- In East Africa, Kenya’s venture capital share grew from 86 percent in 2022 to 91 percent in 2023.

- Eastern Africa’s largest economy attracted $880 million (Sh139.9 billion) in 2023, representing 31 percent of all startup investments on the continent.

- Africa: The Big Deal report shows that startups in Kenya that raised $100,000 (Sh16 million) and above stood at 93.

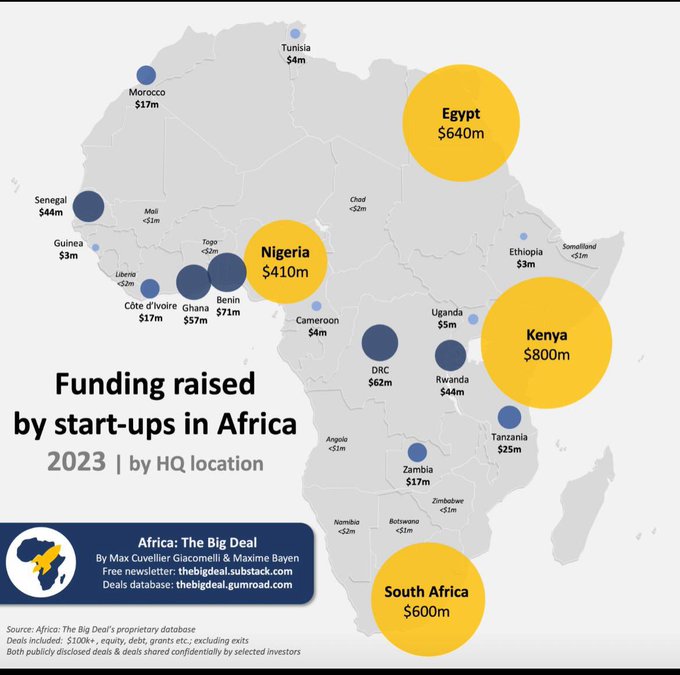

Kenyan startups secured an impressive $800 million in venture capital funding in 2023, surpassing Egypt, Nigeria, and South Africa to emerge as the leading recipient of investments on the continent.

The latest findings from Africa: The Big Deal, a platform specializing in startup deals, reveal that Kenya’s share accounted for 28 percent of the total funds raised across Africa.

The report highlights that Egypt, which took the lead in 2022, secured the second position with $640 million in capital funding. South Africa followed closely with $600 million, while Nigeria secured $410 million in venture capital funding, rounding out the top contenders.

In East Africa, Kenya’s share grew from 86 percent in 2022 to 91 percent in 2023, showcasing its dominance in the region.

The report shows that startups that raised $100,000 (Sh16 million) and above in the country stood at 93.

“If we look at things from a regional point of view, 2023 has seen a rebalancing of startup investments across the continent. While Eastern Africa comes out on top, the four key regions have attracted rather comparable amounts of funding last year,” reads the report in part.”

Leading Kenyan firms in attracting venture capital

With nearly half a billion dollars raised by Sun King and M-Kopa alone, Eastern Africa attracted $880 million (Sh139.9 billion) in 2023, representing 31 percent of all the startup investment on the continent.

It, therefore, took the number one spot up from position two in 2022 and four in 2021.

Debt represented more than half (56 percent) of the funding raised in the region, and overall, 130 startups raised $100,000 or more during the period.

Fintech is still king in attracting funding, accounting for about 45 percent of the total funding. But energy-led startups are increasingly gaining traction.

For the first time, Northern Africa was the second-most attractive region on the continent, as startups from the region recorded a 39 percent decline year on year to $670 million (Sh106 billion).

Southern Africa emerged as the only region among the four primary regions to register a moderate yet positive growth of 6 percent year-on-year.

None of the startups in the region secured funding exceeding $100 million, and the top three fundraisers—Planet42, TymeBank, and E4—accounted for only approximately one-third of the total regional funding, in contrast to 57 percent in Eastern Africa and 86 percent in Northern Africa.

The percentage was even less in Western Africa at 23 percent, yet it boasted the highest number of ventures securing $100k or more (191, constituting 39 percent of the continent’s overall total).

Despite raising just over $600 million in funding, which is 2.6 times less than in 2022, the region fell from the top spot to fourth.

This marks a significant decline in its performance since 2019 when the platform began monitoring deals.

While being the only region to record a 33 per cent year on year growth, from $51 million in 2022 to $68 million in 2023, Central Africa continues to represent a fraction of the total funding (2 percent), orders of magnitude smaller than its neighbors.

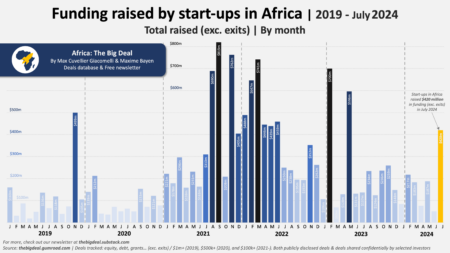

Last year marked the lowest funding for African startups since 2020’s $2.1 billion (Sh332 billion). It’s a 36 per cent decline from 2022’s $5 billion (Sh791 billion) total. The funding streams shrunk as harsh economies surfaced.

Read also: Google US$3.9 million fund for tech startups to export technologies

AfDB Financing

The African Development Bank (AfDB), in partnership with the Global Center on Adaptation, committed $996.6 million in venture capital last year to support youth startups on the continent as part of the fight against climate change.

In 2021–2022, the Big Four were, in order: South Africa, Kenya, Nigeria, and Egypt. During this period, Nigeria raised an astounding $1.7 billion in 2021, followed by $910 million from South Africa, $500 million from Egypt, and $42 million from Kenya.

In 2022, the funding landscape shifted, with $1.2 billion raised in Nigeria, $1.1 billion in Kenya, $800 million in Egypt, and $555 million in South Africa.

In Egypt, 48 ventures raised over $100,000 in 2023, the lowest number among the Big Four. However, thanks to a YoY decline (-20 per cent) more moderate than Kenya and, most importantly, Nigeria, it was enough for the country to claim the second spot.

Egypt’s share of North African funding grew substantially from 72 per cent in 2022 to 95 per cent in 2023 (+23pp, by far the strongest progression), due to the magnitude of MNT-Halan’s fundraising, and Algeria and Tunisia’s inability to repeat their strong 2022 performance.