Banks in East Africa are empathizing with the loss of livelihood and businesses of their clients by easing off on loan payment demands as the covid-19 pandemic continues to disrupt economies.

In 2020, top East African banks increased provisions for bad debts by over $736 million so as to reduce exposure on businesses and household loans in countries that are most affected by the pandemic.

According to a review of the banks audited financial statements, in 2019 the top eight Kenyan banks by market share tripled their loan loss provisions to $960 million from $263.11 million.

In order to take care of $1.56 billion worth of loans that had been restructured to bail out clients who were most affected by the pandemic, equity bank increased its loan loss provision by $198.6 million making it the greatest hit on its net earnings that the bank has ever experienced. This led the bank to increase its bad-loan coverage by more than 89 per cent.

Equity bank is the largest lender in East Africa with assets worth $9.35 billion and market capitalization worth $1.44 billion.

The Chief executive of Equity Bank Group, James Mwangi said “Our corporate purpose of ‘Transforming lives, giving dignity and expanding opportunities for wealth creation’ became the guiding compass of the organisation’s essence on how to navigate through the crisis and the challenging environment. Our results and performance became a human story of resilience and determination to live an ethical human purpose.”

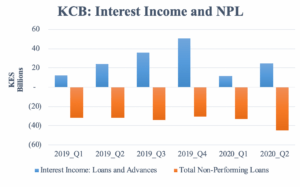

KCB followed by increasing its loans loss provisions by $170.82 million while NCBA also increased its loan loss provisions by $136.69 million. Co-operative Bank grew its provisions by $51.19 million, Standard Chartered Bank Kenya by $30.36 million, Diamond Trust Bank (DTB) by $55.09 million, I&M Bank by $16.88 million and Absa Bank Kenya by $44.22 million.

“The Covid-19 pandemic has seen the world confront its biggest health crisis in this century, posing one of the most disruptive periods to businesses. As a Bank, we recognize that our actions during this pandemic are essential in keeping our economies across the region going,” said Joshua Oigara, chief executive, KCB Group.

In Uganda, Uganda’s Stanbic Bank bad loan provisioning more than doubled to $25 million in 2020 from $11.8 million in 2019. This led the bank to experience a sharp dip in its profits to $66 million from $70.6 million in 2019.

Listed on the Uganda Securities Exchange (USE), DFCU Bank also increased its loan loss provisioning to $8 million from $3.8 million while its profits dipped to $6.5 million from $20 million.

The chief finance officer of DFCU Bank, Kate Kiza said that the increase in net loss provisions was attributed to the negative impact of the pandemic on their customer’s business operations.

Rwandan Banks restructured loans worth $218 million which accounted for 31.7 per cent of total loans in 2020 according to the National Bank of Rwanda.

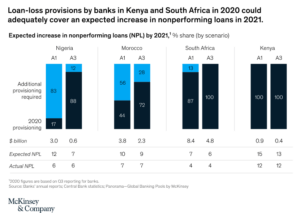

According to market analysts at the African Financials Group who wrote a report dubbed “Sub-Sahara Africa: December 2020 Bank Bad Debt Charge-Offs”, they noted that West African banks under-provisioned their loans by $157 million while South, Central African banks under-provisioned by $28milion.

The report which was released last week shows that in West Africa, Ghanaian banks lent about $614 million with loan loss provisioning increasing from $13 million to $37 an increase of 182 per cent in 2019 while Banks in Nigeria lent a total of $22.57 billion with bad debt charge increasing from $251 million to $433 million an increase by 73 per cent in the same period.

A five-year average loan loss provisioning in Ghana stood at $179 million.

Banks in South and Central Africa reduced their loan charge-off levels in both dollars and percentage terms.

For instance, banks in Zambia reduced loan loss provisions by 29 per cent to $1 million from $2 million on a total loan book of $354 million while Banks in Botswana reduced their loan loss provisions to $2million from $16 million a 85 per cent reduction on a total loan book of $941 million.

According to the report, Ghana and Kenya are the countries where banks look to have done precautionary provisioning as seen in the 2020 loan charge off compared to their five-year average charge off.