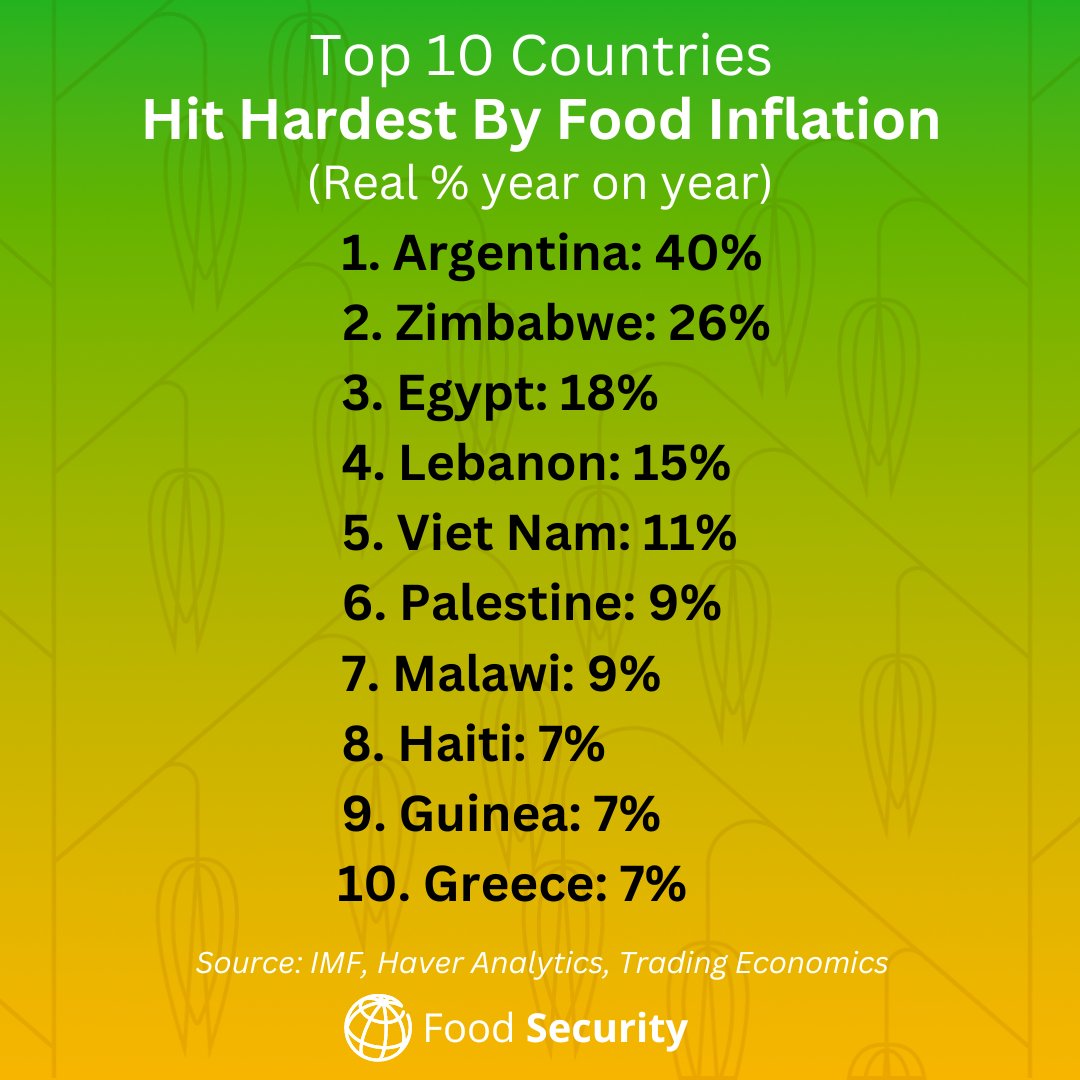

- Zimbabwe is the worst hit in Africa with food inflation at 26% YoY, followed closely by Egypt at 18%, Malawi at 9%, and Guinea at 7%.

- The persistent weakness of the Zimbabwe dollar has been a driving force behind the steep price growth throughout 2023.

- Real food inflation, calculated as the difference between food inflation and overall inflation, provides a dire picture of the strain on households’ budgets in these countries.

The economies of Zimbabwe, Egypt, and Guinea are facing significant challenges due to soaring food inflation, placing them among the top 10 countries globally most affected by this roiling crisis.

According to the World Bank’s February 2024 update, Zimbabwe leads the pack in Africa, with food inflation at a staggering 26 per cent year-on-year, followed closely by Egypt at 18 per cent and Guinea at 7 per cent.

Real food inflation, calculated as the difference between food inflation and overall inflation, provides a dire picture of the strain on households’ budgets in these countries.

Egypt’s food inflation has been on a steady rise since January 2023

The United Nations’ Food and Agriculture Organization (FAO) notes that Egypt’s food inflation has been on a steady rise since January 2023, reaching a peak of 74 per cent in September 2023, compared to 48 per cent at the beginning of the year.

This dramatic increase is expected to impact the consumption patterns of staple foods such as bread and rice among Egyptian households even as risks abound in the horizon.

In response to the crisis, the Egyptian government has taken measures to ensure food security, announcing in January 2024 that national strategic reserves of wheat were sufficient to cover consumption needs for 4.8 months.

Despite these efforts, wheat imports for the 2023/24 marketing year are forecast to be lower than the previous year, indicating ongoing challenges in stabilizing food prices and ensuring adequate supply.

The situation in Guinea, while less severe compared to Zimbabwe and Egypt, still poses a significant challenge, with food inflation at 7 per cent. This underscores the broader issue of food insecurity and the need for sustained efforts to address the root causes of food price volatility in these countries.

The Institut National de la Statistique de Guinée reported that the cost of food in Guinea rose by 14.90 per cent in December 2023 compared to the same month in the previous year. Food inflation in Guinea has averaged 18.73 per cent from 2005 to 2023, reaching an all-time high of 64.40 per cent in September 2005 and a record low of -1.50 per cent in December 2014.

Food inflation in Zimbabwe worsened by tanking currency

Zimbabwe has been grappling with a challenging economic situation, particularly concerning the steep rise in maize meal prices, as highlighted by data from FAO. After a period of relative stability in late 2023, maize meal prices surged in January 2024, primarily due to the sharp depreciation of the national currency – the Zimbabwe dollar – against major world currencies.

The persistent weakness of the Zimbabwe dollar has been a driving force behind the steep price growth throughout 2023, pushing Zimbabwe’s national inflation rate to 35 per cent in January 2024, up from 27 per cent in December 2023.

This inflationary pressure has significantly eroded the purchasing power of households, leading to an estimated 3.5 million people being acutely food insecure and in need of urgent assistance until at least March 2024.

The high prevalence of food insecurity is exacerbated by reduced agricultural outputs from the previous cropping season in 2022/23, particularly in the southern and western provinces of Zimbabwe.

This reduction in agricultural productivity has further strained food security conditions, limiting rural households’ income-earning opportunities from crop sales.

Looking ahead, FAO predicts that Zimbabwe’s food security conditions will remain stressed in 2024, primarily due to the expected poor agricultural output. This limitation in agricultural productivity, coupled with the ongoing steep price growth, will continue to challenge households’ capacity to purchase essential goods and services.

Read also: Costly voyages: Will EAC shoulder the burden of Houthi rebels in the Red Sea?

Global agricultural markets: Stability amidst challenges

The February 2024 Agricultural Market Information System (AMIS) Market Monitor paints a picture of relative stability in global commodity markets, with wheat, maize, and soybean export prices hitting their lowest in two years.

However, the situation is not without its challenges, particularly in the rice value chain sector, where prices are nearly one-third higher than a year ago due to El Niño-induced production shortfalls and export restrictions imposed by India.

One of the major concerns highlighted in the report is Brazil’s soybean production, which is being threatened by below-normal rainfall, leading to stress on crops. This could have significant implications for global soybean markets, as Brazil is a major producer and exporter of soybeans.

In addition to production concerns, the report also points out shipping disruptions that have affected global trade flows, particularly in key maritime chokepoints such as the Red Sea waters and the Panama Canal.

These disruptions have not only increased shipping costs but also delayed deliveries, impacting global value chains and posing challenges to industries reliant on timely shipments.

The report raises concern about the potential long-term effects of these disruptions on trade costs, greenhouse gas emissions, and the sustainability of the agricultural sector. It underscores the importance of addressing these challenges through coordinated efforts to ensure the stability and resilience of global agricultural markets.

While global commodity markets have maintained relative stability in early 2024, challenges such as production shortfalls, export restrictions, and shipping disruptions highlight the need for vigilance and proactive measures to mitigate risks and ensure the sustainability of the agricultural sector.