- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Afro-Asia Fintech

- Rwanda and Kenya lead E. Africa in the list of most entrepreneurial countries in Africa.

- All other five East African countries do not make Africa’s top 10 list.

- Fintech remains the leader in entrepreneurship growth in Africa.

Entrepreneurship is growing at a tremendous rate across Africa and is to date the most powerful catalyst for economic growth and creation of employment for youth.

According to the UN Assistant Secretary-General and Director of the UN Development Program Ahunna Eziakonwa, digital innovation is the leading enterprise in Africa.

Entrepreneurship, a solution to poverty

The diplomat also recognizes the diversity that Africa’s vastness offers numeurous opportunities but on the other hand creates new challenges to ‘creating universal solutions for issues such as poverty and food security, because each country has its own capacity for innovation.’

“I think one of the flaws in development practice in the past has been taking Africa almost as …

- The use of digital solutions is revolutionizing all kinds of financial transactions from making simple payments to borrowing and lending.

- With mobile phone and internet penetration rising at a phenomenal phase, even the remotest parts of Africa can now access financial services through their mobile phones.

- The World Bank: It is time for policymakers to embrace fintech opportunities and implement policies that enable and encourage safe financial innovation and adoption.

Financial technology or the application of digital tools to streamline financial services more commonly known in the short form Fintech, is reshaping the future of financial services and creating a boom for investors in the fast-growing segment.

The use of digital solutions is revolutionizing all kinds of financial transactions from making simple payments to borrowing and lending. Be it your next investment portfolio or your insurance, you name it, almost any financial service you can think of can now be …

With financial inclusion in mind, governments are taking notice and offering more supportive regulatory frameworks, ever further assuring that the African fintech industry growth rivals that of more mature markets, the likes of Vietnam, Indonesia, and India.

Despite the high potential seen in East Africa, with countries like Kenya standing out, South Africa still commands approximately 40 per cent of the industry revenues.

On the western part of the continent, too, in places like Ghana, growth is at 15 per cent per annum and will only get higher all through 2025. Then you have the larger economies coming in; Nigeria and Egypt are both expected to enjoy annual growth rates of 12 per cent over the same period.

While growth rates at this early stages are higher in less developed East African countries, economies with more mature financial systems and digital infrastructure, the likes of South Africa stand a greater …

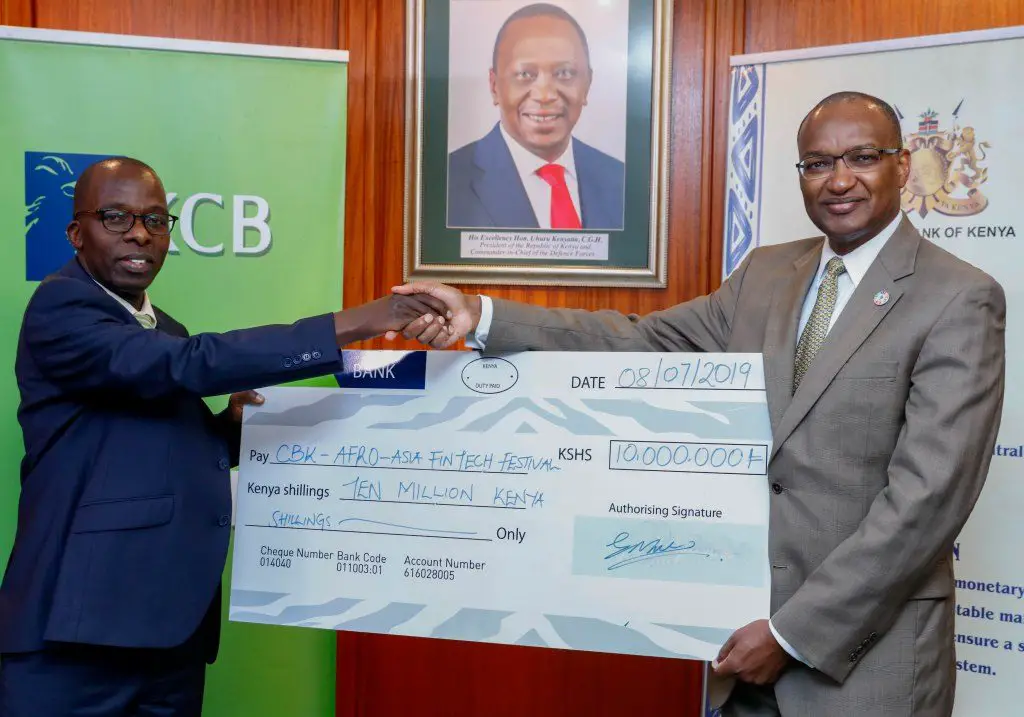

KCB Bank Kenya has committed Ksh10 million (US$97,448) to the Afro-Asia Fintech Festival 2019, a first of its kind in the region which will be held next week.

The funds will go into supporting the mega financial technology (Fintech) summit being hosted by the Central Bank of Kenya (CBK) and the Monetary Authority of Singapore.

The forum will take place between July 15–16 and is themed, ‘Fintech in Savannah’, modeled along the Singapore Fintech Festival.

KCB backing is informed by the need for Kenya to continue driving innovations in the banking sector to boost financial inclusion, the Nairobi Securities Exchange (NSE) listed lender has noted.

Speaking during the cheque handover to the CBK, KCB Group Chief Operating Officer Samuel Makome said: “For the past five years, we have made significant investments in financial technology in the realization that the future of banking is in digital finance. We will therefore remain …