- China integrates mega logistics firms to ease trade with Kenya, Africa

- South Africa Inflation falls to a Four-Year Low Before Rate Decision

- A deep dive into how Africa’s hospitality industry is evolving to meet 2025 travel trends

- Green energy revolution in Kenya: How solar power is transforming rural communities

- Trump’s Presidential Win Influences Currency and Financial Decisions in Africa

- Gabon’s Referendum: the First Step Toward a Return to Civilian Rule

- COP29: Africa calls for fair GDP valuation of its $6 trillion natural wealth

- Africa’s rising global role as BRICS onboards Egypt and Ethiopia

Browsing: Uganda

- The UAE, Saudi Arabia, and Qatar, have poured billions into developing airports, airlines, and seaports across Eastern Africa in the last 10 years.

- In the latest development, UAE’s Sharjah Chamber of Commerce and Industry is set to build a new international airport just outside Kidepo National Park, in Uganda.

- These investments are transforming the region into a pivotal stopping ground for global trade, tourism, and travel.

The economic ties between the Gulf Cooperation Council (GCC) countries and Eastern Africa have deepened significantly over the past 10 years, driven by strategic investments in key infrastructure.

The Gulf nations, notably the United Arab Emirates (UAE), Saudi Arabia, and Qatar, have poured billions into developing airports, airlines, and seaports across Eastern Africa.

These investments are transforming the region into a pivotal stopping ground for global trade and travel, enhancing connectivity, and fostering economic growth.

Eastern Africa airports and airlines enhancing connectivity

The UAE…

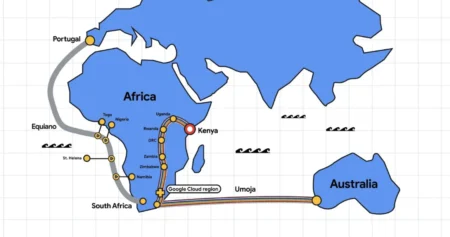

- Google is rolling out Umoja cable, the first-ever fibre optic link directly connecting Africa with Australia, aiming to enhance global digital infrastructure and foster economic growth.

- The Umoja project, developed in collaboration with Liquid Technologies, will improve connectivity and drive digital inclusion across Africa.

- This initiative is part of Google’s long-term commitment to Africa’s digital transformation, with investments in infrastructure, cybersecurity, and AI innovation to support growth.

In a deal set to revolutionize digital connectivity across continents, tech heavyweight Google has announced the launch of Umoja, the first-ever fibre optic link directly connecting Africa with Australia. This project is poised to enhance global digital infrastructure, foster economic growth, and drive digital inclusion on a new level scale.

The Umoja cable, anchored in Kenya, will traverse a diverse array of African countries, including Uganda, Rwanda, the Democratic Republic of Congo, Zambia, Zimbabwe, and South Africa, before crossing the Indian Ocean …

- Xente, co-founded by Francis Nkurunungi, is a fintech platform that streamlines business payments, collections, and financial operations.

- Targeting medium to large enterprises, Xente offers a digital wallet and integrates with systems like VISA to facilitate secure, efficient transactions and manage financial documents in one place.

- Currently, the startup has onboarded over 500 businesses in Uganda and plans to expand rapidly into Kenya, Tanzania, Nigeria, and Ghana.

When you think about the next big thing in fintech, your mind might drift to Silicon Valley or China. But Francis Nkurunungi, the COO and Co-Founder of Uganda-based fintech Xente, wants to change that perspective. He believes that Africa is the next frontier for technological innovation and investment.

At the sidelines of the 13th edition of the AIM Congress 2024 in Abu Dhabi, Francis shared Xente’s entrepreneurial journey, the opportunities and challenges they face, and their ambitious plans for the future. This is …

- Founded in Uganda, Famunera is a tech-driven startup that digitizes agribusiness operations, providing farmers, cooperatives, and agribusinesses with easy access to financing, market access, and supply chain traceability.

- Initially a B2C model for farm inputs, it transitioned to a B2B platform to address the unique financing needs of agribusinesses.

- With growing presence in the UAE, and the Netherlands, Famunera has onboarded over 1,000 agribusinesses and indirectly employed over 50,000 farmers.

Imagine a world where farmers from Uganda can seamlessly connect with agribusiness financiers in the United Arab Emirates (UAE), while cooperatives in the Netherlands can procure produce from African farmers without the usual hurdles of financing and market access. This vision is no longer a far-off dream but a reality, thanks to Famunera, an innovative agribusiness startup.

Famunera, founded by Naika Enock Julius in 2016, is on a mission to transform the global agribusiness scene. By leveraging technology, Famunera is …

- Under a new COMESA programme, farmers in the five East African countries are expected to access quality seeds, and training on how to improve production and distribution.

- The five-year programme is expected to help the countries cut post-harvest losses in horticulture to 40 per cent or lower, from highs of 60 per cent, for instance in Kenya.

- Agriculture is estimated to contribute on average 27% of the gross domestic product (GDP) in the EAC and accounts for the highest share of employment not only in the region but across Africa.

Agriculture is the backbone of nearly all East Africa region’s economies and the main economic activity for more than 70 per cent of the population. It is estimated to contribute on average 27 per cent of the gross domestic product (GDP) in the EAC and accounts for the highest share of employment not only in the region, but the African.…

- The funding is designated for the construction of a bridge spanning the River Nile in northwest Uganda and the enhancement of roads stretching over 105 kilometers.

- Uganda has encountered obstacles in accessing financial support from international institutions like the World Bank, primarily due to policy differences.

- The loan holds the potential to stimulate job creation, foster entrepreneurship, and spur innovation

Uganda has finalized an agreement with the Saudi Islamic Development Bank (IDB), securing a $295 million loan to bolster infrastructure development, particularly road construction projects across the country. This landmark agreement, signed by Uganda’s Finance Minister, Matia Kasaija, and IDB President Muhammad Al Jassar in Riyadh, underscores Uganda’s strategic shift towards diversifying its sources of external funding amidst ongoing negotiations with traditional lenders such as the World Bank.

The financing agreement, which was formalized during Minister Kasaija’s attendance at the 2024 Islamic Development Bank Group Annual Meetings in Riyadh, marks …

- 121 African startups secured $466M, marking a 27 per cent drop from the previous quarter; women-led startups got 6.5 per cent of the capital.

- About 87 per cent of startup funding in the three months to March went to entities in Nigeria, Kenya, Egypt, and South Africa.

- Gender imbalance persists as only 6.5 per cent of the financing went to female-led startups in Africa.

The big four economies of Nigeria, South Africa, Kenya, and Egypt continue to attract the highest share of funding going to startups in Africa, even as the ecosystem suffered a 27 per cent drop in financing to $466 million in the three months to March 2024.

The latest analysis from Africa: The Big Deal shows that 87 per cent of startup funding in the three months to March went to upcoming entities in Nigeria, Kenya, Egypt and South Africa.

Attracting $160 million, Nigeria’s economy accounted for …

- East Africa’s banking giant KCB Group reports heightened operational expenses, which surged to $627 million in 2023, up from $447.9 million in 2022.

- The costs are associated with the consolidation of its subsidiary in the Democratic Republic of Congo, Trust Merchant Bank (TMB),

- Additional expenditures were related to a voluntary retirement scheme as well as litigation fees.

KCB Group, one of East Africa’s banking giants, has reported a net profit decline to $282 million for the year ending December 2023, from $307 million in 2022.

The bank has attributed this decline to increased operational costs and higher provisions for bad loans as primary reasons for the downturn in profitability.

In a period marked by economic challenges and strategic expansions, KCB Group faced heightened operational expenses, which surged to $627 million in 2023, up from $447.9 million in 2022.

DRC-based Trust Merchant Bank consolidation costs

This increase was largely due to …

- The IMF has issued Uganda $120 million as part of its Extended Credit Facility (ECF) Arrangement to aid recovery.

- Total disbursement to Uganda under the ECF Arrangement now reaches $870 million.

- IMF urges Uganda to give its Central Bank independence

Kampala is set to receive $120 million as part of its Extended Credit Facility (ECF) Arrangement with the International Monetary Fund (IMF) to aid Uganda’s economic recovery amidst various challenges, including backlash due to a harsh anti-LGBTQ law.

The IMF executive board has approved immediate disbursement of the said amount after the conclusion of its fifth review of Uganda’s ECF Arrangement. “This brings the aggregate disbursement under the ECF Arrangement to about $870 million,” the IMF note says in part.

Uganda qualified for about $1 billion under the ECF Arrangement as of June 2021, which is now distributed in part every other year.

IMF loan to aid Uganda’s economic recovery

…- These businesses, along with their affiliates in Kenya, Uganda, Somalia, Cyprus and UAE form the backbone of a sophisticated network that launders millions of dollars for Al-Shabaab.

- US says firms such as Nairobi-based Crown Bus Services and other investment projects that masquerade as legit commercial ventures, empower Al-Shabaab’s lethal agenda.

- Al-Shabaab is estimated to siphon over $100 million per year from the regional and global financial system.

The US, through its Department of the Treasury’s Office of Foreign Assets Control (OFAC), has cast a wide net across the UAE, Kenya, Uganda, and Somalia, targeting entities and individuals with wide-ranging sanctions for their complicity in financing Al-Shabaab terror network.

This designation, enveloping 16 entities and individuals, reveals the intricate web of financial operations spanning from the Horn of Africa to the opulent corridors of the United Arab Emirates (UAE) and the serene island nation of Cyprus.

This sprawling network, carefully pieced …