- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Digital Banking

Customers can also buy airtime and access other mobile network operator services using their Visa or Mastercard debit and credit cards through Tingg, Cellulant’s digital payments platform.

Tingg by Cellulant is at the forefront of ensuring digital financial solutions are available across the continent. Tingg, which integrates 211 banks in Africa, is a one-stop payment aggregator for multinational corporations, mid-caps, and small and medium-sized enterprises (SMEs).

Tingg enables merchants to receive, view and reconcile all their payments through a single platform or their system by integrating Tingg’s Application Programming Interfaces (APIs), eliminating the need to subscribe to multiple providers’ payments and, in the case of mobile money, mobile network operators (MNOs) and banks.…

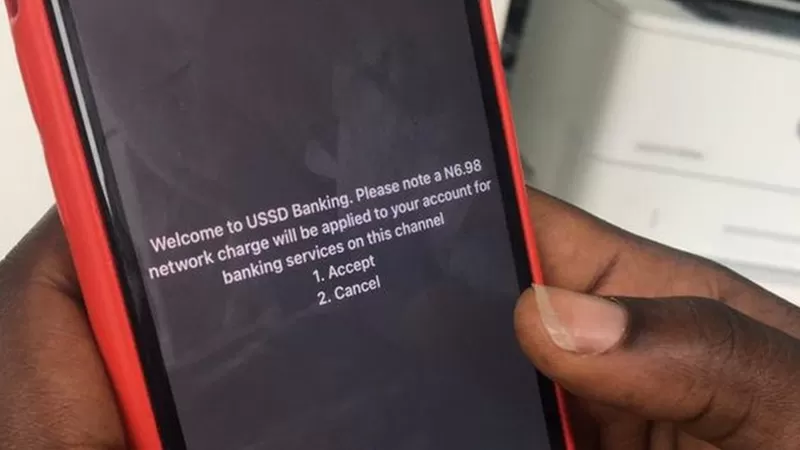

As far back as June 28, 2017, This Day Live said another point to note is that USSD is very important within emerging economies, where the cost to access data services is increasing. Despite the growth of smartphone penetration and 3G/4G coverage, the data access cost is a key factor in deciding how information is consumed.

Meanwhile, the continued reliability of USSD will enable mobile service providers and financial institutions more opportunities to satisfy new market segments, add more value to the customer, and meet underserved customer needs.

In a related article by Myriad Connect published January 29, 2018, the core benefit of USSD is that it doesn’t rely on a data connection to operate, thereby helping reach the billions of people in areas where network coverage is at its most basic or for sectors of the population for whom a data connection is too expensive to access.

So long …

Financial technology (FinTech) is a major force shaping the structure of the financial industry in sub-Saharan Africa. New technologies are being developed and implemented in sub-Saharan Africa with the potential to change the competitive landscape in the financial sector.

In an area that traditionally suffered limited access to financial services such as Credit, insurance, and banking Financial technology [FinTech] has aided in accelerating financial inclusion in this sub-Saharan Africa region.

While the bell has long been chiming for businesses to rapidly adapt, harness the power of data and streamline their digital processes, COVID-19 reprioritized the need for these capabilities. It made these elements of digital strategy essential, and at a frightening pace.

The Fintech sector in Africa has since rapidly emerged with more and more startups coming up as compared to other years. As consumers avoided touching cash or point of sale devices, digital payment usage increased dramatically and continues …

Kenya’s Absa Bank has launched a new solution that allows its customers to access their bank accounts and transact via WhatsApp, as part of their committed to invest at least Sh1.6 billion this year towards digitization, automation and innovation.

The bank says the solution, a first in the market, will allow Absa customers to conduct some of the most popular digital transactions in the market.

These include account-to-Mpesa/Airtel Money transfers, inter-account transfers, bill payments, balance enquiry, among others, on WhatsApp.

Absa Bank Kenya Managing Director Jeremy Awori said that the move is a demonstration of the bank’s commitment to continue investing in digitally led innovative solutions that have the potential to significantly transform customer experience.

“This is a really exciting moment for us at Absa not just because this solution is first-in-market, but more so because it will significantly transform the way our customers interact with us. Essentially, we are …