- The Bikita mine, located 308 kms south of the capital Harare has the country’s largest lithium mines with reserves of 10.8 million tons of lithium ore.

- An export ban is designed to change the incentives for processing firms to relocate or add value to the source market

- A growing number of countries rich in natural resources that the rest of the world needs are introducing export restrictions of raw.

Zimbabwe has prohibited the export of raw lithium from its mines so it can cash in on value addition. Zimbabwe holds the biggest lithium reserves in Africa and the fifth biggest in the world.

The southern African country boasts of many lithium greenfield projects in places like Goromonzi, Mberengwa, Shurugwi, Zvishavane, Bikita and Mutoko.

According to Quartz, the Bikita mine, located 308 kms south of the capital Harare has the country’s largest lithium mines with reserves of 10.8 million tons of lithium ore.

“The Arcadia Lithium Mine is expected to reach an annual production of 2.5 million tons of lithium ore after the mine is deployed, which would roughly equate to US$3 billion in exports.”

Mineral exports account for about 60 per cent of Zimbabwe’s export earnings while the mining sector contributes 16 per cent to its GDP, according to a 2021 mining report by the London School of Economics.

In a Statutory Instrument 213 of 2022 gazetted last week, the export of raw or unprocessed lithium was effectively banned by the mining authorities.

“…No lithium bearing ores, or unbeneficiated lithium whatsoever, shall be exported from Zimbabwe to another country except under written permit of the Minister.”

For any miner or entity wishing to export lithium, the SI 213 of 2022 directed that express authority has to be sought from the Minister of Mines and Mining Development. If granted the approval to export, the SI stipulated that a commensurate VAT payment has to be remitted.

“On written application by any party— wishing to export samples of lithium bearing ore or unbeneficiated lithium for assaying outside Zimbabwe; or to a miner or exporter of lithium upon production of written proof satisfactory to the Minister that there are exceptional circumstances justifying the exportation in question and that the lithium bearing ores or unbeneficiated lithium in question have been valued in terms of section 12D(3) of the Value Added Tax Act [Chapter 23:12] for purposes of payment of the export tax on unbeneficiated lithium..” read part of the SI

“…any person who contravenes or fails to comply with any order or with the terms and conditions of any permit issued to him or her under an order shall be guilty of an offence and liable to— (i) a fine not exceeding level 9 or twice the value of the base minerals in respect of which the offence is committed, whichever is the greater; or (ii) imprisonment for a period not exceeding two years; or to both such fine and such imprisonment,” further read parts of the SI.

Chamber of Mines of Zimbabwe (CoMZ) and Zimbabwe Miners Federation (ZMF) says the blanket ban on raw lithium exports is a step in the right direction to push for the development of the ‘green metal’ mining sector in the country.

Why Zimbabwe banned export of raw lithium?

An export ban is designed to change the incentives for processing firms to relocate or add value to the source market so that resource-rich nations can make more of the value-added in, for example, the manufacturing of electric batteries.

In an interview published by Daily News, ZMF president Henrietta Rushwaya said lithium mining in the country was marred by leakages leading to the loss of revenue to the government, compromising the attainment of the US$12 billion mining economy by 2023 target.

“There are lots of leakages and the government continues to lose out on revenues. As a country we are not realizing the true value of the resource that we possess as a nation.

“We want the participation of serious players in the beneficiation process so as to create jobs for local indigenous Zimbabweans for us to attain the US$12 billion mining economy target,” she said.

“If we continue exporting raw lithium we will go nowhere. We want to see lithium batteries being developed in the country,” he said. “We have done this in good faith for the growth of industry,” said deputy mining minister Polite Kambamura.

Read: Africans still losing game-changer natural resources advantage

When it comes to abandoning fossil fuels and ensuring that the world can transition to a zero-carbon future, lithium is undoubtedly the most crucial component due to its high electrochemical potential. Rechargeable lithium-ion batteries, which are used in most personal electronics and, most crucially, electric cars, contain the lightweight metal.

In order to ensure that there is enough lithium supply to fulfill demand, corporations are rushing to target numerous lithium development projects in response to the dramatic surge in EV demand in recent years.

A growing number of countries rich in natural resources that the rest of the world needs are introducing export restrictions of raw, unprocessed extracted materials.

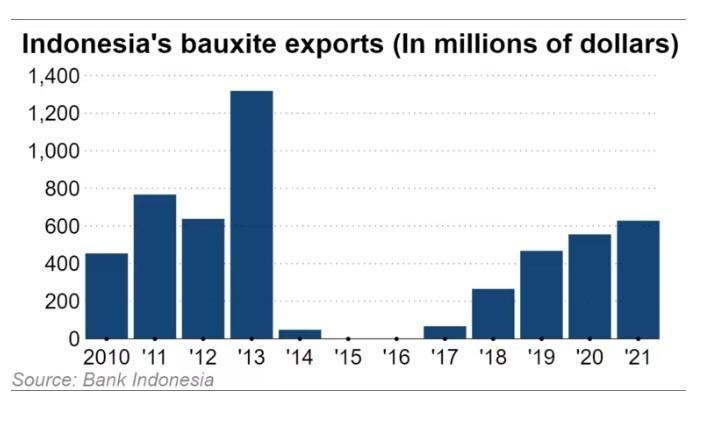

Indonesia has announced a ban on exports of bauxite, as part of a strategy to develop a domestic mineral refining and processing industry. The ban on exports of bauxite, the world’s primary source of aluminium, will take effect in June 2023.

“The government is committed to continually building sovereignty in our natural resources sector and add value to domestic

-

Basic

Premium $5.00 -

All Access Plus

Premium $40.00 -

All Access Plus + Print

Premium $100.00 -

Free

Free Membership $0.00 -

All Acces Print

Premium $500.00

Aluminum is widely used in kitchen utensils, window frames, building materials, aircraft and a huge variety of other products.

Indonesia was the world’s fifth largest producer of bauxite in 2020 and had the sixth-most reserves, according to the U.S. Geological Survey.

According to an article by Nikkei Asia published on December 21, 2022, China had been the single biggest importer of Indonesia’s bauxite for several years leading to the first ban, with 99 per cent of the shipments going to China in 2014. Although China has reduced its dependence on Indonesia for bauxite it has been buying more and more from the country since the 2017 relaxation. China last year sourced nearly a fifth of its overall aluminum ore and concentrate imports from the archipelago.

Indonesia this year also temporarily banned shipments of coal and palm oil, creating commotion in those markets.