- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

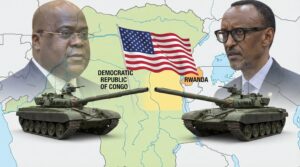

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Browsing: Oil and Gas

For the first time in climate summits, diplomats from nearly 200 countries at COP28 have agreed on a new global…

Global oil and gas producers have remained under immense pressure to show more goodwill in the energy transition agenda. As…

Africa’s oil and gas industry looks flat in the final quarter of 2023. That is, as AEC details in its newly released 2024 African Energy Outlook, capital expenditure (CAPEX) on upstream projects is still rising, but it is on a relatively slow upward trajectory — and it is moving up more slowly than we had predicted last year because of changes in the timeline of certain African upstream projects.

The Nigeria-Saudi Business Council could see the Middle Eastern country fund several sectors of the West African economy. Through the…

As the 16th president of Nigeria, Bola Ahmed Tinubu has inherited an economy grappling with record-high inflation, enduring unemployment, extreme poverty, crumbling infrastructure and high levels of insecurity. However, Nigeria’s debt situation is a sore thumb among these challenges.

Nigeria’s external debt stock stood at US$41.69 billion in 2022. Multilateral lenders accounted for almost half of this figure, with Eurobonds taking about 38 per cent of Nigeria’s external debt. China’s Exim Bank accounts for US$4.3 billion, or 86 per cent of the $5 billion in bilateral debt.

Several gas finds in East Africa dating decades have suffered long delays from the time they were “found”. Lengthy negotiations…

The Nigerian government has taken various steps to address the persistent fuel shortages, including rehabilitating the country’s refineries, the establishment of new refineries, and promoting private sector investment in the downstream sector. However, progress has been slow, and the problem persists. However, the Dangote oil refinery’s boost to Nigeria’s oil refining capacity should help the government in its quest to address the persistent fuel shortages and end the energy sector crisis.

African countries will be largely impacted by the decision by the global cartel of oil producing countries to cut oil production given that only 14 out of 54 countries in Sub-Sahara Africa produce oil, which accounts for the lion’s share of their annual export earnings.

Many African countries have to import refined oil and rely on oil products in power generation. A hike in oil prices will boost economies of oil producing countries, by gaining foreign exchange earnings to carry out development projects such as Nigeria, Angola, Gabon, Libya, Cameroon, and Congo among others.

Consequently, this will create more job opportunities and greatly aid in poverty alleviation. In addition, the revenues could be redirected to other sectors that make significant contributions to the respective economies. By example, in countries like Cameroon, Gabon and Congo, internet infrastructure and technology could largely benefit from re-investing.

The crisis has thrown the energy market into chaos, sending fossil fuel prices soaring. This has birthed the global demand for thermal coal, especially from the Asian and European markets; with most countries in both regions having been dependent of Russia, as the country is the world’s third largest supplier of thermal coal used chiefly for power generation. Coal plants that had been scheduled for closure in Europe have been reopened, to fill the deficit in mitigating fuel costs and generating electricity; as the alternative gas, is inarguably more expensive. With energy security under threat, climate policies and commitments have taken a back seat. The EU recently declared that natural gas now qualifies for green investments.

The African coal market is projected to enjoy double its revenue for the next one year. The prevailing energy gap has created a window of opportunity for African coal producing nations. According to a report by Reuters, South Africa’s coal exports rose by 11 folds in the months following the war. Botswana has also projected growth in its coal market. The massive demand far outstrips the available supply, resulting into prices of thermal coal leaping to record levels. African countries with coal resources, have doubled profit margins, with the surge in demand from European buyers. Italy, France, Portugal and Spain have been sourcing from Nigeria, whilst Germany has sought Senegal for gas supplies.

The revenues gained from increased energy exports to Europe and other markets could be reinvested to boost agricultural productivity in Africa to mitigate reliance on Russia and Ukrainian wheat products. In addition, the surplus could boost the continent’s manufacturing sector, pertinently fertilizers to promote agricultural productivity which fuels most economies in Africa.

African governments must consider strategies to optimise the effective use of imported oil. The optimisation will reduce net oil import proportions to minimise expenses. More generally, African nations must explore these strategies to minimise their reliance on oil as their only energy source.

Reducing oil consumption by shifting to renewable resources represents a long-term or short-term solution. In contrast, if Africa is to benefit or gain from the imminent possibility of an increase in oil prices, these few oil-producing nations must expand their crude oil production and refinery capacity.