Discovery has partnered with EasyEquities to offer local and international share trading through the Discovery Bank app.

In a statement, the digital bank says users can now open a new EasyEquities account, or link an existing one through the Discovery Bank app, making investing in their favourite local and global brands and other asset classes simple and accessible.

“The platform is transparent, easy-to-use and makes equity trading cost-effective and intuitive for all kinds of investors, from first-timers all the way through to seasoned traders. In collaboration with EasyEquities we’ve been able to make the journey to investing in equities simple and frictionless. This is all part of our focus on promoting a positive long-term savings and investment culture across our client base,” said Discovery Bank CEO Hylton Kallner.

- Discovery Bank has partnered with investment platform EasyEquities to offer clients share trading via the digital bank’s mobile app.

- Discovery Bank clients can now buy, hold and sell shares on local and international stock exchanges and access a wide range of ETFs, ETNs, as well as cryptocurrency.

Discovery Bank clients can now buy, hold and sell shares on local and international stock exchanges and access a wide range of ETFs, ETNs, as well as cryptocurrency.

Read: List of Exchange Traded Funds on the Zimbabwe Stock Exchange

“We are incredibly proud to partner with an innovative business such as Discovery Bank. To see our brand alongside Discovery Bank and to work with their incredible team is a real honour and a privilege. We look forward to delivering an exceptional “Easy” experience to their clients” said Charles Savage, CEO of Purple Group.

The partners said Discovery Bank’s shared value banking model is designed to help clients manage their money well, and EasyEquities shares the bank’s deep conviction that saving and investing is key to helping South Africans build wealth, empower themselves and their communities, and ultimately strengthen our economy.

Discovery Bank said its trading platform offers unique features, including:

- Clients can open an EasyEquities account in just a few steps without submitting any documents. Client data is already pre-populated, so it takes only a few minutes from start to finish.

- Clients can transfer funds from any of their Discovery Bank transaction, credit card, or demand savings accounts to their EasyEquities ZAR account in real-time. The same applies to withdrawals.

- Clients can view their EasyEquities portfolio with all their other Discovery products in the banking app. They can also seamlessly buy and sell local and international shares in just a few taps.

- Clients pay no transfer fees between their Discovery Bank account and their EasyEquities ZAR account, no minimum investment amounts, and no monthly trading account fees.

“The introduction of share trading with EasyEquities is consistent with our focus on helping our clients manage their money well over the long-term – and they get rewarded immediately through the Vitality Money programme for doing so,” said Kallner.

Vitality Money, an AI-powered programme on the Discovery Bank app, gives users an understanding of behaviours that influence their financial well-being and how to manage their money.

The better clients do, the higher their Vitality Money status and the greater the value they receive, they explain.

The EasyEquities investment portfolios integrate directly into Discovery Bank’s Vitality Money programme, automatically counting towards the client’s Vitality Money status.

On September 30, 2022, Discovery Bank announced several new products and changes at its annual product update event with financial advisors. However, the CEO Hylton Kallner said that the new features will be made available from October and through the first quarter of 2022 on a phased basis.

According to Business Tech, Discovery Bank clients can use the Discovery Bank app to transact and trade in real-time in these currencies. With the Multicurrency FX Account, clients can also receive international payments and choose to pay in more than 60 currencies, Kallner said.

“South Africans invest 75 per cent of their assets in the country, yet these investments make up just 0.3 per cent of total investments in the world. Diversification in investment portfolios is an important lever to lower investment risk.

“However, to save and transact in foreign currencies is often considered a luxury that is only available to a few. We are changing this and making it affordable and easy for all our clients to save and transact in the currency of their choice with a Multicurrency FX Account.”

Kallner said that the account would have very low fees, does not require a minimum balance, and transaction fees can be allocated to a beneficiary or shared.

Discovery Bank also launched Discovery Pay, a platform that promises secure payments between Discovery contacts with just a cellphone number.

“Clients will be able to make health payments through the Discovery Bank app to all hospitals, pharmacies, laboratories and approximately 6,500 General Practitioners by linking their Discovery Bank card to their Discovery Health Medical Scheme membership,” said Kallner.

Another exciting product is a travel platform. The new Discovery Bank travel platform will allow bookings on a wider range of local and international flights, accommodation and holiday packages based on Vitality Health, Drive and Money integration.

It will also offer Discovery Bank clients an extended local airline range, providing discounted flights to over 40 destinations across Southern Africa.

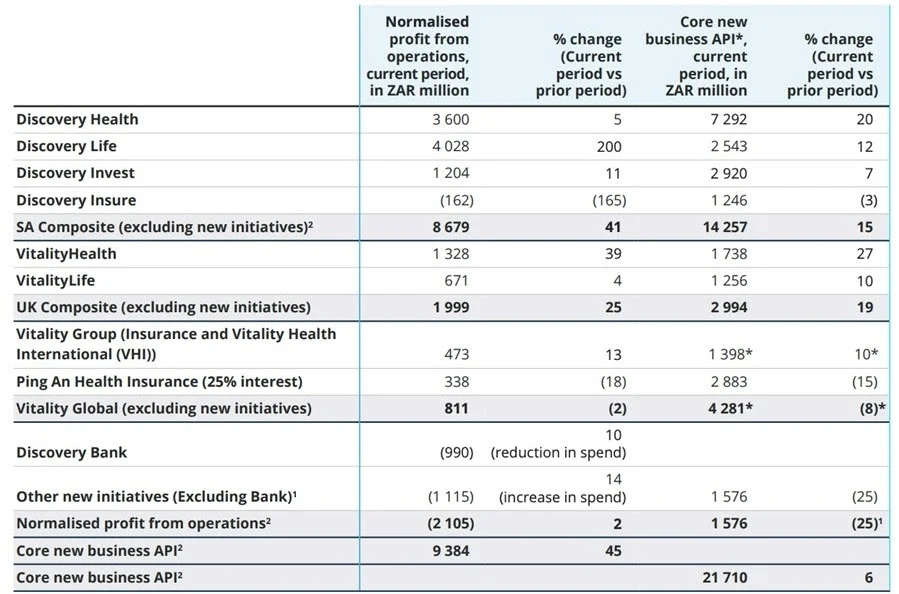

Meanwhile, Discovery Bank reported its operating loss for the financial year ended June 30, was R990 million, 10 per cent lower than the previous financial year.

The digital-only bank continues to expand its current client base, with 470 220 clients (331 000 in the prior period) and 1 023 790 accounts (versus 649 000 in June 2021), which represents a significant milestone for the bank.

“Our first million accounts provide us with a strong foundation to continue to disrupt the market,” commented Kallner.

According to the bank, retail deposits grew by 30 per cent to R10.6 billion and advances grew 14 per cent to R4.3 billion.

It added that new business volumes continued to be strong, achieving more than 800 average daily new-to-bank sales (versus 500 in June 2021), showing significant progress toward a medium-term target of 1 000 sales per day and 1 000 000 clients by 2026.

“The bank has also continued to attract high-quality clients, resulting in high levels of average non-interest revenue and a low credit loss ratio of 1.56 per cent.”

Discovery Bank was first announced in November 2018 billed as the “world’s first behavioural bank.” It went into beta-testing phase in March 2019, when it touted its new offering as revolutionising banking clients’ behaviour.