- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: African fintech giants

- In February, reports claimed Ghanaian fintech Dash was providing false metrics on its user base and transaction volume.

- An audit showcased a significant shortfall of at least $25 million in the company’s accounts.

- Dash Fintech’s high operating expenses and monthly burn rate of $500,000 significantly contributed to its rapid fall from glory.

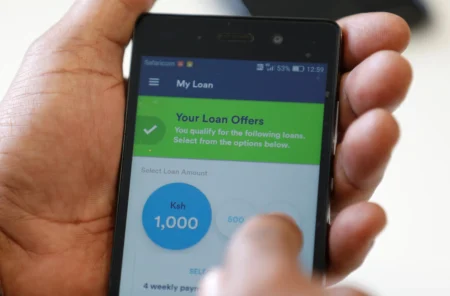

Africa’s fintech industry is among the fastest, and most lucrative economic activities. According to the African Development Bank, the industry will surpass its $3 billion mark in 2022. Despite its significant growth, the industry has struggled to maintain its progressive rate. The steady increase of the cross-border payment platform has flooded the franchise, ultimately, creating a negative effect on the industry. In recent news, Dash fintech, a Ghanaian fintech, shut down after raiding over $86.1 million in five years.

Unfortunately, this has been a rising trend in the industry. If not addressed, Africa’s fintech industry may fall behind …

- The South African payment platform has raised $5.2 million in seed funding.

- Revio fintech has focused its efforts on providing real-time action via different channels like SMS, Email, or Social media.

- With the $5.2 million, Revio fintech intends to expand its services to over 25 African markets.

Africa’s fintech industry is among the fastest and youngest franchises that emerged in the past decade. Its lucrative market has attracted numerous investors and innovators, each trying to gain a piece of this trillion-dollar market. In the latest development, the South African Payment platform, Revio fintech, secured a $5.2 million seed funding from QED Investors and Partech Africa. With this funding, SA’s road to dominate Africa’s digital industry is shaping up quite nicely.

Africa’s fintech industry is one of the most recent economic activities, barely two decades old. Blockchain technology, one of the primary highlights of the 4IR, has redefined how we approach …

- Rwanda and Kenya lead E. Africa in the list of most entrepreneurial countries in Africa.

- All other five East African countries do not make Africa’s top 10 list.

- Fintech remains the leader in entrepreneurship growth in Africa.

Entrepreneurship is growing at a tremendous rate across Africa and is to date the most powerful catalyst for economic growth and creation of employment for youth.

According to the UN Assistant Secretary-General and Director of the UN Development Program Ahunna Eziakonwa, digital innovation is the leading enterprise in Africa.

Entrepreneurship, a solution to poverty

The diplomat also recognizes the diversity that Africa’s vastness offers numeurous opportunities but on the other hand creates new challenges to ‘creating universal solutions for issues such as poverty and food security, because each country has its own capacity for innovation.’

“I think one of the flaws in development practice in the past has been taking Africa almost as …

- The Africa Fintech Accelerator program will remain open until August 25th, and the first cohort will debut in September.

- Plug and Play, the world’s leading innovative platform will partner with Visa to ensure the program’s success.

- Visa committed to invest $1 billion in Africa by 2027.

Africa’s fintech Industry is the continent’s most rapidly growing economic activity. Its growth to fame has attracted plenty of investors and international organizations, each trying to promote the adoption of digital money globally. In recent news, Visa is accepting applications to its Africa Fintech Accelerator Program, urging blockchain-based and fintech startups to sign up. (Alprazolam)

Africa’s fintech accelerator program

To further the continent’s digital transformation, Visa took an active role in supporting Africa’s fintech industry. This global payment technology company has officially opened applications for the Africa Fintech Accelerator Program. The main aim of this endeavour is to revive the adoption rate …

-

- Initially, fintech ImaliPay had roughly 15 partners including powerful gig platforms Glovo, SWVL, Bolt and Gokada.

- At the moment, the firm has over 4,500 vendor points, accounting for over 200,000 transactions monthly.

- London-based Centropy PR is an independent PR agency specializing in tech, financial services, healthcare, and the property sector.

ImaliPay, an African fintech services provider has tapped Centropy PR, a London-based agency, to pioneer its international communications as the firm engages the gas pedal to go global. The move comes after the fintech company recently secured $3 million in funding to power its business operations.

In 2020, Tatenda Furusa and Oluwasanmi Akinmusire, former senior executives at the African digital payment firm Cellutant projected the rise of fintech industry after noticing limits of traditional financial systems.

“The first time I noticed a problem with our current financial service was during a personal experience. Once, a Bolt driver ran out …

- The fintech industry is Africa’s financial inclusion solution for all vulnerable groups including women.

- Sub-Sahara Africa, fintech startups recorded 894% year-on-year growth in funding in 2021

- More than 400 million new mobile subscribers expected to sign up globally by 2025

A report published by McKinsey claims that the number of tech start-ups in Africa tripled to around 5,200 companies between 2020 and 2021 and just under half of these are fintech startups.

In the report titled ‘Fintech in Africa:The end of the beginning’ McKinsey shows that in line with global market leaders, the African fintech industry enjoyed revenues of between US$4 billion and US$6 billion in 2020 and average penetration levels of between 3 and 5 percent.

The fintech industry is Africa’s financial inclusion solution for all vulnerable groups including women, the elderly, and the larger section of the population in remote rural settings.

“What you have here is not …

With financial inclusion in mind, governments are taking notice and offering more supportive regulatory frameworks, ever further assuring that the African fintech industry growth rivals that of more mature markets, the likes of Vietnam, Indonesia, and India.

Despite the high potential seen in East Africa, with countries like Kenya standing out, South Africa still commands approximately 40 per cent of the industry revenues.

On the western part of the continent, too, in places like Ghana, growth is at 15 per cent per annum and will only get higher all through 2025. Then you have the larger economies coming in; Nigeria and Egypt are both expected to enjoy annual growth rates of 12 per cent over the same period.

While growth rates at this early stages are higher in less developed East African countries, economies with more mature financial systems and digital infrastructure, the likes of South Africa stand a greater …

- The Mastercard, OPay partnership will make it possible for OPay customers and merchants in the region to interact with brands and businesses worldwide

- The partnership will benefit users in Kenya, Egypt, Algeria, Nigeria, Morocco, Ethiopia, Pakistan, South Africa and the United Arab Emirates

- Opay customers will be able to make use of the Mastercard virtual payment solution that is linked to their OPay wallets

The announcement of a strategic partnership between Mastercard and the African fintech giant OPay, which took place on May 19 of this year, represents a significant boost for broader financial inclusion.

This partnership makes digital commerce accessible to millions of people across the Middle East and Africa.

The collaboration will make it possible for OPay customers and merchants in the region, which includes Kenya, Egypt, Algeria, Nigeria, Morocco, Ethiopia, Pakistan, South Africa, and the United Arab Emirates, to interact with brands and businesses located anywhere in …

According to the World Bank, the annual SME credit gap in Sub Saharan Africa is about US$330 million. MSMEs are often neglected by lenders due to a combination of factors.

These include the high cost of customer acquisition and due diligence, insufficient data availability for accurate credit assessments, lack of collaterals, uncertain customer lifetime values, and the high costs of distribution and servicing. There is a large opportunity for lenders who are able to overcome these challenges.…