KCB Group shareholders have approved the proposal to acquire 100 per cent of the issued ordinary shares of National Bank of Kenya Limited (NBK) via share swap.

This approval follows the offer made by KCB Group on April 18, 2019 to acquire the shares of struggling NBK by way of a share swap of 10 ordinary shares of NBK for every one ordinary share of KCB. The transaction is subject to regulatory and NBK shareholders approvals.

The acquisition is part of KCB’s ongoing strategy to explore opportunities for new growth while investing in and maximizing the returns from its existing businesses, the management has said.

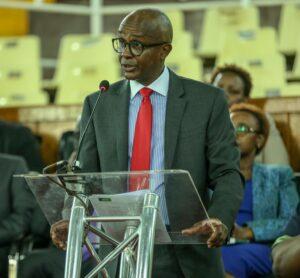

“For us, the acquisition is an opportunity to strengthen the deposit base and lending capacity, increase cost efficiencies due to economies of scale and boost transactional revenue through leveraging of technology. NBK maintains a strong deposit franchise and a wide branch network,” said KCB

Group Chairman Andrew Wambari Kairu, adding that: “This is an attractive commercially viable proposition that provides the scale needed to compete and win in the rapidly evolving world of financial service.”

During the 2018 Annual General Meeting (AGM) held in Nairobi on Thursday, the shareholders further approved the final dividend of Ksh2.50 per share as recommended by the board. This brings to Ksh3.50 the total dividend per share and Ksh10.7 billion (US$105.6 million) as total dividend for the year.

The dividend will be paid on or before July 30, 2019 to shareholders on the register as of close of business on April 29, 2019.

“We delivered on our promises for 2018 on the back of a definite lending strategy and an aggressive digital banking proposition,” said Kairu, “This success was not without headwinds such as the aftermath of the 2017 electioneering period in Kenya and changes to the regulatory landscape, both somewhat redefining the business growth trajectory.”

The Kenya business played an anchor role, contributing 93 per cent of the Group’s profit after tax of Ksh22.4 billion in the year 2018, a growth of 17 per cent.

READ:KCB net profit grows 22% to Ksh24 billion

The international businesses collectively grew by 64 per cent per cent and together with KCB Capital and KCB Insurance Agency are targeted to contribute at least 20 per cent of the Group’s profit by 2020.

“The overall Group performance culminated in the elevation in market share on loans and advances to 14.6 per cent and customer deposits to 18.0 per cent. The loan growth was boosted by advances of over Ksh54.4 billion (US$536.8 million) through our mobile products,” Group CEO and Managing Director Joshua Oigara noted.

Concurrently, the transaction concentration mover further onto the non-branch channels, comprising 91 per cent of the total transactions during the year,” he added, “Our focus is to proactively support our customers’ growth, enabling businesses to thrive and economies across the East African region to prosper, and ultimately, the realization of financial ambitions.”

KCB’s Q1 2019 net profit jumped to Ksh5.8 billion (US$57.2million), an 11 per cent growth from Ksh5.2 billion (US$51.3 million) it recorded during same period in 2018.

NBK on the other hand has been struggling with its operations amid a series of loses. In 2016, it reported a net loss of Ksh1.15 billion (US$11.3million) for the period to December 2015, from a net profit of Ksh2.25 billion (US$22.2 million) in the nine months to September 2015.

The lender has posted a Ksh106.3 million (US$1.05 million) profit for Q1 2019 a recovery from Ksh278.5 million (US$2.7million) loss reported in a similar period last year.

The bank has been hit by a series of scandals in recent times including ‘cooking of books’, which has left the majority state-owned lender on the verge of collapse.

The government and the National Social Security Fund (NSSF) have a combined 70.55 per cent stake in NBK, 48.05 and 22.50 per cent respectively.

In April last year, the Capital Markets Authority (CMA) punished eight former senior NBK managers for falsifying books and stealing more than Ksh1 billion (US$ 9.9 million).

It is not clear whether NBK will continue trading with its name but going by KCB Group chief executive Joshua Oigara’s statement, the lender could still retain its brand.

“The proposed transaction will further consolidate the banking sector in Kenya and will create stronger “institutions” enabling KCB to play a bigger role in the financial inclusion agenda,” Oigara noted.

The KCB-NBK buy out is among the most recent mergers and acquisitions deals in Kenya , with the Central Bank of Kenya (CBK) and government pushing for more consolidations to create stronger financial institutions.

Another deal which is underway is the merger of the Commercial Bank of Africa (CBA) and NIC Group which has received shareholders’ blessings.

READ:How mergers are shaping up Kenya’s banking industry

Currently, there are 42 commercial banks and one mortgage finance institution-Housing Finance, serving the country which has a population of about 45 million people.

Compared to an economy like Nigeria which has over 150 million people with about eight strong banks, financial experts feel Kenya is overbanked.

Oigara recently said the number of banks operating in the country needed to shrink, suggesting the economy needs only 20 banks.

Meanwhile, KCB Group has assured its shareholders of a strong future, renewed investor confidence and improved performance across all businesses.

The Nairobi Securities Exchange (NSE) listed bank is East Africa’s largest commercial bank. Established in 1896 in Kenya, the bank has grown and spread its wings into Tanzania, South Sudan, Uganda, Rwanda, Burundi, with plans to commence full operations in Ethiopia where it currently trades through a representative. It has the largest branch network in the region of 258.