- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

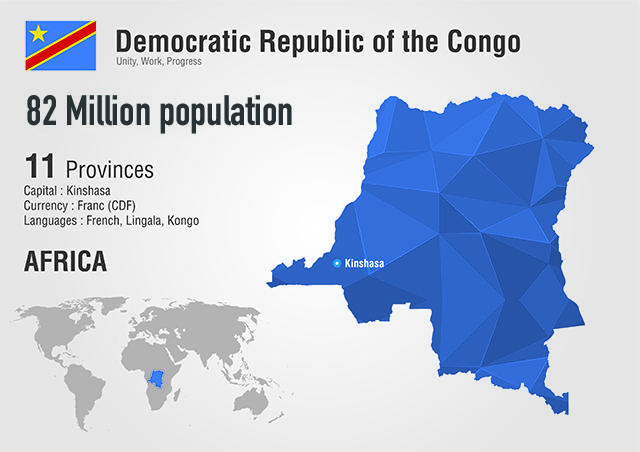

Browsing: Democratic Republic of Congo

If new Congo-Rwanda agreement holds, U.S. companies see a rare window of opportunity to invest in high-risk, high-reward environments. Infrastructure…

East Africa’s banking giant KCB Group reports heightened operational expenses, which surged to $627 million in 2023, up from $447.9…

On December 20, 2023, the eyes of Africa and the international community are keenly focused on the Democratic Republic of…

Africa has today emerged as a fertile ground for groundbreaking startups. As 2024 approaches, the continent’s startup scene is buzzing with activity, marked by impressive funding rounds and strategic expansions. This trend is a fleeting moment and a testament to African entrepreneurship’s resilient and dynamic spirit.

The Exchange Africa spotlights five startups thriving and redefining the business landscape in their respective sectors. From renewable energy solutions in the Democratic Republic of Congo to digital health platforms in Kenya, these companies embody the ingenuity and potential of Africa’s business ecosystem. They attract significant investment and are poised to substantially impact their communities.

In 2020 Democratic Republic of the Congo was placed as the 87th economy in the world in terms of GDP (current US$), number 70 in total exports, number 105 in total imports, number 187 economy in terms of GDP per capita and the number 123 most complex economy according to the Economic Complexity Index (ECI).

According to figures from the Observatory of Economic Complexity (OEC), a global data visualization tool for international trade, as of 2020, the top exports of the Democratic Republic of the Congo are refined copper, cobalt oxides and hydroxides, cobalt, raw copper, and copper ore, exporting mostly to China, Tanzania, United Arab Emirates, South Africa, and Singapore.

The top imports of the Democratic Republic of the Congo are documents of title (bonds etc.) and unused stamps, packaged medicaments, sulphur, refined petroleum, and poultry meat, imported mostly from China, the United States, Zambia, South Africa, and India.

It is obvious that the DRC’s desire to become a member of the EAC is to tap into the benefits of regional trade, i.e. an expanded market of 300 million people, and to increase Foreign Direct Investment (FDI) through its membership in the EAC bloc. DRC’s capital market remains underdeveloped and consists mainly of the issuance of treasury bonds.

There is no stock exchange in the country and only a small number of private equity firms are actively investing in the mining industry. There are hardly any institutional investors in the DRC except for an insurance company and a state pension fund. The Central Bank of Congo (BCC), developed a market for short-term bonds, which are bought and held by local Congolese banks.

The absence of a domestic debt market has meant that the fixed-rate market is limited to government-issued treasury bonds with maturities of up to 28 days traded through commercial banks.

Since the beginning of the Russia-Ukraine crisis, fertilizer prices have risen by 21 per cent.

It was noted that “the recovery of Africa has been impeded by greater inflation and tighter global financial conditions as well as rising interest rates,”

To counter external shocks, such as the Ukraine crisis, she urged public and private sector partnerships to enhance intra-African agri-food, industry, and service trade. She also urged the continent’s recovery from Covid-19 to get back on track.

When asked if Africa needs a second Marshall Plan, Keita said that Africa already has an effective one, in the AfCFTA, that may help it prepare for unpredictable times.

A dollar is trading at 16.67 Kwacha and 13.35 Seychelles rupees as at December 31. Both countries were among the three worst performers in 2020.

This has fueled speculation from corporate participants and currency retail traders on when exactly to exit foreign currency risks for dollar hoarders or whether to buy the Kwacha as a safer haven store for value.

President Hichilema’s government is in the process of reworking as much as $17 billion in external public debt. He has submitted an endorsement request to the IMF as his administration advances talks with creditors from US$3 billion in Eurobond holders to US$5.8 billion owed to the Republic of China.

Francois Kabeya, Goma Mayor General Commissioner, assured that the heightening business growth would expand employment opportunities and consequently create wealth for Goma residents, a city bordering Rwanda.

James Mwangi, Equity Group Managing Director and CEO, said the bank had US$5 million allocated for entrepreneurs ready to invest in manufacturing, tourism and several other sectors in the region.

He said that the aim of the mission was to unite people in both countries adding that the best collaborators in the business community were those that took risks, made mistakes and eventually created wealth.

The trade mission, which brings together Kenyan and DRC investors and entrepreneurs, will be held in four of DRC’s biggest cities that is, Kinshasa, Lubumbashi, Goma, and Mbuji Mayi.

SMEs will have an opportunity to explore opportunities in DRC through business forums and panel discussions moderated by experts in various fields, site visits to various businesses and locations of interest, networking sessions, and trade exhibitions that will allow businesses to showcase their products and services.

Speaking during the official opening ceremony, Bazaiba expressed delight in seeing two sovereign States from the East and Central Africa region championing the growth and integration of Africa through trade and investment.