- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Browsing: SADC

The AfCFTA presents a significant opportunity for African countries to bring 30 million people out of extreme poverty and to raise the incomes of 68 million others who live on less than $5.50 per day. The AfCFTA is the new anchor to pull multinationals to invest in Africa.

This agreement not only brings hope to African governments but also encourages current efforts on the ground, which improve jobs in Africa.

The World Bank points out that the AfCFTA will create the largest free trade area in the world, measured by the number of countries participating. The pact connects 1.3 billion people across 55 countries with a combined gross domestic product (GDP) valued at $3.4 trillion.

It has the potential to lift 30 million people out of extreme poverty, but achieving its full potential will depend on putting in place significant policy reforms and trade facilitation measures.

In June, Zawya Projects announced that Namibia had received 25 submissions for pilot projects, from which it plans to select no more than five.

The four projects – the Daures, Namport, Cleanergy, and TransNamib projects – have a combined value of over N$890 million (53,39 million euros), and some of the funds will be sourced by the initiators of the projects. The four projects will be located in the Erongo region, which has been marked as ‘valley 1’ of the envisaged national hydrogen ecosystem.

Transnet Freight Rail (TFR) will collaborate with Botswana Rail (BR) to fix parts of the 126 km rail line between Swartruggens, in South Africa’s North West province, and Mafikeng, on the border with Botswana, helping South Africa’s landlocked northern neighbor get its minerals, including thermal coal, to market.

According to an article by Reuters published on August 5, 2022, the rail revamp will enable heavy haul trains to travel from Botswana to South Africa’s ports of Richards Bay and Durban, TFR said. The project aims to be up and running in the next 24 months. However, financial terms were not disclosed.

TFR and BR will also build a rail line from Mamabula in Botswana to Lephalale in South Africa’s Limpopo province.

The two rail companies will work together to fight the “scourge of cable theft and infrastructure vandalism” that is impacting rail services, TFR said, adding this was a “rising problem” in Botswana.

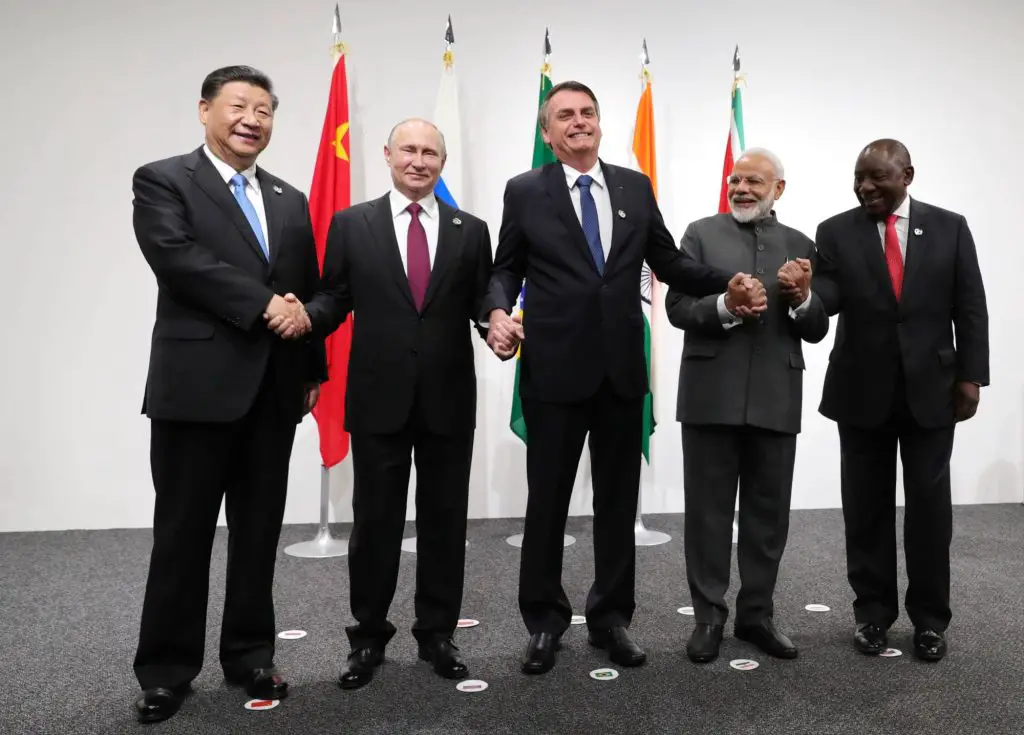

When the United Nations General Assembly voted overwhelmingly on March 2 to condemn Russia’s invasion of Ukraine, African countries accounted…

Over the past decade Africa has been rife with infrastructure developments that hitherto continue to steadily transform the continent, spurring…

According to Deutschland, German companies long concentrated only on South Africa, but this is changing. Over the past eight years, the Association of German Chambers of Commerce and Industry (DIHK) has opened not less than five new branch offices. Apart from South Africa, top investment destinations include Nigeria, Ghana, Angola, Tanzania, and Mozambique.

Alongside their primary business, German companies are also involved in numerous initiatives to support the African economy and combat poverty. Germany’s Mechanical Engineering Industry Association (VDMA) has founded the “Skilled Workers for Africa” initiative in Botswana, Kenya, and Nigeria. Germany’s successful dual vocational training model serves as an example in Africa. At the same time, Germans benefit from collaboration with local partners, who enable them to access new markets. Local shareholders are essential in some countries.

To strengthen their cross-continental network and promote a value and interest-based exchange, Konrad-Adenauer-Stiftung (KAS) and the Hanns-Seidel-Stiftung (HSS) supported by the Africa CDU/CSU group in the German Bundestag, held a conference in May 2022.

Stavros Nicolaou, a Senior Executive at Aspen Pharmacare Group said in the absence of orders or commitments, Aspen is considering the repurposing of two COVID-19 production lines for the manufacture of other products.

“The continent would lose its only existing COVID vaccine manufacturing capacity, It would be a massive setback for Africa’s plans to localize and reduce its dependency on imported vaccines,” he said.

John Nkengasong, director of the Africa Centres for Disease Control and Prevention, said global health security would be undermined if companies like Aspen were not backed.

President Mnangagwa said his Government is convinced that the recent exchange rate movements were driven by negative sentiments by economic agents as opposed to economic fundamentals.

“These negative sentiments have been propagating adverse expectations on future inflation and exchange rate movements, thus giving rise to artificially high demand for foreign currency as economic agents hedge against expected high inflation,” he added.

The Government listed measures that are expected to restore macroeconomic stability, support the current robust economic recovery trajectory, boost economic confidence, increase the appeal of the local currency, preserve value for depositors and investors and deal with market indiscipline.

At the dawn of his administration, President Mnangagwa promised to address the country’s record on human rights, targeting those that oppress political activists and opposition, political party supporters, during elections. He also said his government would introduce economic policies favouring foreign investment. His mantra was ‘Zimbabwe is Open for Business. In its quest to kick-start itself to its former glory, the Zimbabwean government came up with economic policies such as the Look East Policy, and Indigenization, but they failed to yield results.

Mnangagwa’s administration has been rallying anti-sanctions sentiments, embarking on a re-engagement policy and the ‘Zimbabwe is Open for Business mantra. But, the sanctions have remained in place.

According to Afrobarometer, Mnangagwa has managed to mobilize support against the sanctions. In October 2019, leaders of the Southern African Development Community (SADC) agreed to campaign for the removal of the sanctions, arguing that they destabilize Zimbabwe’s economy and adversely affect the region. ZimEye reported a group of ZANU-PF supporters who camped near the U.S. Embassy in Harare on March 29, 2019, and vowed to stay put until the sanctions were lifted.

A report published by Lexology on January 18, 2022, Zimbabwe’s economy is largely driven by the mining, agriculture, and tourism sectors. However, because of Zimbabwe’s foreign currency shortages, there is a significant focus on export-oriented and foreign currency-generating activities.

This allows investors, businesses, and the government to retain value and meet the country’s forex needs. Zimbabwe’s main exports are minerals, agricultural produce, and soft commodities. She also has large reserves of chromite, coal, gold, and iron ore, among others. The country is also one of the world’s largest growers of tobacco.

According to research by Mordor Intelligence, Zimbabwe is a signatory of several bilateral and international agreements (MIGA, OPIC, ICSID, and UNCITRAL) that protect the investments of the companies in Zimbabwe. Zimbabwe has cheap educated, and competitive labour, well-developed infrastructure, and easy access to regional and global markets through its membership in AU, COMESA, SADC, COPAC, and CISSA. Zimbabwe offers free movement of investment capital and attractive investment incentives. Zimbabwe allows for 100% Foreign Direct Investment in almost all sectors barring a few.