- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Author: James Ndwaru

I am a writer based in Kenya with over 10 years of experience in business, economics, technology, law, and environmental studies.

- The protests, dubbed “occupy parliament,” were coordinated and mobilised on social media in contrast to those led and sponsored by politicians.

- Many were demonstrating for the first time and waved signs such as “Do Not Force the Taxes on Us,” while others chanted: “Ruto must go.”

- Unlike previous political anti-government protests, these demonstrations are not characterised by looting, destruction of property, or stone-throwing.

Social media as a weapon

A bold new generation of young Kenyan protesters has emerged on the streets, forcing the government to back down on several unpopular tax proposals.

What started as anger on TikTok about a controversial finance bill has morphed into a revolt without being organised by political parties.

The government of President William Ruto has managed to do what generations of politicians in the East African nation still need to do unite huge numbers of Kenyans beyond ethnicity and party.

On 18th June 2024, …

- SME loan products offer a considerably low interest rate, which helps fund businesses.

- Pezesha is a financing platform for small and medium-scale enterprises (SMEs) that enables them to access affordable credit and other financial services through embedded finance infrastructure.

- Safaricom has partnered with Pezesha, a digital lender, to credit small business owners, adding to the telco’s existing loan products.

Pezesha loan products

Pezesha is a financing platform for small and medium-scale enterprises (SMEs) that enables them to access affordable credit and other financial services through embedded finance infrastructure.

Pezesha has created an integrated digital financial infrastructure whose mission is to lead platforms and marketplaces where small and medium-sized businesses work through a collaborative approach. Financial institutions or networks connect on this platform and are matched with quality SMEs, driving meaningful financial inclusion and reducing any inequalities in access to formal financial services.

In 2023, Pezesha partnered with FSD Kenya to …

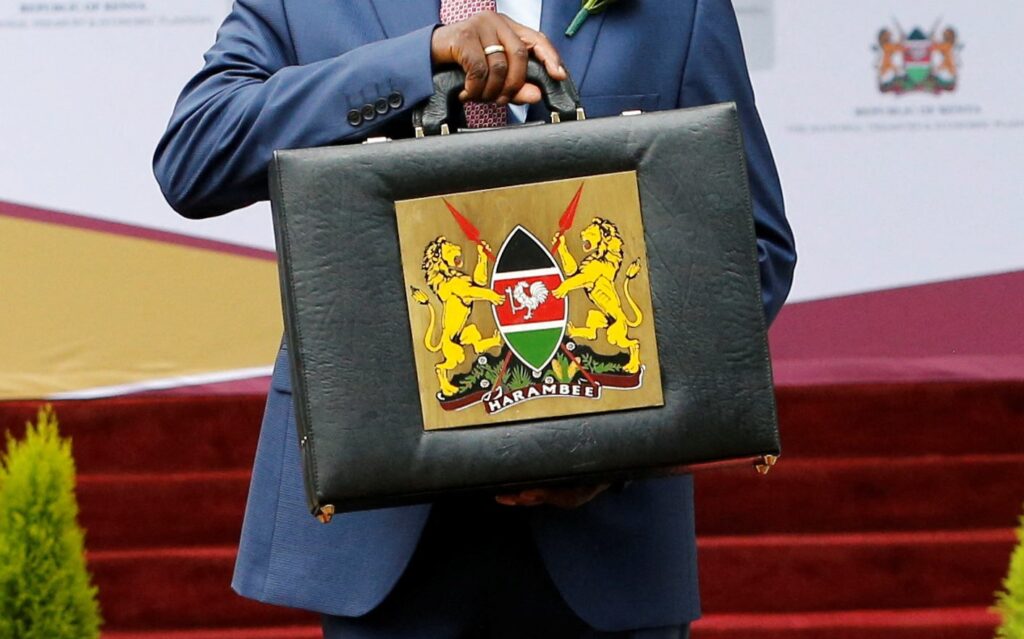

- The finance bill aroused many wounds in many Kenyans, leading to protests in the capital city, Nairobi, over the burden of proposed taxes in the finance bill 2024

- Azimio insists that the tax measures will substantially impact both individuals and businesses in the country.

- The National Assembly Committee on Finance, chaired by Molo Mp Kimani Kuria, is expected to table a report on the Bill after carrying out a public participation exercise.

The protests over the Finance Bill

The finance bill aroused many wounds in many Kenyans, leading to protests in the capital city, Nairobi, over the burden of proposed taxes in the finance bill 2024. The protest, dubbed ” Occupy Parliament” demonstrations, aimed to pressure the lawmakers not to pass the bill.

The Finance Bill 2024 has been opposed over some contentious proposals, including a 16 per cent VAT tax on bread, a 2.5 per cent motor vehicle circulation …

- The World Bank has approved a $2.25 billion loan for Nigeria to shore up revenue and support economic reforms.

- $1.5 billion of the loan will help protect millions who have faced growing poverty since a year ago.

- $750 million, the bank said, will support tax reforms and revenue and safeguard oil revenues threatened with limited production caused by chronic theft.

Nigerian President Tinubu’s economic reforms, including ending decades-long but costly fuel subsidies and unifying the multiple exchange rates have resulted in surging inflation that is at a 28-year high.

Under growing pressure from citizens and workers protesting the hardship, Tinubu’s government said that it was seeking the loan to support its long-term economic plans.

The government said it was also taking steps to boost foreign investment inflows which fell by 26.7 per cent from US$5.3 billion in 2022 to US$3.9 billion in 2023, according to the Nigerian Economic Summit Group …

- Tax reforms proposed in the bill have aroused concerns due to their potential to increase costs and financial burdens across the board.

- A positive proposal in the Bill for the housing sector is the removal of the excise duty rate on cement clinkers.

- Some of the Finance Bill proposals highlighted reflect the government’s attempts to promote affordability, stimulate construction, and streamline property transactions in the housing sector.

The Finance Bill 2024 has become the focal point of discussions across Kenya, capturing the attention of individuals and businesses alike. This widespread interest stems from the significant and far-reaching impact the proposed bill could have on various sectors and the daily lives of Kenyans.

The comprehensive tax reforms proposed in the bill have aroused concerns due to their potential to increase costs and financial burdens across the board. With the prospect of higher taxes on fuel, motor vehicles, and digital services, many …

- Africa homes about 30 per cent of the world’s mineral reserves, including 40 per cent of the world’s gold, 60 per cent of its cobalt, and 80 per cent of the platinum group metals.

- Mineral resources are a critical source of revenue for Africa.

- The interest in renewable energies in the mining industry arises from the escalating energy demand within the sector.

Mining in Africa faces ongoing challenges due to environmental degradation and social conflicts with local communities. Deforestation, land degradation, and air pollution are persistent issues linked to mining activities. However, effective prevention and mitigation measures can alleviate these impacts.

Africa’s mineral wealth is staggering. The continent homes about 30 per cent of the world’s mineral reserves, including 40 per cent of the world’s gold, 60 per cent of its cobalt, and 80 per cent of the platinum group metals. The Democratic Republic of Congo (DRC), for instance, with …

- Smart cities are emerging as a critical solution to address the rapid urbanisation and infrastructure challenges facing African cities.

- Smart cities in Africa focus on infrastructure development to enhance connectivity, mobility, and accessibility.

- The limitations in human resources, organisational capacity, and rigid bureaucracy are significant obstacles to adapting to the demands of digital transformation and smart cities in Africa.

Smart cities in Africa

Smart cities are emerging as a critical solution to address the rapid urbanisation and infrastructure challenges facing African cities.

Smart cities agenda in Africa strive to ensure inclusive and equitable development by addressing social inequalities and providing all residents equal access to opportunities and services. This includes affordable housing programs, social safety nets, and community development initiatives to improve living standards and reduce poverty in urban areas.

Smart city projects also prioritise accessibility and universal design principles to ensure that infrastructure and services are accessible to people …

Intra-regional trade in Africa serves as the backbone of economic transformation. East African Community (EAC) member states are increasingly trading with one another and with other African countries. At the same time, they reduced their trade with other continents like Europe, Asia, and other parts of the world, shaping the intra-regional trade in Africa’s dream projected to boost commerce and livelihoods on the continent.

The seven countries in the region (as of 2023) increased their trade with the rest of Africa by $584.6 million to $4.3 billion in the fourth quarter of 2023, a 14 per cent rise compared with a similar period in 2022, according to the latest data by the EAC Secretariat.

Cross-border trade within the region also recorded a 12 per cent rise, from the previous year’s $2.6 billion to $2.9 billion in last year’s Quarter 4, indicating rising trade within the region over the year.

During …

- Artificial Intelligence (AI) integration into various industries has sparked a wave of both anticipation and concern among employees.

- As AI and automation become prevalent, new job categories and roles emerge.

- Cultivating interpersonal skills and collaborating effectively with technology to drive innovation and achieve successful outcomes in the future workplace is key.

Artificial Intelligence and automation in the business landscape

Artificial Intelligence (AI) integration into various industries has sparked a wave of both anticipation and concern among employees. As Artificial Intelligence evolves, employees express growing apprehensions about its impact on job security and overall well-being.

AI and automation are revolutionising the workforce, paving the way for a new era in employment. The adoption of artificial intelligence in automated technologies is poised to transform the job market. Organisations are turning to AI to improve operations and efficiency and stay competitive and relevant in a rapidly evolving landscape.

With the rise of AI …

- This climate finance deficit presents a pressing challenge to Africa, as it directly affects the continent’s capacity to address critical climate-related issues.

- African governments must adopt innovative financing opportunities that blend public and private partnerships.

- Leaders from Africa, the Republic of Korea, and the Global Green Growth Institute (GGGI) have jointly called for more collaboration and cooperation to bridge the climate finance gap

Climate finance

The climate finance gap has been a persistent topic of climate change discussions for the longest time. Despite a financing need exceeding $3 trillion by 2030, the continent receives merely about a 10th of its climate finance need, representing less than 5.5 per cent of the total global climate finance. This gap is felt especially keenly in countries like Uganda, which, despite being one of the many African countries committed to Nationally Determined Contributions (NDCs), experiences a distinct lack of climate funding.

According to the …