- Climate emergency has been a new concern in businesses across the markets

- From those polled 87 per cent of respondents agreed to some extent that they were concerned about physical climate risks

- 72 per cent of corporates surveyed had experienced an extreme weather event in the last five years

Nearly four out of every five businesses in many of the countries most vulnerable to the impacts of the climate emergency are already suffering the consequences of a rapidly changing environment.

The startling finding is contained in British International Investment’s third annual Emerging Economies Climate Report – a survey of its investee businesses in Africa, Asia and the Caribbean. The report is a joint effort between Grantham Research Institute on Climate Change and the Environment and ODI, the global think tank.

BII, Managing Director and Head of Climate, Diversity and Advisory Amal-Lee Amin says that that 79 per cent of companies surveyed said that climate change was already impacting their business, up from 68 per cent in 2022.

“Businesses and entrepreneurs across the emerging economy markets in which we operate are on the front lines of the climate emergency. Their businesses are already feeling the significant impacts of the climate emergency,” said BII, Managing Director and Head of Climate, Diversity and Advisory Amal-Lee Amin.

Key Climate Emergency Concerns

It also found that 72 per cent of corporates surveyed had experienced an extreme weather event in the last five years with droughts, floods and heat cited as the greatest cause for concern.

From those polled 87 per cent of respondents agreed to some extent that they were concerned about physical climate risks – up from 70 per cent in 2022. A greater 73 per cent of respondents agreed to some extent that they were concerned about the risks associated with a low-carbon transition – up from 66 per cent in 2022.

More respondents are concerned about climate change affecting business growth and viability: 61 per cent thought climate change will affect the viability and growth of their business in the next five years compared with 56 per cent in 2022.

The survey further shows that more respondents agreed that climate action leads to more long-term business success and 97 per cent agreed to some extent that organisations that take steps to reduce their carbon emissions and reduce vulnerability to physical climate change risks will be more successful in the long term.

Read also: COP28 failures: Climate change undermines Africa’s food security

Strategies in response to climate change

The majority of respondents (65 per cent) have adapted their business strategies in response to climate change; and more are calculating their carbon footprint compared with last year (45 per cent).

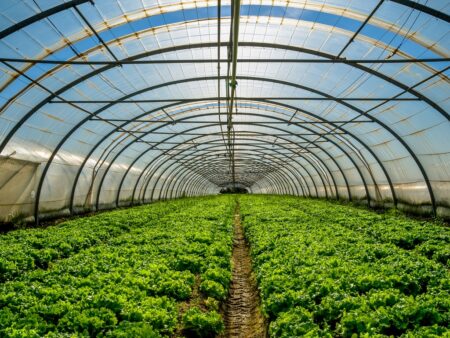

Survey responses varied across sectors and business types; financial services or fund managers cited fewer climate impacts, while corporates – particularly agricultural businesses – are facing more significant impacts.

While 86 percent of corporates said they are being impacted by physical and transition risks today, 68 per cent of financial services firms said the same.

Despite many respondents highlighting that acting on climate can be cost-saving and add long-term business value, they also noted they did not have the knowledge and resources to respond to climate risks and opportunities. Respondents to the survey said they would benefit from more technical training on how to respond to the climate emergency as well as targeted investment and policy and regulatory action.

“As long-term investors in climate finance, it is the role of BII and others to equip these businesses with the capital and expertise to play a key role in the fight against the climate emergency and to safeguard their long-term viability.” Added Amal-Lee Amin

Nick Robins, the Professor in Practice of Sustainable Finance at the Grantham Institute, mentioned that the report demonstrates the significant demand among companies in emerging economies for specific investments to empower them in addressing the climate crisis.

He added that there is a strategic need for businesses and investors in the Global South to increase capital flows in a manner that fosters a fair transition for workers and communities. Robins underscored the importance of shaping the transition to enhance the creation of high-quality jobs and promote gender equality.