- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: IMF

- The IMF’s support fund refers to the designated Special Drawing Right (SDR), which serves as an international reserve asset to supplement the official reserves of its member nations.

- It represents a potential claim on the members’ freely usable currencies, primarily intended to provide liquidity to a nation in the event of an economic crisis.

- As of September, Kenya’s SDR quota at the IMF stood at US$542.8 million, equivalent to KSh91.8 billion.

Leaders from developing countries continue to pursue the implementation of the proposed re-channeling of the IMF’s support fund through development banks, aiming for affordability and increased impact scale.

This was evident on the sidelines of the recent COP28 summit, where African leaders emphasized the acceleration of the process towards realizing the proposal. The summit took place between November 30 and December 12 last year in Dubai.

Proposal: IMF’s support fund to come through AfDB

African Development Bank (AfDB) Group …

Africa will be the second fastest-growing regional economy in 2024. Over 10 African countries will experience substantial GDP growth. In October 2024, the International Monetary Fund emphasized Africa’s pivotal role in global economic development and resilience.

Africa could face economic headwinds this year. However, some of the continent’s brightest spots are lighting up the economic prospects. According to the International Monetary Fund, six of the top 10 performing nations globally are projected to come from Africa in 2024.…

Since Covid-19 struck, developing nations have been battered by global external forces further dampening their growth prospects.

- Under the World Bank’s income classifications, the world currently comprises 28 low-income, 108 middle-income, and 81 high-income economies.

- Worse, the World Bank says, in more than a third of the poorest countries, incomes per head will be below 2019 levels in 2024.

Economic indicators for Kenya and other developing nations have continued to depict a grim picture over the past four years, according to a new World Bank report.

The global lender states that economic growth prospects for developing nations, including Kenya, for the first four years of the 2020s have proven to be the weakest in almost 30 years.

According to the World Bank’s January economic forecast report, the average growth rate for developing nations during the period under review is 3.4 per cent, lower than it has been since the 1990s.…

- Burundi is the other country projected to record one of the fastest growing economies in 2024, according to the IMF.

- The Fastest Growing Economies in 2024 (real GPD growth) projections index places Rwanda ahead of her regional peers with a projected growth of 7.0% next year.

- Tanzania comes in closely with a projected growth of 6.1% while that of Burundi is forecast to grow at 6%.

Rwanda, Tanzania and Burundi will be the fastest growing economies in East Africa in 2024, the latest projection by the International Monetary Fund (IMF) indicates, with all countries posting economic growth above the world’s average.

The Fastest Growing Economies in 2024 (real GPD growth) projections index places Rwanda ahead of her East African Community (EAC) peers with a projected growth of seven per cent this year.

Tanzania comes in closely with a projected growth of 6.1 per cent while that of Burundi is projected …

- World Bank foresees $12 billion in support for Kenya between 2023 and 2026.

- This financing is subject to approval as East Africa’s economic powerhouse continues to depend on borrowing to bridge budget gaps in the wake of high recurrent expenditures and revenue shortfalls.

- The World Bank said it is fully committed to support Kenya in its journey to become an upper-middle-income country by 2030.

Kenya stands to benefit from up to $12 billion in financing from the World Bank over the next three years, as indicated by the global lender, ensuring continued support for the debt-saddled country.

This is subject to approval, the World Bank noted on Monday, as East Africa’s economic powerhouse continues to depend on borrowing to bridge budget gaps in the wake of high recurrent expenditures and revenue shortfalls. The World Bank stated that it is fully committed to supporting Kenya in its journey to become an …

The International Monetary Fund (IMF) has committed an additional $938 million to Kenya as part of a strategy to stabilise the country’s economy.…

The International Monetary Fund (IMF) has agreed to lend $938 million to Kenya, pending management approval and consideration by the Executive Board. The board is expected to make its decision in January 2024.

Haimanot Teffara, the IMF Mission Chief to Kenya, stated that the move aims to shield the country from liquidity problems and economic difficulties resulting from the adverse impacts of COVID-19, the Ukraine War, and drought.…

South Africa is set to topple Nigeria and Egypt as Africa’s biggest economy in 2024. This is according to forecasts from the International Monetary Fund. According to IMF’s World Economic Outlook, South Africa’s gross domestic product will reach $401 billion per current price in 2024. On the other hand, Nigeria’s GDP will reach $395 billion, with Egypt’s GDP reaching $358 billion.

South Africa, the continent’s most industrialised nation, is expected to maintain the top spot as Africa’s biggest economy for only one year. In 2025, the country will again lag behind Nigeria and fall to third place behind Egypt a year later. This is according to the IMF’s World Economic Outlook, a report released last week.…

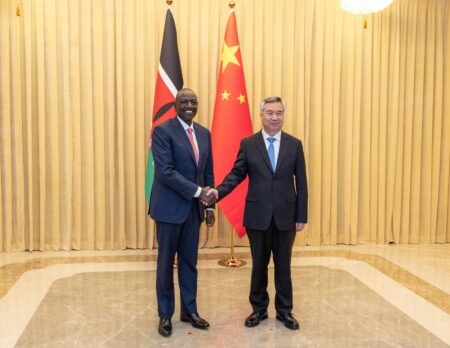

- President William Ruto who is attending the third Belt and Road Forum in Beijing is urging Chinese investors to target energy, water and housing sectors in Kenya.

- He said Kenya will support investors who will add value to the country’s abundant raw materials.

- The President witnessed the signing of a Memorandum of Understanding between the Ministry of Energy and Petroleum and Energy China.

Kenya is seeking more investments from China amid a slow return to borrowing for development, which could see the East Asian country continue with its dominance in Kenya’s infrastructure space.

President William Ruto, who is attending the third Belt and Road Forum in Beijing, has urged Chinese investors to exploit opportunities in the fields of energy, water and housing in Kenya. He said Kenya will support investors who will add value to the country’s abundant raw materials.

“Kenya presents real opportunities for investment especially in transformative areas …

Nairobi will continue purchasing fuel on credit from three state-owned Gulf oil marketers until December 2024 in a plan the government is banking on to ease piling pressure on Kenya’s forex reserves.

The move comes in the wake of high expenditure on oil imports even as Kenya remains a net importer grappling with a widening trade deficit that hit $10.8 billion last year. Last year, Kenya’s expenditure on imports rose by 17.5 per cent to $16.9 billion (KSh2.5 trillion), despite growing export volumes.…