- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Author: Jack Oduor

Experienced Editor with a demonstrated history of working in the media and video production industry. Skilled in Breaking News, Media Relations, Radio, Corporate Communications, and Social Media. Strong media and communication professional with a Diploma In Mass Communication focused in Broadcast Journalism from K.I.M.C.

In Kenya, the level of bank clients running two bank accounts stood at 53% in 2023 compared to 48.2% in the 2022 survey. Industry survey ranks Cooperative Bank as the best overall lender in customer experience in the country followed by regional giant NCBA. The results show that the respondents had an overwhelmingly positive view of their banks. The competition within Kenya’s banking sector is driving an increasing number of customers to diversify their relationships, opting to hold accounts with multiple institutions, a practice commonly referred to as multi-banking, in order to tap into a range of benefits. In a…

With the funding for growth, Lapaire intends to open 300 eye care centres. Eye care in developing countries like Kenya and many other African states remains underfunded. While it initially began with a B2B sales approach, it has since abandoned that model, favouring direct contact with the customers. Kenya-based Eyewear Startup Lapaire has secured $3 million (KSh476 million) in private equity funding for growth initiatives across African markets. Following the deal’s closure, Lapaire intends to open 300 eye care centres, targeting 80 new outlets by December 2024. Impact investment fund Investisseurs & Partenaires (I&P) led the equity round with AAIC, FINCA…

Expensive loans remain a significant issue across populations engaged in agriculture in Nigeria, Tanzania and Zambia. A report by the Alliance for Green Revolution in Africa (AGRA) says capital injection is a significant strategy agribusinesses use to survive. Moreover, agribusinesses face high operational costs from fuel prices and low-profit margins driven by currency devaluations. The lack of agriculture-friendly financial systems saw agribusinesses turn down expensive loan options in the market, with only 15 per cent taking on commercial capital in 2023 and the rest sourcing capital from friends, family and their business savings. The incentives by the government channelled towards…

Mastercard and the Uganda Ministry of ICT and National Guidance have signed an MoU that will support digital innovation The agreement will accelerate the adoption of digital solutions in the country aimed at enhancing government services. The deal is aligned with Uganda’s push for digital Innovation Mastercard and the Uganda Ministry of ICT and National Guidance have signed a Memorandum of Understanding (MoU) to accelerate digital innovation and transformation across the country. This collaboration marks a significant milestone in the implementation of the ‘Digital Uganda Vision’, aimed at driving socio-economic development, enhancing services, and driving financial inclusion. The signing of the…

Less than half of media industry CEOs are optimistic that 2024 will be a good year 12 per cent of the media industry CEOs expressed low confidence Slowing in subscription growth – as well as increasing legal and physical harassment also tops media industry CEO’s worries Less than half of media industry CEOs are optimistic that 2024 will be a good year for the industry reeling from the changing business models. An estimated 47 per cent of editors, CEOs, and digital executives say they are confident about the prospects for journalism in the year ahead, with around four in ten…

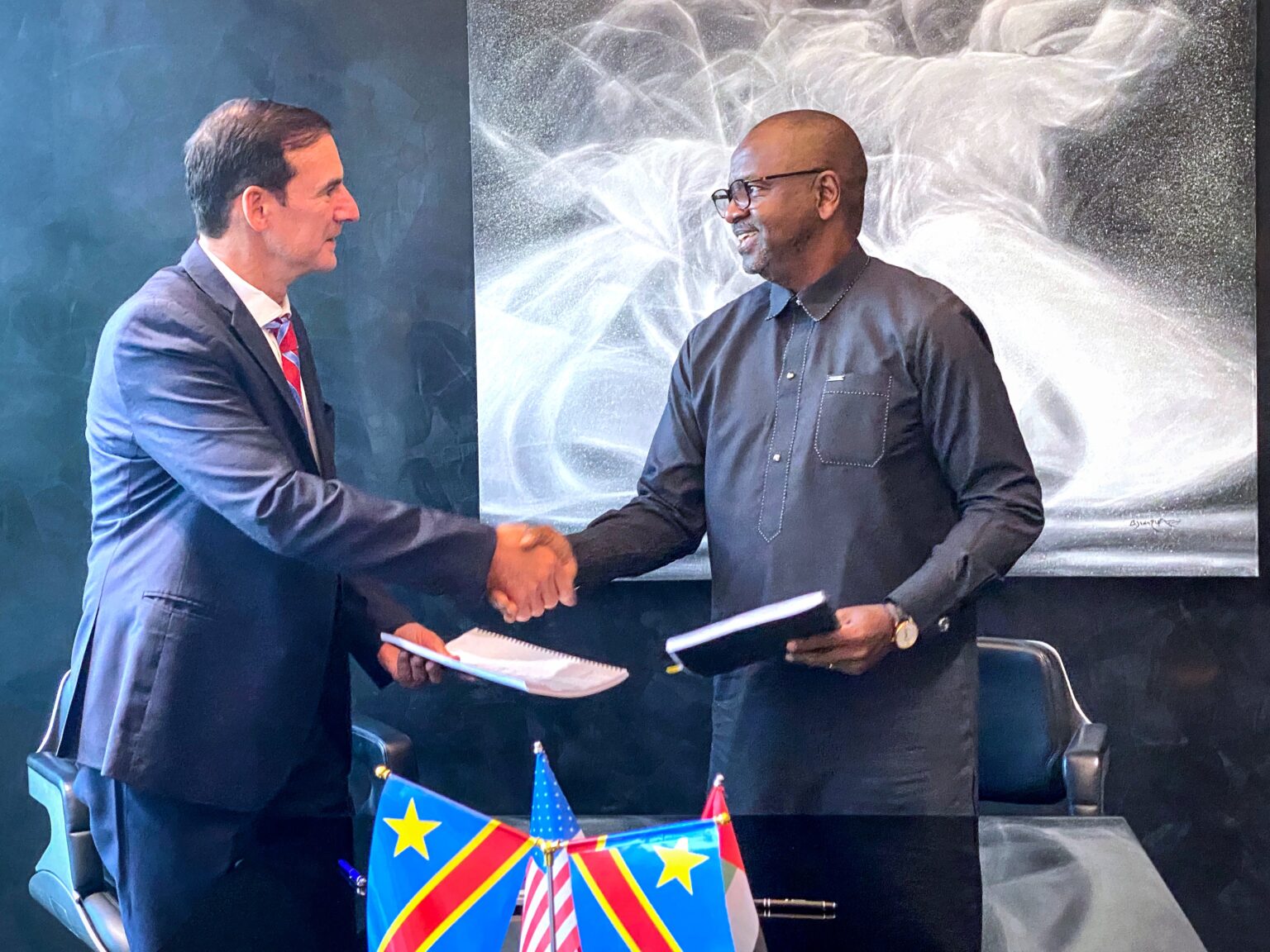

The joint development of the Green Giant Project will expedite the construction of the first 200MW phase of the investment. Mini-grids account for more than half of all new connections in DRC. The agreement represents a significant milestone in the collaborative efforts between SkyPower, AFC, and the DRC. The Democratic Republic of Congo (DRC), Africa Finance Corporation (AFC) and SkyPower Global have entered into a joint development agreement for the first phase of SkyPower’s Green Giant project in the mineral-rich country. The move is meant to promote the use of renewable energy in the Eastern African state. This 200MW Phase…

Anti-Money Laundering watchdog removed Uganda from its grey list Treasury said Kenya underwent an assessment conducted by the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) in 2022. CS Ndung’u said the move underscores the need for swift action to bolster Kenya’s compliance efforts. Finance Action Task Force (FATF), the global anti-money laundering watchdog, has placed Kenya on a list of 23 countries that are ‘not doing enough’ to fight money laundering. FATF placed Kenya on its ‘grey list’ while Uganda has been removed from the list. The decision to put Kenya on the grey list might diminish Nairobi’s position…

Shell also ventured into offshore gas mining in Nigeria last month In conjunction with gas monetization efforts, Nigeria is leading major pipeline projects for the offshore gas mining project Nigeria has estimated 203 trillion cubic feet of natural gas Nigeria is ready to solidify its position in the global oil market by leveraging its vast natural gas reserves through an offshore gas mining facility. With an estimated 203 trillion cubic feet of natural gas, the country strategically positions itself as a leading exporter of Liquefied Natural Gdurex intense vibrations ring air max 270 women inflatable kayak durex intense vibrations ring black…

Ransomware Attacks and backdoors are the leading threats Kenyans contend with According to the CAK, Kenya experienced 860 million cyberattacks in 2022–2023. Check Point Research has also identified ransomware Attacks among the first rising in Africa. Kenya was the second most attacked country by cybercriminals in the Middle East, Turkey, and Africa region (META), according to new data released by cybersecurity solutions provider Kaspersky. Only Turkey recorded the highest number of attacks among the 12 countries in the META region. The region comprises Bahrain, Egypt, Kenya, Kuwait, Nigeria, Qatar, South Africa, Saudi Arabia, Turkey, UAE, Oman, and Pakistan.keyvone lee jersey yeezy boost…

Intra-African Payment Systems is expected to simplify trade among member states on the platform. In West Africa Nigeria, Ghana, Guinea, Gambia, Liberia, and Sierra Leone have joined the Intra-African Payment Systems. 3 Countries in East Africa, Kenya, Rwanda, and Djibouti are among the early members of Intra-African Payment Systems. The push for a single trading platform for African countries is gathering pace after tnike air max 90 futura jordan max aura 4 custom maple leafs jersey dallas cowboys slippers mens blundstone uomo yeezy boost 350 v2 hyperspace custom stitched nfl jersey jordan proto max 720 custom kings jersey dallas cowboys…