- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Equity Bank

- Central Bank of Kenya says active mobile subscriptions hit 66.8 million by December 2023 compared to 65.7 million a year earlier.

- Increasing usage of mobile money saw the banking industry in Kenya experience a drop in the value of banking transactions via bank agents to $10.5 billion.

- Kenya is a trailblazer in the adoption and usage of mobile money across Africa.

A steady rise in the use of cashless transactions as well as the opening of 8,555 new mobile money agent shops in Kenya drove the value of mobile money transactions up by 13.8 percent to record KSh788.35 billion or $6 billion in 2023.

Kenya has been a trailblazer in the adoption and usage of mobile money across Africa since the launch of pioneer cash transfer platform M-PESA by Safaricom PLC in 2007.

“Amidst the increasing adoption of technology and the widespread use of mobile phones in daily life, coupled …

ohio state jersey

florida state football jersey

49ers jersey

Iowa State Football Uniforms

Iowa State Football Uniforms

Iowa State Football Uniforms

asu football jersey

49ers jersey

ohio state jersey

ohio state jersey

ohio state jersey

Florida state seminars jerseys

custom made football jerseys

asu football jersey

- Equity Bank dividend payout of $0.03 (KES4) per share will amount to a 36 per cent payout of the regional lender’s $331.6 million net profit.

- Customer numbers grew to 19.6 million, translating to an increase in deposits, which hit $10.6 billion in 2023.

- Loan books also increased to $6.7 billion (KES887.4 billion) from KES706.6 billion in 2022.

Equity Group’s profits saw a five per cent decline to $331.6 million (KES43.7 billion) for the financial year ending in December 2023, down from $349 million (KES46 billion) the previous year. However, despite the drop, Equity Group’s dividend payout has hit record …

- East African Cables is a private limited liability company incorporated in mainland Tanzania. It manufactures extensive cables for domestic and industrial lighting and power electricity transmission.

- The sale is subject to regulatory and shareholders’ approval.

- Upon completion of the sale, EAC Tanzania will cease being a subsidiary of the company.

Msufini Tanzania Limited (MTL), a chlorine and sodium hydroxide manufacturer, is set to buy a majority stake in East African Cables’s Tanzanian subsidiary if regulators and stakeholders approve an agreed deal between the two firms.

East African Cables, which is listed on the Nairobi Securities Exchange, has entered into a share purchase agreement with Msufini for the sale of 16 218,000 ordinary shares at a value of Tsh10, constituting 51 per cent of the issued share capital of East African Cables (Tanzania) Limited.

East African Cables is a private limited liability company incorporated in mainland Tanzania. It manufactures extensive …

- The latest Nairobi Securities Exchange monthly Barometer shows month-on-month growth comparing January this year and December last year, with prospects looking much better after a bear run last year.

- Market capitalisation increased by 0.08 per cent in January to $9.11 billion from $9.05 billion in December 2023.

- The NSE 20 and NSE 25 Share Index recorded increases in activity of 0.89 per cent and 1.32 per cent, respectively, while the All-Share Index experienced a 0.08 per cent increase.

Nairobi Securities Exchange showing recovery signs

Kenya’s capital market is showing a sign of recovery this year, with the Nairobi Securities Exchange (NSE) recording a gain in January, albeit minimal, as large stocks pay investors.

This is despite interest rates in advanced economies remaining high into 2024, a trend that has seen foreign investors focus on home markets, mainly the United States.

The latest NSE monthly Barometer shows month-on-month growth comparing January …

- In 2023, a significant investor sell-off led to a $15.5 million (KSh4.2 billion) decline in the Kenya stock market.

- During the review period, Safaricom’s market valuation declined, attributed in part to prolonged and price-agnostic portfolio outflows by foreign investors in favor of dollar-denominated assets.

- Utility Umeme Limited recorded the highest valuation gains throughout 2023, registering an impressive 115.6 percent return.

Nairobi Securities Exchange-listed firms, including Safaricom PLC, British American Tobacco (BAT), and Cooperative Bank, emerged among the top counters experiencing the highest investor sell-off in 2023, a new trading report reveals.

Over the past year, a consistent trend of investor flight led to the Nairobi Securities Exchange (NSE) witnessing a drop of $15.5 million (KSh4.2 billion) in the value of shares traded on the bourse

The 2024 outlook report by AIB-AXYS Africa Investment indicates that despite some firms, such as Safaricom, recording improvements in share prices towards the end …

- 20 investments in manufacturing, ICT, energy, health and agri-business have been signed in past two months.

- Latest Kenya-US trade ties place the East African country at a pole position on attracting more American dollars.

- Since President William Ruto took office in September 2022, Kenya-US engagements have been on a full throttle.

Deepening Kenya-US trade ties have started to pay dividends as American firms move to invest in East Africa’s largest economy. With modern infrastructure, and skilled labour force, Kenya offers one of the best opportunities for US investors eyeing the region.

Currently, Kenya is the second most preferred destination by Americans seeking to invest in Africa. The 2023 US government review shows Kenya hosts 142 American firms while Nigeria has 195 conglomerates.

Latest developments, however, place Kenya at a pole position in attracting more American investors in the short to medium-term.

Deepening Kenya-US bilateral ties

Since President William Ruto took …

- Telco giant Safaricom is the most valuable Kenyan brand, estimated at $648 million. It also has the highest Sustainability Perceptions Value at $93 million.

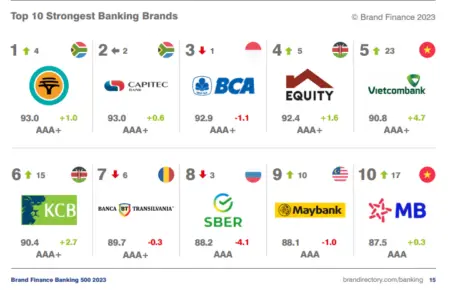

- Equity Bank and Kenya Commercial Bank rank second and third most valuable brands and top-two strongest brands with impressive AAA+ ratings.

- Crown Paints Kenya is the fastest-growing Kenyan brand, up 70 percent

Safaricom’s value went up by 14 per cent to $648 million over the past year maintaining its position as Kenya’s most valued brand even as lenders Equity and KCB regional expansion drive also paid dividends as measured by consultancy Brand Finance.

Brand Finance East Africa Regional Director Walter Serem says Safaricom has shown considerable resilience during difficult operating conditions over the past year. In the period under review, East Africa’s most profitable telco registered significant revenue growth, while successfully completing the first two years of its five-year strategy.

This strategy is guided by the …

- Equity Bank (Kenya) Limited (EBKL), has completed the acquisition of certain assets and liabilities of teachers-owned Spire Bank Limited following regulatory approvals.

- With completion of the transaction, customers holding deposits in Spire Bank, other than the remaining deposits from Spire Bank’s controlling shareholder, and specified loan customers will now transition to become EBKL customers, having new Equity Bank accounts.

- The decision to acquire Spire Bank’s certain assets and liabilities was inspired largely by the banks’ history with teachers who have continued to support the Bank over the years.

Equity Bank Kenya Limited (EBKL) has completed the acquisition of certain assets and liabilities of Kenyan teachers’ owned Spire Bank Limited following receipt of regulatory approvals.

The bank had to get approvals from the Cabinet Secretary Treasury and Planning under Section 9 (1) of the Banking Act, the Central Bank of Kenya under Section 9, ( 5) of the Banking Act, the …

- South African Banks topped the list of the world’s top 500 most valuable banking brands in Africa according to Brand Finance Banking 2023 report.

- South Africa scooped the first top five spots in Africa headlined by First National Bank ranking at number 155 worldwide albeit a drop from 146 the previous year.

- Kenya’s Equity bank came in 6th position followed by National Bank of Egypt in 7th position while Nigeria’s Access Bank and Zenith Bank followed at 8th and 9th position respectively as Egypt’s Banque Misr closed the regional to ten list.

South African Banks topped the list of the world’s top 500 most valuable banking brands in Africa according to Brand Finance Banking 2023 report.

The report shows South Africa scooped the first top five spots in Africa headlined by First National Bank ranking at number 155 worldwide albeit a drop from 146 the previous year.

Other banks who …

- Equity Group has reported a 36% growth in its after-tax profit to hit KSh 24.4 billion, principally driven by the growth of loans to customers

- The Kenyan-based regional lender also attributed the performance to its recovery and resilience strategy

- Equity Group CEO James Mwangi said the loan growth was targeted to supporting their clients to recover and rebuild after the Covid-19 business disruptions

Equity Group has reported a 36 per cent growth in its after-tax profit to hit KSh 24.4 billion.

The performance was principally driven by a 29 per cent growth in interest income to KSh 55 billion, up from KSh 42.8 billion as a result of the growth of loans to customers by 29 per cent to KSh 650.6 billion, up from KSh 504.8 billion.

The Kenyan-based regional lender also attributed the performance to its recovery and resilience strategy.

Equity Group CEO James Mwangi said the loan growth …