- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Author: june njoroge

The carbon credits market is gaining momentum as one of the lifeline sectors in a depressed global economy. African nations have been exploring this novel market as one way to offset their bulging debts and raise loans by selling carbon credits, thereby unlocking billions for climate finance and economic development in the continent. Climate change has had disastrous consequences especially for African countries but seemingly, nature now has the potential of providing developing nations with an economic boost. Most African economies have been hanging on by a thread, in the wake of the myriad existential challenges that have bombarded the…

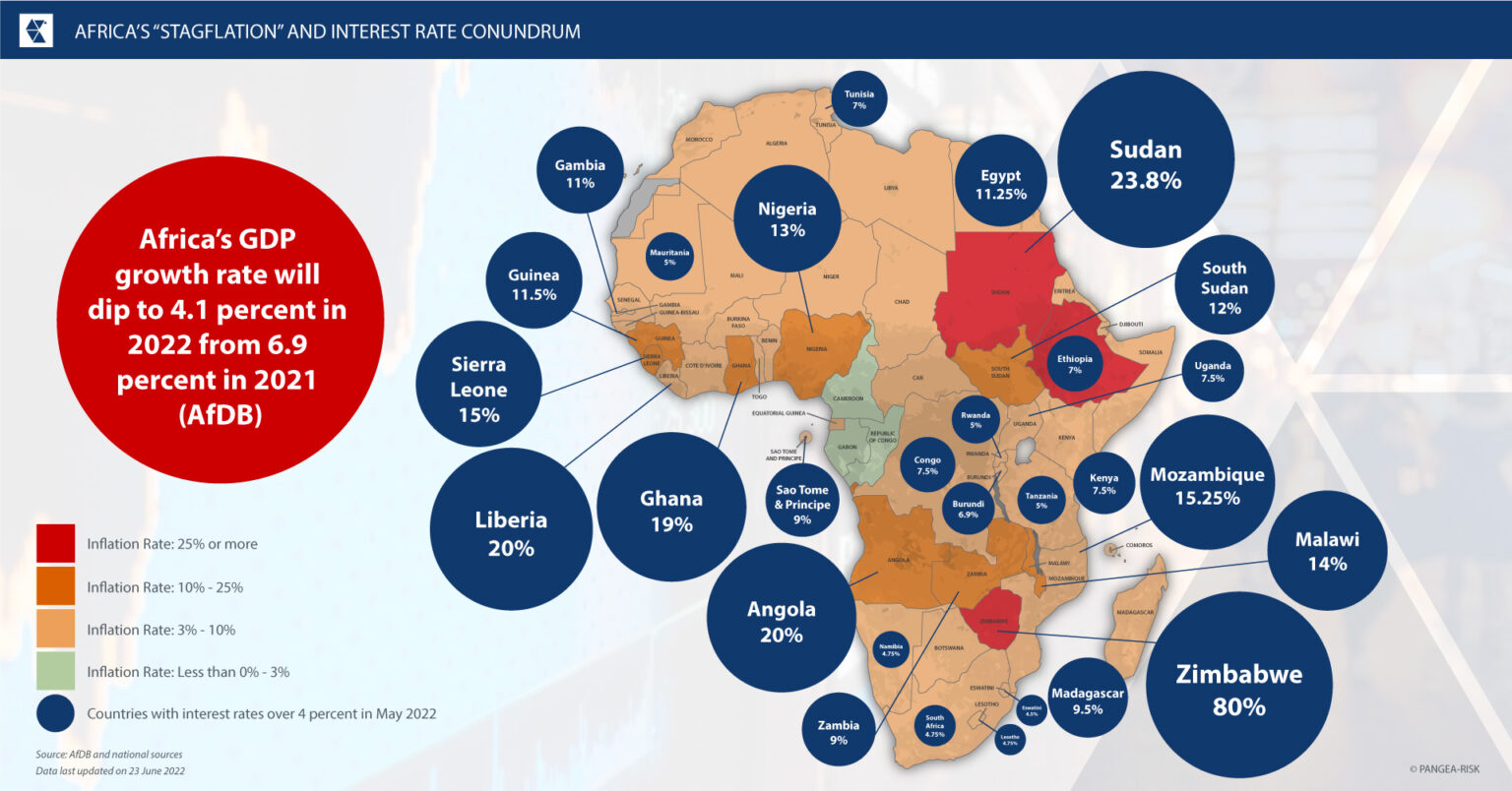

Africa has stumbled headlong into what has been called the ‘perfect storm’’. From the heavy burden of debt servicing, the instability created by election cycles, geopolitics and war as well as the lingering threat of food insecurity caused by conflict and adverse weather conditions. Seemingly, the proverbial pandora’s box of horrors has been let ajar and the evils through different manifestations are ravaging the continent from all corners. However, as the Greek myth holds, only one thing is said to have been left in the box after it was shut; hope. Amid all the daunting troubles Africa is facing, hope…

Africa’s blue economy is set to flourish and gain a whole new prominence in 2023, with increased investments lining up to exploit this lucrative but undervalued sector. One of the major announcements that has signalled an increased interest in the blue economy came out of the twenty-seventh session of the Conference of the Parties (COP 27) in Sharm el-Sheikh, Egypt in November 2022. The World Bank announced a Mangrove Blue Carbon Pilot Program, an initiative meant to catalyze financing and provide operational response to developmental challenges in coastal-marine areas of the African continent. Dubbed the Blue Economy for Resilient Africa…

The world is on the cusp of a new geopolitical order, embracing multipolarity and swiftly effacing the long-standing unipolar world that has for decades on end, placed the U.S on a pedestal as the sole dominant superpower. In the recent past this hegemonic position has been challenged by emerging global powers, led by China, Russia, Germany, U.K, South Korea, France, Japan, UAE, and several others. These countries have grown in power, asserting an independent and to some degree collective influential role, in global economic affairs and security development, thereby ushering in a new multipolar world order. The fall of the…

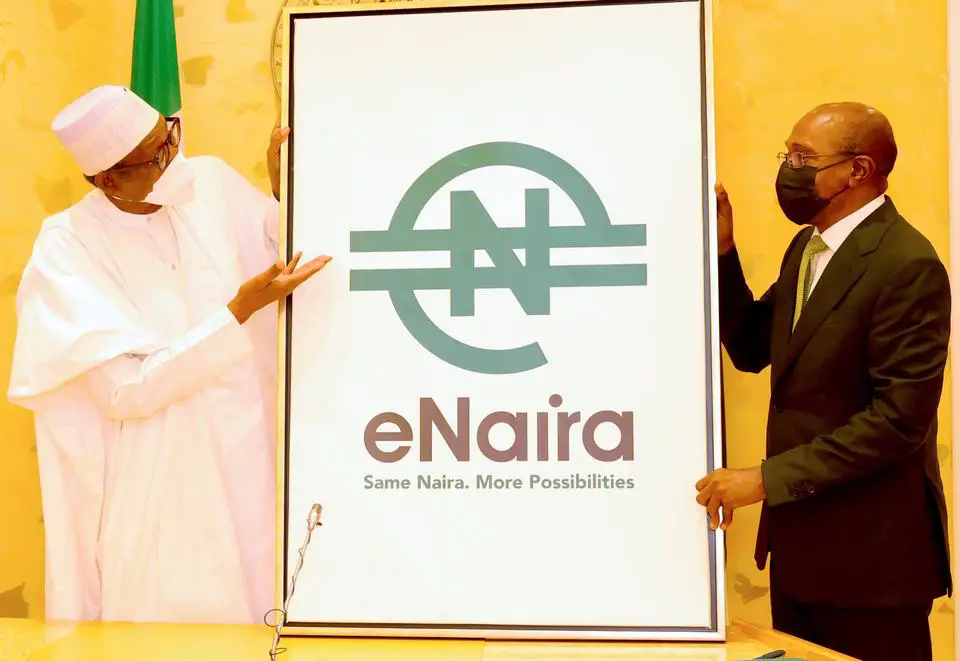

In full throttle the world is diving deeper into the Fourth Industrial Revolution (4IR). Resultantly, among the new wave of technologies marking this new era is the adoption of digital currencies such as a CBDC. This relatively nascent era of economic disruption has birthed a need for digital currencies and we might very well be in the twilight years of using the traditional fiat currency. In his book, “The Future of Money: How the Digital Revolution is Transforming Currencies and Finance” economist Eswar Prasad, predicts that the era of cash is drawing to an end and that of central bank…

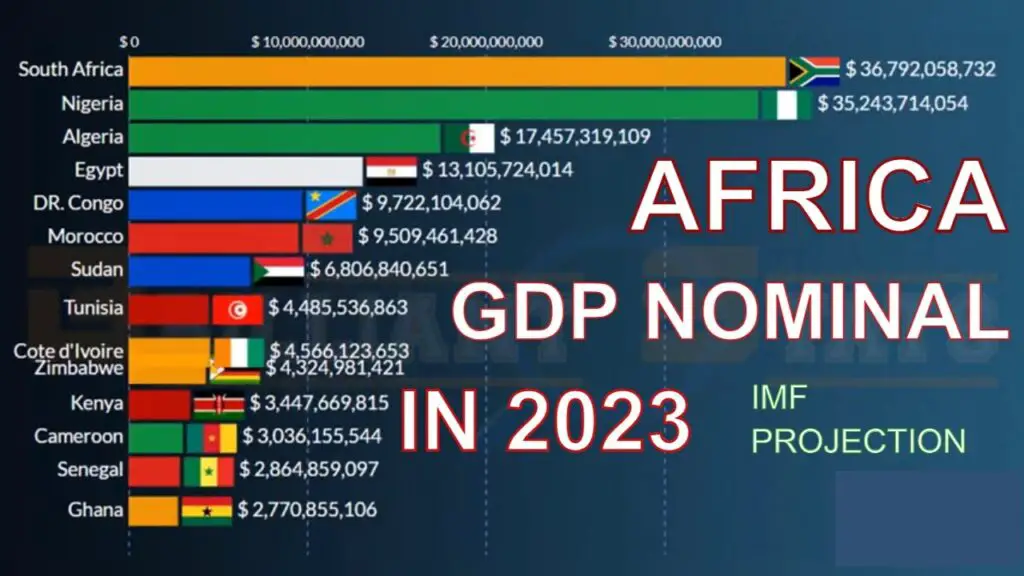

Most African economies have been staring into an economic abyss, besieged by a plethora of daunting challenges that have left many teetering on the edge of a precipice. A glance into Africa’s economic crystal ball for 2023 depicts a mixed bag of fortunes, with some economies set to flourish like a green bay tree, some will find themselves staring down the barrel of a recession whilst others will remain in the doldrums. According to the International Monetary Fund (IMF), economic growth in Sub-Saharan Africa is expected to reach 3.7 percent in 2023. Slowing global growth, higher external borrowing costs and…

African countries have been at a crossroads of whether to continue adopting the green energy transition in full throttle, or tap into the myriad economic opportunities, presented by the Russian-Ukraine war. African gas has gained prominence in the global energy market pertinently from Europe, as it seeks to wean itself off Russian gas, through its ‘REPowerEU Plan’. The Plan is targeted at saving energy, producing clean energy and diversifying energy supplies. Hence, oil and gas producing countries in Africa, have been rushing to cash in on this ‘dash for gas.’ Oil and natural gas-producing countries in Africa like Mozambique, Nigeria,…

Africa continues to grapple with what has been described by the UN, as the ’perfect storm of horrors’, due to the plethora of troubles that has hit the continent. From the climate change crisis, drought and famine, conflict, Covid-19 pandemic and the Russia-Ukraine war. The war has especially wreaked havoc on the continent’s food security, due to disruptions in global supply chains pertinently in food, fuel and fertilizers. Food insecurity in the continent was already at an all-time high before the war, principally in the Horn of Africa due to the locust invasion which was climate-induced. The situation was worsened…

The new administration under President William Ruto, is striving to set the economy in the right tempo having inherited a heavily indebted government.

Through debt restructuring among other key economic reforms, Ruto’s administration is committed to quell inflation and create a thriving economy for all Kenyans.

The recently published East Africa Economic Outlook report, indicates that Kenya is among the countries in the region that could face rising risks of debt distress, thus widening fiscal and current account deficits, largely due to structural weaknesses exacerbated by the pandemic and the Russia-Ukraine war.

According to the 2022 African Economic Outlook (AEO), by AfDB inflation is projected to edge up to 7 per cent, close to the upper end of the target band at 7.5 per cent, caused by greater energy and food inflation. The Kenya National Bureau of Statistics (KNBS), reported that the country’s inflation rate as of October 2022 stood at 9.6%, creeping up 0.4% from September’s all time high of 9.2%.

Libya’s economy has been teetering on the edge of a precipice since the ousting and killing of Colonel Muammar Gaddafi in 2011, as part of the protests that marked the Arab Spring. Once a progressive economy now a war-torn country, a playground for foreign powers rushing to satisfy their own interests, has left ordinary Libyan citizens to bear the brunt of a cycle of conflicts and civil wars, stagnating economic growth for a decade. The conflict birthed an unmatched refugee crisis, with thousands crossing the Mediterranean to seek greener pastures in Europe. Today’s Libya remains in electoral limbo as the political stalemate persists. Prospects for elections fade daily.

The situation in the country remains extremely volatile, rife with political uncertainty as to when a national government will be formed, and the formulation of a constitution thereof. Both presidential and parliamentary elections, slated to be held this year have been postponed several times with no exact date set.

The country awash with violent non-state actors where different militia groups vie for political power are being backed by foreign entities in a bid to control the country’s oil and gas sector. As the first anniversary of the postponed elections draws nigh, there is no clear end in sight. The UN Special Representative Abdoulaye Bathily, warned against prolonging the interim period as Libya could become even more vulnerable to political, economic and security instability, as well as risk of partition.