- Africa private capital deals fell to to 450 deals in the past one year.

- The continent’s total private capital deal value stood at $5.9 billion, the fourth largest value on record since 2012.

- Decline in Africa private capital deals marked the continent’s steepest year-over-year decline in volume in 12 years.

Africa recorded a 28 per cent year-over-year (YoY) decline in the total private capital deal volume for the first time since 2016, falling to 450 deals. This downturn is attributed to the global economic turmoil, which led to inflation spikes and the devaluation of continental currencies.

In Kenya and Nigeria for instance, the Shilling and the Naira plunged to historic lows in 2023, while in Egypt, a shortage in foreign currency led to increased controls over its usage in the country.

According to the 2023 African Private Capital Activity Report, the depreciation of local currencies and the depletion of foreign exchange reserves affected the importation of goods and services and increased the cost of doing business for most companies in Africa.

Read also: Intra-African Trade Fair exceeds targets with $43.8 billion deals signed

Africa posts steepest decline in 12 years

This marked the continent’s steepest year-over-year decline in volume in 12 years, as well as a 22 per cent drop in deal values. Even so, deal volume on the continent surpassed the annual average of 264 deals from 2012 to 2022 and the average of 387 deals from 2019 to 2022.

“With the era of zero rates, quantitative easing, and fiscal stimulus reaching its end in key global markets, capital has become more expensive worldwide,” says AVCA CEO, Abi Mustapha-Maduakor. “As a result, this has prompted many investors to adopt a more cautious approach to deal-making, a trend that was not only evident in Africa in 2023 but also globally.”

Africa’s total private capital deal value stood at $5.9 billion, the fourth largest value on record since 2012, and remained above the decade-long average of $4.7 billion.

Notably, the second half of the year experienced a significant surge in investment values, marking a 35 per cent increase from the first half of 2023. However, the substantial increase in investment value, which reached $3.4 billion in the latter half of 2023, was primarily driven by two large infrastructure investments sized above $250 million each.

These investments, both in the renewable energy sector in South Africa, contributed to 37 per cent of the total deal value reported during the second half of the year. Despite a 48 per cent YoY decline in volume, Africa recorded 43 exits in 2023, which marks a return to pre-2022 averages of 42 per year.

Africa private capital deals decline

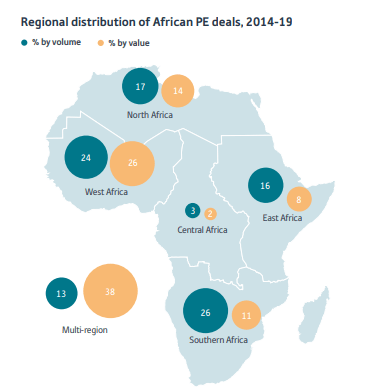

Economic challenges were exacerbated in 2023, ending the exit rush in Africa of 2022 led by fund managers dealing with a backlog of mature portfolio companies from the Covid-19 pandemic. Southern Africa, demonstrating its position as a mature exit market, was the most popular sub-region for exits, increasing its overall share of exits to 36 per cent Year -on Year.

Overall, the Financials, Information Technology and Consumer Discretionary sectors emerged as the top three most active sectors by volume, collectively constituting 54 per cent of the total number of private capital deals on the continent. Meanwhile, Utilities emerged as the top recipient of investment value, accounting for a substantial 35 per cent of the total investment value for the year.

“Investors are increasingly recognizing the imperative of transitioning towards a greener Africa, which in turn is driving substantial investments that are expected to reshape the continent’s investment landscape in line with global trends,” the report reads.

Historically, the Consumer Discretionary sector has been one of the most prominent within Africa’s private capital industry, often ranking first or second in investment volume since 2016. However, 2023 marked a notable shift as the sector slipped to the third position, accounting for 15 per cent of the total investment volume, behind Financials and Information Technology.

“Given that this sector represents nonessential consumer goods and services, investors may have exercised caution due to the expectation of declining purchasing power amid the uncertain macroeconomic environment.”

In aggregate, the financial sector recorded 96 private capital investments with a total reported value of $1.4 billion. This represented the largest year-over-year decline in investment volume at 47 per cent across all sectors, and the second-largest drop in value at 43 per cent, marking the lowest values for the sector since 2021.