- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Funding

- UK’s $18.86M investment will support healthcare workers recruitment and retention efforts in Kenya, Nigeria, and Ghana.

- Financing is seen as a boost to achieving universal health coverage while bolstering global pandemic preparedness.

- The three countries were selected for the financing due to their evident need for workforce support.

In a significant move to address pressing healthcare workers’ challenges in Africa, the UK government has allocated $18.86 million in funding to boost healthcare staffing levels in Kenya, Nigeria, and Ghana.

This investment is geared towards supporting healthcare staff recruitment and retention efforts. Overall, the investment seeks to fortify these nations against global health crises.

UK Health Minister Will Quince, speaking on the importance of this funding, emphasized that it aims to enhance the performance of health systems in these countries. Quince added that the initiative will have a cascading effect on improving global pandemic preparedness and reducing health disparities.

Boosting global

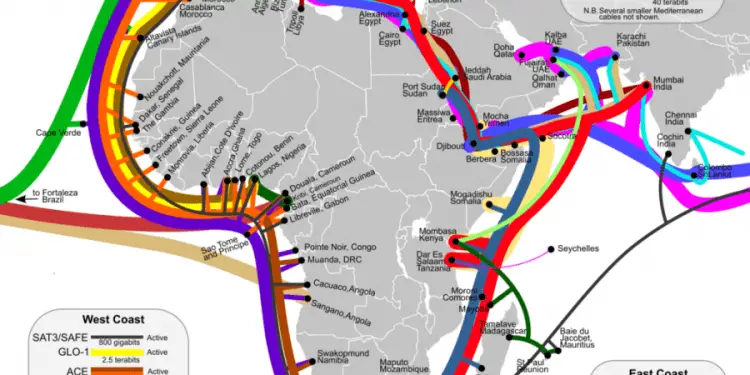

…- The funding will see SEACOM grow its broadband cable network and cloud-based product offering in sub-Saharan Africa.

- Under the new deal, IFC will provide a $207 million long-term loan to SEACOM.

- The funding will support SEACOM to become the next-generation cloud-based IT service business.

SEACOM has partnered with the International Finance Corporation (IFC) to increase the access to broadband IT services for small and medium-sized businesses across Africa. The partnership will see SEACOM, a digital infrastructure and IT services company, grow its broadband network and cloud-based offerings in sub-Saharan Africa.

IFC will offer SEACOM a $207 million loan, which includes $70 million from IFC’s own financing. A total of $42.24 million co-financing will come from institutional investors through IFC’s Managed Co-Lending Portfolio Program. Another $94.76 million will be mobilized from Nedbank Limited and Mauritius Commercial Bank.

SEACOM expanding cloud-based services

“Access to affordable, good-quality internet is central to economic …

- PROPARCO and the IFC, are scaling up of renewable energy production in both Kenya and DRC.

- The two organisations will support Nuru, an early-stage company that provides decentralized and low-carbon power solutions in DRC.

- PROPARCO will invest in the first close of E3 Low Carbon Economy Fund I (LCEF), which based in Kenya.

Two renewable energy investments in the Democratic Republic of Congo (DRC) and Kenya will receive financial backing to enhance their low-carbon power solutions.

The move comes after PROPARCO and IFC announced plans to support scale up of renewable energy in the two countries. PROPARCO and IFC are members of the Alliance for Entrepreneurship in Africa.

The two organizations declared support for Nuru, an early-stage startup that offers decentralized and low-carbon electricity solutions in the DRC, during the Paris summit for a new global funding agreement.

“Our support for Nuru, delivered with partners through the Alliance for Entrepreneurship …

- Women and youth in Kenya’s agricultural sector are set to benefit from new AfDB funding.

- Another $1.3 million has been set aside to support the youth and women entrepreneurs in Kenya’s agriculture value chains.

- The funding was provided by the European Union in partnership with the AfDB.

Kenya’s women and youth in agriculture are set to benefit from fresh financing after the African Development Bank (AfDB) approved an equity investment of $19.65 million in the Africa Guarantee Fund (AGF).

Another $1.3 million will support the youth and women entrepreneurs engaged in the country’s agricultural value chains. The funding, approved on June 6, 2023, was provided by the European Union (EU) under its partnership with the AfDB.

“The approval is another milestone in the implementation of the partnership with the EU, which also signals the importance given to the role of women and youth in the agricultural sector in Kenya,” the …

- Funding aimed at increasing the efficiency of domestic resource mobilization and public expenditure.

- The move will enable the government to have more resources to finance public services and respond to economic shocks.

- The program targets more inclusive access to e-declaration and performance-based management in customs administration.

In order to assist Benin in improving the effectiveness of domestic resource mobilization and public expenditure, the World Bank has granted financing from the International Development Association (IDA) totaling $150 million.

The Economic Governance for Service Delivery Program for Results (PforR) will support projects aimed at increasing the effectiveness of domestic resource mobilization and public expenditure. This will to provide the government with greater funding to support public services and react to economic shocks.

The program aims for performance-based management in customs administration and more inclusive e-declaration access.

Additionally, it encourages the creation of a setting favorable to citizen scrutiny of public finances and …

- The funding, Mozilla African Innovation Mradi, promotes ideas based on unique African user needs.

- The program scouts for innovation that produce a meaningful impact on the African internet ecosystem.

- Kenya is a leader in broadband connectivity, ICT infrastructure and is home to over 300 tech start-ups.

Kenyan tech start-ups are jostling for a pie of Mozilla’s $300,000 funding targeting projects solving unique user needs in Africa. The funding, a collaboration between Mozilla Africa Mradi and the Nairobi City County, will supporting tech-based firms in Kenya’s capital.

Dubbed Mozilla African Innovation Mradi, the funding promotes innovation led by and grounded in tackling unique needs of users in Africa.

Africa Innovation Mradi leverages Mozilla’s role as stewards of the open web to promote innovation in African countries.

The program establishes networks of partners and communities exploring and developing new projects and technologies. Winners will produce projects that offer meaningful impact on …

- The Baobab network has called for applications for the Cohort 1, 2023 accelerator programme

- The accelerator programme is designed to give Entrepreneurs in Africa the funding and platform they need to take their ideas global.

- The programme will offer start-ups $50,000 USD in funding, a three month cohort program including personalised two-week consultation sessions with tailored support, in exchange for 10 percent equity.

The Baobab Network has called for applications for the Cohort 1, 2023 accelerator programme aimed at supporting Africa’s boldest innovators to scale homegrown solutions.

The accelerator programme is designed to give Entrepreneurs in Africa the funding and platform they need to take their ideas global.

The programme will offer start-ups $50,000 USD in funding, a three month cohort program including personalised two-week consultation sessions with tailored support in exchange for 10 percent equity.

Their venture team works with startups to accelerate growth, build capacity and unlock the …

In Nigeria, where an estimated 38 million people, or 36% of adults, remain financially excluded, the government has set a target of 95% financial inclusion by 2024.

While this may seem like an ambitious goal, that will require institutions to re-strategize initiatives and policies to accelerate the delivery of financial inclusion services, a lot of tech-backed firms are being developed in the West African country to help achieve this goal.

Among them is Lagos-based FinTech unicorn Interswitch which seems to have heeded that call, leveraging its position as a market leader in digital payment services to bridge the massive financial inclusion gap and help bring as many people into the financial and economic fold as possible.…

This and other challenges including unpredictable prices of farm produce and a lack of working capital often plague small restaurants and food vendors across the continent.

This is what largely drove the creation of TopUp Mama- Former Kibanda TopUp- in Kenya.

The firm launched in February 2021 in Nairobi and has reported significant growth over the past year since its inception.

Founded by Njavwa Mutambo, Emilie Blauwhoff and Andrew Kibe, the startup has grown 10-fold in just over a year with more than 3,000 merchants (1,000 active) using its platform to make orders every month.…

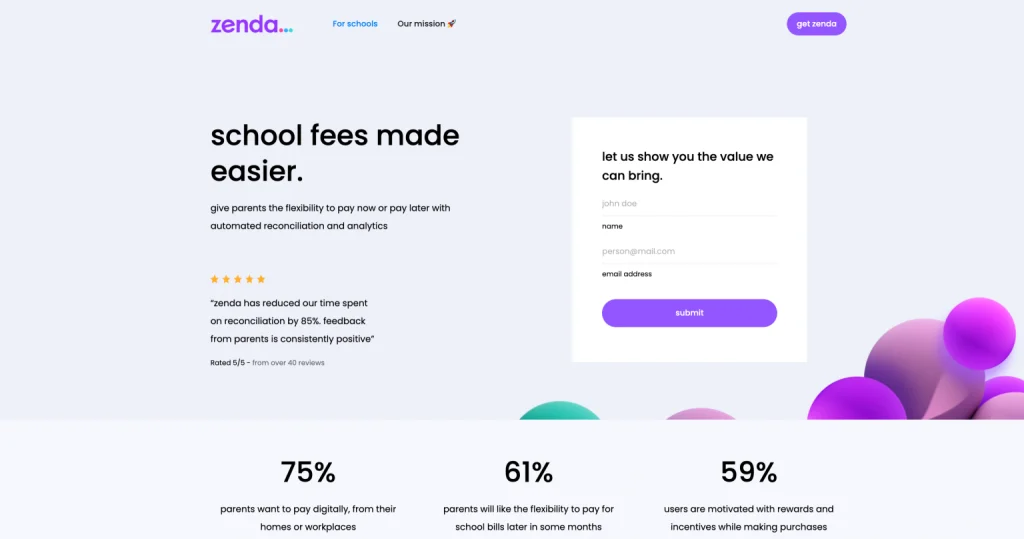

- Through its app, Zenda allows parents to pay fees directly to schools, all while streamlining collections by enabling schools to accept and manage online payments

- Parents do not necessarily need to provide bank deposit slips as proof of payment because all transactions on Zenda happen in real-time

- Zenda’s users have increased 20 fold, with the app reaching over US$100 million in annual contracted payment volumes by the close of last year

UAE- based startup Zenda is now eyeing Africa as its next frontier market for growth.

The company which is looking to change how parents pay school fees and the way in which educational institutions manage the collection of fees is looking to expand its reach to Africa.

Formerly known as nexopay, the firm plans to penetrate the African market through Egypt in the coming months as the firm embarks on a growth drive accelerated by a US$9.4 million seed …