- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Inflation in Africa

- East Africa is set to outshine other regions in 2024 growth with Rwanda, Kenya, Tanzania and Uganda posting impressive numbers.

- This year, Africa’s overall growth is forecasted at 4 per cent, a notable increase from 3.3 per cent in 2023.

- These are findings of a new Africa 2024 outlook report by Stears, an economic analysis and data-driven insights provider.

The prevailing economic woes in Kenya are projected to continue in 2024 with persistent currency depreciation and inflationary pressures taking toll on individuals and businesses. This is according to a new Africa 2024 Outlook report by Stears, a Nigeria-based economic analysis and data-driven insights company.

Already, the latest statistics show that the Kenyan Shilling has already breached the 160 mark against the US dollar.

Stears’ 2024 Outlook delves into key African countries, specifically Kenya and the continent’s powerhouse Nigeria, projecting persisting economic challenges for both economies.

he macroeconomic analysis …

- AFDB has revised its short to medium-term macroeconomic forecast for Africa, for 2023 and 2024 downwards to 3.4% and 3.8%, from 4.0% and 4.3%.

- The bank cites the effects of COVID-19, geopolitical conflicts, climate shocks, a global economic slowdown, and limited fiscal space as constraints to Africa’s recovery.

- AfDB is calling on governments to scale up investment in human capital and infrastructure to boost productivity, and regain momentum in economic growth.

Global shocks have prompted the African Development Bank (AfDB) to revise its short to medium-term macroeconomic projections for Africa in 2023 and 2024, reducing the forecast to 3.4 per cent and 3.8 per cent from the earlier estimates of 4 per cent and 4.3 per cent.

AfDB cited persistent global shocks impacting African economies in the period under focus. The bank said the enduring impacts of COVID-19, ongoing geopolitical tensions and conflicts, climate-related shocks, a worldwide economic deceleration, and …

The Kwacha is the official currency of Zambia. The country’s foreign exchange rate remained unsettled for a very long time. However, Zambia has made substantial steps in recent years to strengthen its currency through economic measures and foreign support.

Zambia has set an example for other African nations by efficiently controlling its currency. While facing numerous economic issues, such as a drop in copper prices and a large debt, the Kwacha exchange rate has remained reasonably constant.…

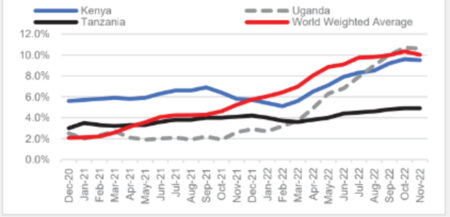

- High cost of living is expected to continue in East Africa in 2023 as the region is projected to experience sustained high inflation pressures according to the latest data from Sanlam Investment East Africa, 2023 investment outlook report.

- The region’s median inflation rate is currently estimated at almost 9 percent with some economies registering double digit inflation.

- High inflation is a key investment risk with central banks leaning towards higher interest to curb inflation.

High cost of living is expected to continue in East Africa in 2023 as the region is projected to experience sustained high inflation pressures according to the latest data from Sanlam Investment East Africa, 2023 investment outlook report.

The report attributes the sustained high inflation pressures to key risks arising from higher energy prices due to the protracted Russia – Ukraine war.

The region’s median inflation rate is currently estimated at almost 9 percent with some …

Undoubtedly, the return to peace after two years has restored hope Ethiopia’s economy can regain its growth momentum. According to officials, a permanent return to peace will help unlock more than $4bn in frozen funding. The funds will ease a crippling shortage of foreign exchange that plagued the economy even before the war began. Agriculture, the primary sector driving Ethiopia’s economy, should provide the much-needed boost to economic recovery.…