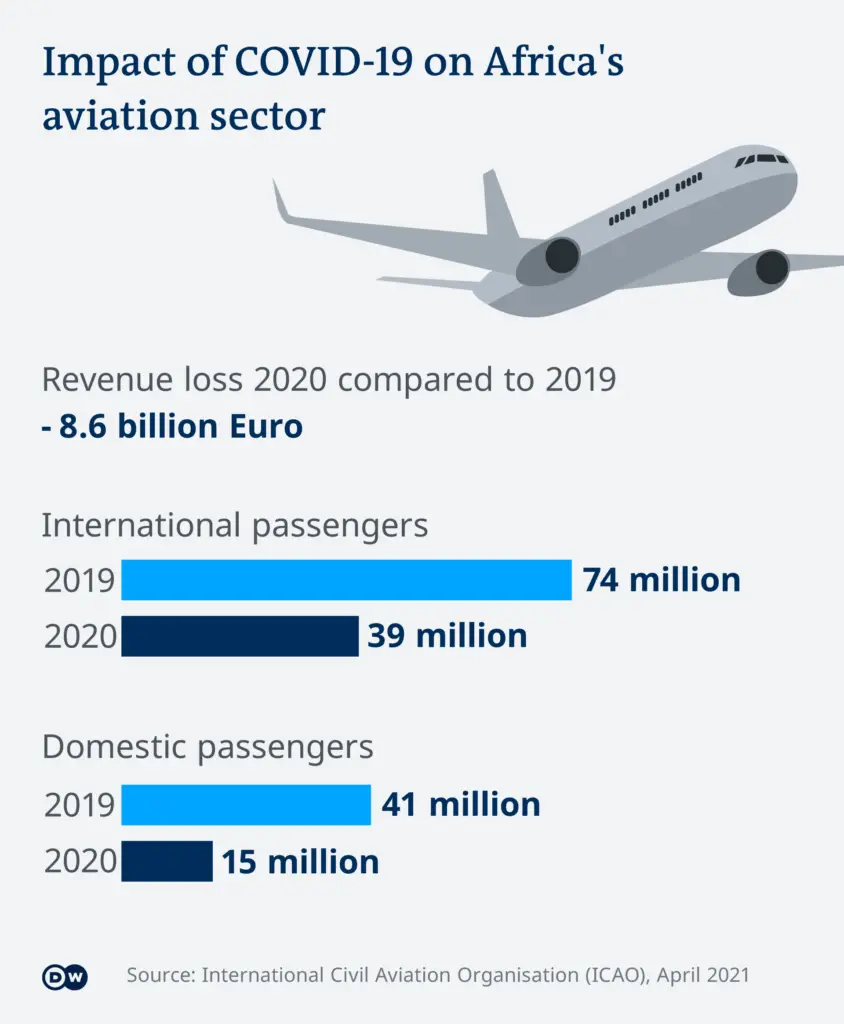

- Africa’s aviation industry lost a whopping $9 billion between 2019 and 2020.

- The Covid-19 pandemic shook the industry to the core, removing chronically inefficient but large commercial airline businesses from circulation in some countries.

- According to the World Travel and Tourism Council, the rate of commercial air transport increased by at least 23 percent in 2022 and is expected to jump by 9.5 percent this year.

At the height of the Covid-19 pandemic, a number of African economies saw their airlines fly into near collapse even as others reduced their dependence on it to power certain segments of their economies. In many countries, policymakers picked up hard lessons on how some economies heavily relied on the aviation industry to source income for other sectors such as tourism.

Africa’s aviation industry experienced phenomenal passengers and freight traffic growth of between 45 percent and 80 percent from 2010-2015, giving a ray of hope for its economic value in different countries. Despite its steady increase, however, Africa reported the lowest rate of commercial air transport compared to the entire world.

According to the International Air Transport Association, Africa ranked last on international connectivity of various countries within the global air transport network. Across the continent, the most dominant commercial airlines are Ethiopian Airlines, Kenya Airways, Royal Air Maroc, South African Airlines, and Egypt Airlines.

Despite the slow-paced growth rate of Africa’s aviation market, it still signifies various improvements. It had an average growth rate of 6.1 percent compared to the global average, the Middle East and the Asia Pacific, which stood at 5.8 percent, 7.9 percent and 6.9 percent respectively. At the time, more economies, such as Kenya and South Africa, sought to improve their aviation industry to strengthen their global connectivity and enhance various economic activities.

Read: Jobs in Demand in 2021 and beyond

Ethiopia is among the few African countries to improve commercial air transport through privatization to increase foreign and domestic investment. At the time, this economic move quadrupled passenger count, and the government took this opportunity to expand its destinations. In addition, its government announced plans to massively overhaul its terminal in Addis Ababa Bole International Airport.

The advancements of this East African country inspired its peers to focus more on their global connectivity. Kenya Airways later added several carriers to its stable. The steady growth of Africa’s aviation industry is in tandem with an increase in transcontinental and foreign tourism, a significant economic activity for various countries.

The Covid-19 pandemic saw a significant regress in various economies in Africa. However, non suffered more than the aviation industry as countries shut their doors to the world. In 2021, Air Namibia had to cease its operations due to the significant losses it faced and filed for bankruptcy. The airline had operated for over 70 years, but the sudden drop in passengers had taken its toll.

South Africa, which significantly relied on its tourism industry, had to ground its airlines to prevent further losses. According to statistics, Africa’s aviation industry lost at least $9 billion between 2019 and 2020.

According to the African Airlines Association, the pandemic had caused a brief shutdown of various airlines or completely crippled them. The global slump in international air traffic had affected the globe, but Africa felt its effects a little more, given that other industries heavily depended on it. 2021 was no better as more governments had ordered any airline to unwind any reinstated international flights.

Fortunately, various governments opened airline routes, but passenger footfall was a mere shell of its former glory. Emirates had opened its routes to Johannesburg, Nairobi, Addis Ababa and Dar es Salam. Morocco has also followed suit as it opened its borders for a brief time to Iberia, Tangier and Marrakech. Qatar had closed entirely off its flights to Africa but promised to reinstate them in 2023.

Aviation industry spending

According to the IATA, commercial air transport supports over 7.7 million jobs and accounts for $63 billion in African economic activity. In 2018, the pre-pandemic period, it accounted for 2.2 percent of all employment and 2.7 percent of all GDP in African countries.

Africa’s aviation industry’s spending with suppliers supported an additional 500,000 jobs and a $5.5 percent million contribution to its GDP. One of the industries that heavily relied on commercial air transport was the tourism industry. Its ability to interconnect Africa with its target audience has significantly increased the economic development of various countries.

Uganda, Algeria, Egypt, South Africa and Kenya are the few countries heavily relying on its tourism industry. As a result, each state government has significantly invested in improving and expanding Africa’s aviation market.

Read Tanzania’s banking on transport economy to ace East Africa’s market.

According to a report, 40 percent of international tourism travel by air and generates 29 million jobs globally, directly and indirectly. According to the IATA Review 2023, establishing sustainable connectivity in Africa internally and to global markets with commercial air transport is critical for bringing people together to create social and economic development.

Africa’s aviation market is among the top methods that the UN’s Sustainable Development Goals (UN SDGs) will use to lift 50 million people out of poverty. Yvonne Makolo, CEO of RwandAir and first female chair of the IATA Board of Governors, explains that aviation is a crucial game changer for the continent’s economy.

She further states that Africa stands out as the region with the most significant potential and opportunity for aviation. The Focus Africa initiative renews IATA’s commitment to supporting Africa’s aviation market. During the pre-Covid period, spending by foreign visitors supported an estimated 6.5 million jobs contributing to $44 billion.

Aside from tourism, Africa’s cargo business is significantly gaining from its air transport. In Kenya, Aero Africa is a leading air cargo management group that has established profitable connections throughout the entire continent and globe. Per the IATA report in June 2022, cargo volumes within the country grew by 5.7 percent in 2022 compared to 2021 despite the worldwide demand reducing by 6.4 percent. More economies have turned to the air cargo business to increase trading activities in Africa internally and globally.

Ray of Hope in aviation

Even before the Covid-19 pandemic, commercial air transport had suffered significantly due to poor management, infrastructure and funding. Despite this, the Covid pandemic made it all too clear that Africa’s aviation industry required significant improvement.

With travel doors finally opened, business travel in Africa is among the first noticeable improvements offered. According to the World Travel and Tourism Council, the rate of commercial air transport will increase by at least 23 percent in 2022 and by 9.5 percent in 2023.

The boost in business travel is crucial when determining the health of several African industries. Business travel accounted for at least 12 percent of global travel, which led to a 70 percent increase in revenue for high-end hotels. In 2022, Ethiopian Airlines raked up to $5 billion in annual revenue from its commercial air transport. This figure reflects the high rate of demand for Africa’s aviation industry. According to the government Ethiopia seeks to rebound from the pandemic by focusing its efforts on its airlines.

Steady improvement

After the Covid crisis, Africa’s aviation industry only accounts for 1.9 percent of the world’s airline passenger market, representing a 0.2 percent loss since 2019. Fortunately, this shed some glimmer of hope for the continent.

According to the AFRAA, the Covid pandemic was necessary to pave the way for improvement of Africa’s aviation market. Andrew Curran, a leading aviation author and industry expert, stated that airline analysis consultancy OAG argued that too many airlines were operating in Africa.

Read: Propelling Africa’s Aviation Sector to greater heights

The pandemic shook the industry and removed chronically inefficient but large commercial airline platforms. This is defined as separating the weak from the strong. Those who survived the pandemic will implement various policies to boost their operations in efficiency and quality.

The OAG also noted that for Africa’s aviation industry to thrive, governments must liberalize it. In addition, poor management has plagued this industry for decades, and a structural change is in order. In 2021, the few industry survivors did turn in a substantial profit.

Kenya Airways earned $282 million in revenue, a significant increase from $200 million in 2020. Ethiopian Airlines achieved an operating profit of $25 million and a net profit of $29 million, surpassing its previous predictions in 2020.

Blessing in disguise

Despite the substantial losses, it is indeed a fact that the Covid-19 pandemic opened up the eyes of several governments as far as aviation industry was concerned. Namibia realized that it operating airline served as a burden to its economy. The company has since gone into voluntary liquidation.

To recover from the hit, Kenya Airways is seeking partnerships with other government-backed airlines such as South Africa Airways with a view to establish better routes and help increase the economic value of their commercial air transport. Many airlines in Africa are now shutting down or improving their infrastructure, management and quality of services to survive. The Covid-19 pandemic was a reminder that Africa’s aviation market required reinvention.