- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Afreximbank

- Since 2014, AFC has invested over $1 billion in Africa’s mining of precious metals and critical minerals across several countries.

- The latest partnerships will further strengthen the sector by driving significant capital flow into the continent.

- According to the United Nations Conference on Trade and Development (UNCTAD), two-thirds of developing countries depend on commodities.

Boosting the mining of precious metals in Africa

Africa’s mining sector is poised for significant developments as the Africa Finance Corporation (AFC) throws its weight behind the industry, a key driver of economicjordan air force 1 castelli gabba yeezy shoes under 1000 jordan proto max 720 yeezy boost 350 v2 hyperspace durex intense vibrations ring air jordan 1 element brock purdy jersey dallas cowboys slippers mens custom kings jersey custom dallas stars jersey air jordan 1 element uberlube luxury lubricant air jordan 1 low flyease custom dallas stars jersey growth in commodity-dependent countries.

AFC, the …

- As AfCFTA becomes a part of the daily business environment, governments and businesses need to know how product standards and regulations protect traders and the society.

- Governments need to create an enabling environment for investors, which becomes more attractive to foreign direct investment if harmonization of standards exists.

- Other trading blocs such as the European Union are strong because they collaborate on standards and compliance regulations.

The African continent presents huge potential for growth, and the recently introduced African Continental Free Trade Area (AfCFTA) agreement promises to underpin trade facilitation and economic expansion, becoming the largest free trade area since the formation of the World Trade Organization in 1995.

The longest journey starts with a single step. Governments, public bodies, private institutions, and investors are engaging in conversations with a pointed focus on compliance standards, verification of conformities, and regulatory alignment to encourage safe import and export.

Africa’s current population …

- Afreximbank has announced plans to establish a $1 billion Africa Film Fund in 2024.

- Africa Film Fund will oversee financing of African filmmakers, producers, and directors of creative projects across the continent.

- Despite its potential to employ over 20 million people, Africa’s film industry is facing several challenges. These include limited access to financing and copyright infringement due to weak copyright laws.

The African Export-Import Bank (Afreximbank) has announced plans to establish a $1 billion Africa Film Fund to be launched in 2024. Addressing the opening of the 2023 CANEX Summit held as part of the third Intra-African Trade Fair (IATF2023), Kanayo Awani, Executive Vice President at Afreximbank, said that the fund will oversee film financing, co-finance with large studios, finance African filmmakers, and finance producers and directors of film projects across the continent.

Awani revealed that so far, the Bank has a pipeline of over $600 million …

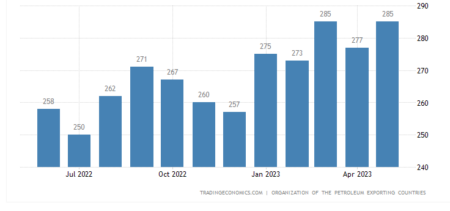

- Congo is working to increase its crude oil and gas production ahead of OPEC negotiations in November.

- Afreximbank is offering $300 million loan to Trident OGX Congo to increase crude oil production by 30%.

- Congo-Brazzaville’s production is expected to rise to 400,000 barrels per day by next year.

Congo is rolling out a plan to increase crude oil and gas production ahead of vital negotiations over OPEC production baselines in November. In the latest move, the African Export-Import Bank (Afreximbank) has entered into an agreement to provide a $300 million loan to Trident OGX Congo aimed at increasing the country’s crude oil production by 30 per cent.

The $300 million loan will enhance Congo’s crude oil output significantly within a year, and double gas production in two to three years, effectively stepping up the country’s 2024 output quota.

Congo-Brazzaville’s production is currently just below 300,000 barrels of oil equivalent per …

- Afreximbank and Nigeria’s Anambra State have partnered to advance the state’s “Smart Mega City” vision and foster economic growth in Africa.

- The partnership involves an MOU that seeks to offer project preparation and advisory services for state development.

- The collaboration opens the door to a potential debt financing of up to $200M, which could support the realization of transformative projects.

The African Export-Import Bank (Afreximbank) and Nigeria’s Anambra State have entered into an agreement to accelerate the region’s vision of becoming a “Smart Mega City”.

In an agreement signed during the Anambra Investment Summit, the partnership also underscores Afreximbank’s commitment to fostering economic growth and development across Africa.

The MOU, signed by Afreximbank’s Executive Vice President, Intra-African Trade Bank Kanayo Awani and the Governor of Anambra State, Charles Soludo, signifies a collaborative effort to drive state development through the provision of project preparation and advisory services.

It also opens …

Africa is home to nearly all the valuable minerals that are essential to generating wealth, producing commodities, and advancing technology. Approximately 30 per cent of the world’s mineral reserves are in Africa, but most mineral-rich countries remain poor with little to celebrate. Some of the key minerals found in Africa include oil, diamonds, gold, silver, copper, cobalt, coal, iron ore, uranium, and platinum.…

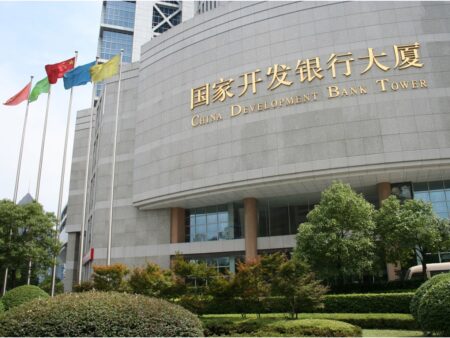

In a significant move to bolster Africa’s economic landscape, the China Development Bank (CDB) and the African Export-Import Bank (Afreximbank) have embarked on a collaborative journey in Cairo. The outcome of this partnership centers around a $400 million loan. The loan will catalyze the growth and prosperity of small and medium-sized enterprises (SMEs) across Africa.…

Djibouti is set to receive a $120 million loan from the African Export-Import Bank (Afreximbank) in a deal targeting projects that will accelerate the country’s economic growth.

The financing, which will go to Djibouti’s Great Horn Investment Holding (GHIH) to execute projects in the country’s Damerjog Industrial Development Free Trade Zone, is part of a total facility amount of $155 million. The remaining $35 million will be financed through Banque pour le Commerce et l’Industrie Mer Rouge of Djibouti. …

- To facilitate the execution of these projects, Afreximbank will collaborate with Arise IIP.

- In May, the lender rolled out a $3 billion program aimed at spurring Kenya’s economic growth.

- The plan will also include the establishment of the $600 million e-mobility manufacturing plant in Kenya.

African Export–Import Bank, popularly referred to as Afreximbank, has entered into an agreement with Kenya that will see the lender identify key economic projects that it will finance and manage.

Under the deal signed on May 2, 2023, Afreximbank, through its subsidiary, will conduct a comprehensive feasibility study on these proposed projects. It will them provide the necessary financing for their implementation.

One of the major focus of Afreximbank in Kenya is to provide funding for various special economic zones spread across different counties. The initiative is part of the broader industrial parks development and investment plan for Special Economic Zones (SEZs) in Africa.

“On …

- The three-year $3 billion programme will support viable trade and related investments in Kenya in both private and public sectors.

- It will be implemented using loans, guarantee facilities, trade services, investment banking and advisory services.

- The financing will also go to the creative arts sector through the Kenyan government’s youth empowerment programme.

The Afreximbank is rolling out a $3 billion program aimed at spurring Kenya’s economic growth. The three-year programme by the African Export-Import Bank will support viable trade and trade-related investments in Kenya’s private and public sectors.

The financing will be implemented using several instruments including loans, guarantee facilities, trade services, investment banking and advisory services.

The memorandum was signed on 2 May 2023 in Nairobi by National Treasury Cabinet Secretary Professor Njuguna Ndungu alongside Afreximbank Chairman Professor Benedict Oramah in the presence of President William Ruto.

Digitise government services

“This programme is a step forward in our economic …