is a marginal 1% compared to other emerging markets and developing economies. This slowdown in economic and income growth by the World Bank has been attributed to price pressures from the ongoing Russian and Ukrainian conflict. The conflict has adversely affected the affordability of food and eroded incomes.

The World Bank expects that more people in Sub-Saharan Africa will fall into poverty, especially in countries that are reliant on imports for food and fuel. This poverty stems from the fact that Sub-Saharan African countries have anaemic domestic economies and depend on foreign trade for their economic growth and performance. This is a stark contrast to India, which has managed to grow its economy despite a background of slowing economic growth.

Despite the vulnerability of countries in Sub-Saharan Africa, the impact of the geopolitical tensions in Europe has been somewhat limited compared to European countries. The World Bank reported that “…Limited direct trade and financial linkages with Europe and Central Asia have helped contain some of the adverse effects of the Russian Federation’s invasion of Ukraine on Sub-Saharan Africa”.

So far, the impact of this conflict has been restricted to economic headwinds caused by rising food and energy prices. The only respite for Sub-Saharan countries from these economic headwinds is the benefit from elevated commodity prices, which has led to increased exports for countries that produce these. Inflation from rising food prices and farming inputs will remain going forward in the future.

The World Bank notes, “Food insecurity is worsening in SSA, especially in countries dependent on food imports and where the poor account for a large share of net food buying households”. This is a serious vulnerability given that, reportedly, on average, food imports take up at least 20% of imports in Sub-Saharan Africa.

This is twice as high as other emerging markets and developing economies. The World Bank report also noted that at least 75% of Sub-Saharan African countries are already classified as food-deficit countries. This shows that would the rest of the world classifies as a small problem in Africa tends to be catastrophic because of how vulnerable the Sub-Saharan region is to external shocks.

- Some of the drivers of economic growth in Sub-Saharan Africa include the continent’s massive population, which is reported to number in the region of 1 billion. The population is made up of relatively young members who are migrating from rural areas to urban metropolises.

- This process, known as modernization, is Africa’s second driver of economic growth.

- The World Bank report found that rising food inflation and energy prices will constrain the ability of the Sub-Saharan region to grow or maintain its level of growth.

AfCFTA is one way to deal with this excessive vulnerability to external shocks by Sub-Saharan African countries. The continental free trade area should spur trade between African countries and lead to them being less dependent on foreign countries that are not on the African continent. AfCFTA, if successful, should create a single domestic African economy which will empower all African countries. Not just those in Sub-Saharan Africa.

While the rest of the world waves goodbye to the COVID pandemic and its impact, Africa will continue to grapple with the poverty that the pandemic created. Overall, the World Bank expect economic growth in the region to slow down from what was originally projected in 2021. The Sub-Saharan region was expected to grow by 4.1% to 3.7% in 2022. This is because of weak domestic demand, tightening monetary policy, and rising inflation.