- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Kenya

- AI in agriculture is being used to drive the sourcing of real-time data, perform predictive analysis, and run algorithms that optimize farming practices.

- In South Africa, Kenya, and Zimbabwe, ITIKI, an innovative project is tapping indigenous environmental knowledge among African communities, integrating it with AI to predict droughts with better precision.

- GSMA: AI in agriculture is poised to enable the deployment of innovative digital financial solutions such as credit and insurance products for millions of farmers.

In Africa, a continent of over 1.2 billion people, agriculture remains the primary economic activity, accounting for 17 percent of the GDP on average while offering jobs to nearly 60 percent of the population.

The bulk of the food produced in Africa or about 80 percent is, however, attributable to the effort of smallholder farms, where women provide much of the workforce. Unfortunately, these smallholder farmers continue to face multiple challenges, a scenario that …

- Central Bank of Kenya says active mobile subscriptions hit 66.8 million by December 2023 compared to 65.7 million a year earlier.

- Increasing usage of mobile money saw the banking industry in Kenya experience a drop in the value of banking transactions via bank agents to $10.5 billion.

- Kenya is a trailblazer in the adoption and usage of mobile money across Africa.

A steady rise in the use of cashless transactions as well as the opening of 8,555 new mobile money agent shops in Kenya drove the value of mobile money transactions up by 13.8 percent to record KSh788.35 billion or $6 billion in 2023.

Kenya has been a trailblazer in the adoption and usage of mobile money across Africa since the launch of pioneer cash transfer platform M-PESA by Safaricom PLC in 2007.

“Amidst the increasing adoption of technology and the widespread use of mobile phones in daily life, coupled …

- Ratings agency Moody’s has downgraded Kenya’s local and foreign-currency long-term issuer ratings to Caa1 from B3, with a negative outlook.

- This downgrade ushers the economy into an era of reduced capacity to rollout revenue-based fiscal consolidation.

- The move also has broader implications for the country’s near-term economic stability.

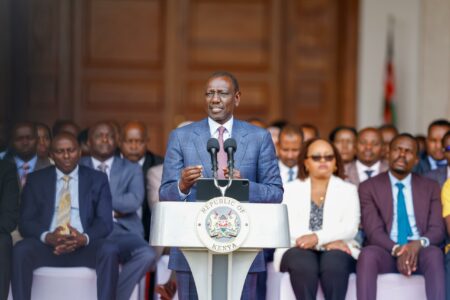

East Africa’s giant economy is at a pivotal moment following ratings agency Moody’s move to downgrade its local and foreign-currency long-term issuer ratings to Caa1 from B3, with a negative outlook.

This downgrade, which comes just a week after a three-week nationwide revolt forced the government to shelve the Finance Bill 2024, ushers the economy into an era of reduced capacity to roll out revenue-based fiscal consolidation. This negative outlook also has broader implications for the country’s near-term economic stability, Moody’s states.

Kenya’s fiscal consolidation challenges amid negative outlook

Moody’s downgrade signals the Kenyan government’s shift away from planned tax increases, opting …

- In the first three months of this year, Asia remained the leading source of Kenya’s imports accounting for goods worth $3.4 billion, as the country’s import bill closed the quarter at $5.4 billion.

- Kenyan traders and government imported goods worth $990.2 million from China, data by the Kenya National Bureau of Statistics (KNBS) shows, making it the biggest import source by country.

- Unlike his predecessors, President Ruto is seen to lean more towards the West as he seeks financing and trade cooperation.

Kenya’s imports from Asian countries including China

China and India remained the top exporters to Kenya in the first quarter of this year, leading other Far East nations in retaining a firm grip on the East African economic powerhouse’s trade and investment space, which they have dominated for over a decade.

This trend continues despite President William Ruto’s heightened charm offensive to economies from the West, which is …

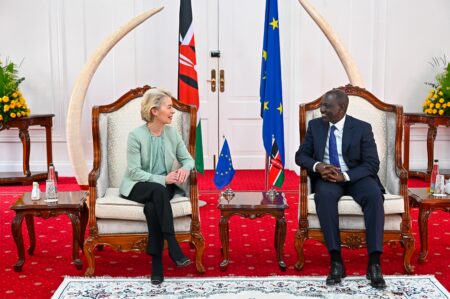

- The EU-Kenya agreement will boost bilateral trade in goods, increase investment flows, and strengthen the ties between these partners.

- It is also expected to facilitate mutually advantageous economic relations sustainably, stimulating job creation and economic growth.

- The EU-Kenya EPA is the most ambitious deal negotiated with an African country in terms of sustainability and can serve as a template for other sustainable trade agreements.

The activation of the EU-Kenya Economic Partnership Agreement (EPA) on July 1st, 2024, marks a historic moment in the growing economic relations between Kenya and the European Union.

According to a statement from Kenya’s Ministry of Investments and Trade as well as the EU, this agreement is poised to greatly transform Kenya’s trade with Europe, opening doors for Kenyan exporters to access duty-free the opportunities set by the $18 trillion bloc.

“The EPA will also create more opportunities for Kenyan businesses and exporters, as it will …

- ATIDI supports the 35MW greenfield geothermal project in Kenya with its Regional Liquidity Support Facility (RLSF).

- The project, the first to be considered for RLSF cover in Kenya, is set to benefit from ATIDI’s liquidity instrument which will cover the risk of payment default by public entities: Geothermal Development Corporation and Kenya Power.

- Kenya’s power sector benefits from an active private sector and boasts abundant renewable energy resources with hydro, wind, and geothermal projects dominating its energy mix.

Regional Liquidity Support Facility (RLSF)

The African Trade and Investment Development Insurance (ATIDI) and Globeleq Africa Limited, have jointly announced the former’s support for the 35MW Globeleq Menengai Geothermal Project with liquidity cover via the Regional Liquidity Support Facility (RLSF).

RLSF, a joint initiative of ATIDI, the KfW Development Bank and the Norwegian Agency for Development Cooperation (Norad), is a credit enhancement instrument available to renewable energy Independent Power Producers …

- Businesses in Kenya seeking government tenders will soon have to contend with new regulations.

- Among the proposed changes is the amending of the compulsory requirement that compels the government to award tenders to the lowest bidder.

- According to the Institute of Economic Affairs the compliance rate of public procurement regulations is low.

Kenya’s Procurement Regulator Strategic Plan for businesses that seek government tenders will soon have to contend with new regulations should the Public Procurement Regulatory Authority forge ahead with the proposed changes on the issuance of state tenders.

Among the proposed changes is the amending the compulsory requirement that compels the government to award tenders to the lowest bidder. PPRA argues out that this has compromised the quality of some of the projects undertaken under this model of procurement.

The Authority’s Director General Patrick Wanjuki, said that in the next three years, PPRA is looking to strengthen its capacity …

- Kariakoo Traders from Tanzania are striking against higher taxes heaped on them by the authorities.

- The government has however assured the traders on the safety of their property.

- Unlike tear gas and fights in neighbouring Kenya that have caught global attention, Tanzania’s strike is rather less chaotic.

“No more taxes and the strike is the only apparatus we have to get what we want and the way forward” says Frank, a merchant and trader in the Tanzania’s open market pulse, Karikoo. Frank and like most of his peers, often young people, who invested significantly in stores that charge over $220 rent per month – is forced to see his investment wither by the day, as tax revolt intensifies.

Thanks to social media, the traders circulated a message on June 22, 2024 that directs all traders in Kariakoo to close their businesses, including their shops, offices and any other activities …

- MSMEs and the e-commerce sector in Kenya are emerging as a formidable force driving economic growth.

- With over 7.4 million MSMEs contributing about 40 percent of the country’s GDP, their potential to boost the economy is huge.

- With internet penetration in Kenya currently above 74 percent, the country is well-positioned for e-commerce growth banking on an expanding middle class.

In a world where technology continuously reshapes the business scene, the relationship between Micro, Small, and Medium Enterprises (MSMEs) and the e-commerce sector in Kenya is emerging as a formidable force driving economic growth.

This dynamic was highlighted during a recent stakeholder forum reviewing the Kenya e-commerce strategy, launched in December 2023.

The strategy aims to foster innovation, inclusive participation, and economic growth through digital commerce for Kenyans, regardless of location, age, gender, or abilities.

With over 7.4 million MSMEs contributing about 40 percent of the country’s GDP, their potential to …

- The deployment is part of a larger mission led by Kenya to restore order in Haiti, where gangs have taken control of most of the capital, Port-au-Prince.

- Gangs in Haiti have been responsible for widespread killings, kidnappings, and sexual violence.

- Police officers from Jamaica, the Bahamas, Barbados, Chad, and Bangladesh set to form part of the 2,500-international force.

Kenyan police depart for Haiti

The first group of Kenyan police officers has departed for Haiti to address the rampant gang violence plaguing the Caribbean nation. The deployment is part of a larger mission led by Kenya to restore order in Haiti, where gangs have taken control of most of the capital, Port-au-Prince, and have been responsible for widespread killings, kidnappings, and sexual violence.

Kenya’s commitment to leading this international force dates back to July 2023, when it volunteered to spearhead efforts to tackle the violence in Haiti. The mission, which includes …