African countries cannot leapfrog their way into industrialization. Yes, there was a telecommunications jump largely bypassing landlines to mobile phones in the early 2000s, but internet penetration is still low at 36%. Other sectors of many African economies are stagnating. For instance, electricity is a foundational requirement for industry, manufacturing enterprises, for doing business, for running hospitals, schools, and for improving the quality of life at home. Yet over 600 million Africans still lack access to reliable and affordable electricity. This further depresses business productivity and generating their own power increases the operating expenses of companies. More broadly, the objectives of the landmark African Continental Free Trade Area to boost intra-African trade are severely hampered by the limited transportation options to facilitate the affordable and efficient movement of people, goods, and services from one country to another. The lack of adequate water and sanitation presents overwhelming and adverse health outcomes across the region. Limited availability of irrigation hampers agricultural productivity. And so on.

On the other hand, investors regularly struggle to find a deep and broad pipeline of bankable projects. While many options are presented, the majority are unfortunately poorly structured and are not deemed to be commercially viable. This leaves investors scrambling to participate in a small number of projects; which creates an imbalance in the market. The main bottleneck is really not the capital – it’s the lack of projects. Without a robust pipeline, African countries will struggle to see their industrialization aspirations realized. Underpinning this is the lack of a clear legal and regulatory enabling environment with many governments unable to identify or plan for projects. It is therefore imperative for African countries to individually and collectively assiduously work on creating a conducive policy environment to build this pipeline.

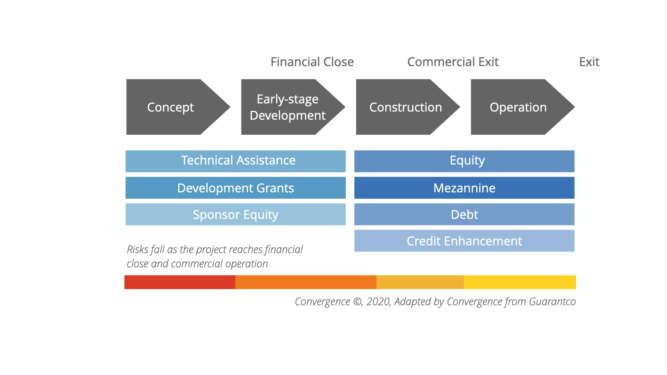

Project preparation is a critical first step in developing bankable projects that are able to raise capital for construction and operation. Project preparation grants are also one of the four most common blended finance archetypes identified by Convergence. It involves a series of studies to ascertain the commercial viability of the proposed undertaking, obtaining the necessary permits, authorizations, and licenses, as well as finalizing and securing key contracts. It typically starts with the national government identifying the legal, financial, regulatory, and environmental requirements for successfully implementing projects and creating the right enabling environment to facilitate this. The government would then develop the project concept and undertake pre-feasibility studies that outline the scope, objectives, risks, constraints, externalities, project options, commercial viability, social and environmental sustainability, as well as the critical success factors. It may then concession out the project for further development by a private entity that would subsequently finalize the Feasibility Study, Detailed Technical Studies and Engineering Designs, Business Plan, Financial Model, Market Study, Environmental and Social Impact Assessment, as well as obtaining the necessary licenses and permits and negotiating contracts to construct and operate the project.

At the end of this lengthy process, which can span two to four years and require millions of dollars, depending on the project complexity and jurisdiction, the expectation is a well-structured transaction (comprising a series of good documents) that is deemed bankable and that meets the risk-return appetite of investors. Due to the high dependence on government support, the risk of developing and implementing projects is high and requires additional layers of risk mitigation; which necessarily increases their complexity. Blended finance, which is the strategic use of concessional capital to de-risk transactions to improve their risk-return profiles to attract private investment, is a viable approach to overcome these risks.

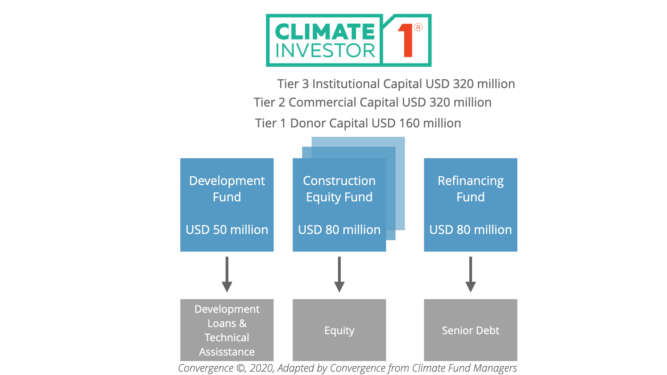

This challenge informed the design of Climate Investor One, a blended finance facility comprising three funds to provide wholesale, lifecycle financing for renewable energy projects. The USD 500 million Development Fund, another example, was capitalized by donors to provide concessional loans and technical assistance for project preparation. The Construction Fund is an equity vehicle with three tranches of capital: Tier 1 is capitalized by donors and provides first loss protection; Tier 2 is comprised of commercial capital from development finance institutions (DFIs) and banks; while Tier 3 is capitalized by institutional investors on fully commercial terms.

Below I discuss two critical factors for success that could help African countries build effective Project Preparation Facilities to develop a credible pipeline of projects that are well structured, reach final close, and that are operated efficiently.

- Create and fund self-sustaining Project Preparation Facilities (PPFs)

Most of the projects developed in the past couple of decades have relied on project preparation funding from a small number of facilities which have primarily provided straight grants. These Project Preparation Facilities (PPFs) have had mixed results with some of the projects reaching financial close and getting to their commercial operation date, while others have either faced delays or have stalled due to a myriad of issues. More of these PPFs are required with significantly higher volumes of capital. Typically, project preparation activities require 5 – 10% of the total project investment cost; so, introducing cost recovery mechanisms into these PPFs would increase the pool of funding available to develop more projects. This could include recoverable grants as well as the facility selling its own equity stake in the project (if it has) to an investor.

Other sources of project preparation funds could be equity from the developer (although the high risk for projects originating from the government are a disincentive and often restrict the number and/or quality of private developers bidding), private equity funds, commercial banks, and institutional investors, whose comfort levels would be assuaged in the later, less risky stages of the project development process when the bankability has been established and with confidence in the developer’s track record. These equity investments could be channeled through pooled funds, as was done in the case of Climate Investor One (to spread risk and to overcome the high transaction costs of appraising and investing in a single project) or directly to the developer. The trade-off is that these equity investors will expect a high risk-adjusted return for their participation. Limited public and philanthropic capital can also be utilized to provide first loss protection or guarantees to build investor confidence and early appetite.

Other examples include Africa50, a commercially run investment vehicle created by the African Development Bank (AfDB) to provide development capital and invest in infrastructure projects across the region. Its development company extends a success fee to projects that reach financial close as an incentive to the developers (and potentially to the early stage investors). This type of mechanism could prove valuable to engage more investors in financing project preparation, given the incentive structure that could limit project failure. Moreover, investors would be able to sell their stakes further in the project lifecycle. This approach has also been used effectively by the India Infrastructure Project Development Fund.

- Build capacity within specialized government units, agencies, and ministries

Donors and other concessional capital providers who might support the creation of PPFs must be convinced of the technical capacity and expertise of the teams running the facilities, given their own fiduciary responsibilities and their need to justify expenditures to taxpayers and to present objectively verifiable impact. It will therefore be incumbent upon the relevant government authorities to recruit skilled professionals with the relevant qualifications and experience to successfully run the facilities and to deliver bankable projects within realistic lead times. Without this track record of performance, funding will be restricted and the ability of countries to develop the pipeline will be impaired. It would therefore be effective to ensure that the Government has oversight of the PPFs but that they operate independently and with a commercial mandate. As a starting point, this function could be fulfilled by a competitively recruited private firm that will have no further interest in developing the projects due to the conflicts, or through existing entities (such as the Nigeria Sovereign Investment Authority – NSIA in Nigeria). These facilities may perform better if they are not embedded within Government agencies.

Ultimately, no country has been able to industrialize without building robust hard and social infrastructure; which are themselves underpinned by the “soft infrastructure” of a conducive enabling environment. There is simply no way to advance with a giant leap, skipping these critical steps, and concessional capital should therefore be leveraged strategically to help create well-structured projects that can succeed.

Time is running out for African countries to achieve the SDGs and to catch up with the rest of the world. Unless they vigorously invest in hard, soft, and social infrastructure development, their industrialization aspirations will remain unrealized.

By

Lade Araba, Managing Director, Africa at Convergence

Ladé is a seasoned development finance professional with over 17 years of experience. She previously served as Technical Adviser to the former Minister of Finance of Nigeria and was the Head of the Strategic Monitoring Unit. She was also an Adviser in the Power Sector Team at the Nigeria Infrastructure Advisory Facility (NIAF), a Technical Assistance Program funded by the UK Department for International Development (DFID). Prior to NIAF, Ladé was Technical Adviser to the Executive Secretary of the United Nations Economic Commission for Africa (UNECA) where she advised on the building blocks for financing regional infrastructure projects and promoting intra-African trade. She was formerly a Senior Investment Officer at the African Development Bank, where she played key roles in deal origination and appraisal, and received Board approval for senior loans to several infrastructure projects across Africa. Ladé was previously an Enterprise Development Specialist at the UN Food and Agriculture Organization (FAO) and also worked for the QED Group LLC in Washington, DC.

Also Read:Ten African heads of state and government