- South African Banks topped the list of the world’s top 500 most valuable banking brands in Africa according to Brand Finance Banking 2023 report.

- South Africa scooped the first top five spots in Africa headlined by First National Bank ranking at number 155 worldwide albeit a drop from 146 the previous year.

- Kenya’s Equity bank came in 6th position followed by National Bank of Egypt in 7th position while Nigeria’s Access Bank and Zenith Bank followed at 8th and 9th position respectively as Egypt’s Banque Misr closed the regional to ten list.

South African Banks topped the list of the world’s top 500 most valuable banking brands in Africa according to Brand Finance Banking 2023 report.

The report shows South Africa scooped the first top five spots in Africa headlined by First National Bank ranking at number 155 worldwide albeit a drop from 146 the previous year.

Other banks who made it to the top five in Africa list include Absa Bank that ranked number 158, Nedbank ranking at 204, Investec Bank at 209 and Capitec which was ranked number 262 globally.

Kenya’s Equity bank came in 6th position followed by National Bank of Egypt in 7th position while Nigeria’s Access Bank and Zenith Bank followed at 8th and 9th position respectively as Egypt’s Banque Misr closed the regional to ten list.

“This year, we interviewed 29,259 customers to assess 741 banking service brands across 5 regions and 39 markets. Since the beginning of the COVID-19 pandemic, the banking sector went through a digital transformation. Brands have focused on highlighting the innovative use of technology by creating sophisticated apps in which customers can use a wide range of banking services,” said, Carine Guillou Research Director, Brand Finance.

Other African banks who made it to the World’s top 500 most valuable banking brands’ list include Morocco’s Banque Populaire du Maroc, Kenya’s KCB Bank, Nigeria’s United Bank for Africa, Egypt’s CIB Bank, Nigeria’s GT Bank, South Africa’s Rand Merchant Bank and First Bank of Nigeria.

Brand Equity

“Brand Finance’s research has found that Trust is a dominant driver of choice. When considering banking services, customers are after guarantees that they can proceed with confidence. Other key drivers are Easy to deal with, Excellent website & apps and Great customer service. This suggests that investing in initiatives that facilitate quality interaction can drive customer acquisition – that is both online and face to face,” Guillou added.

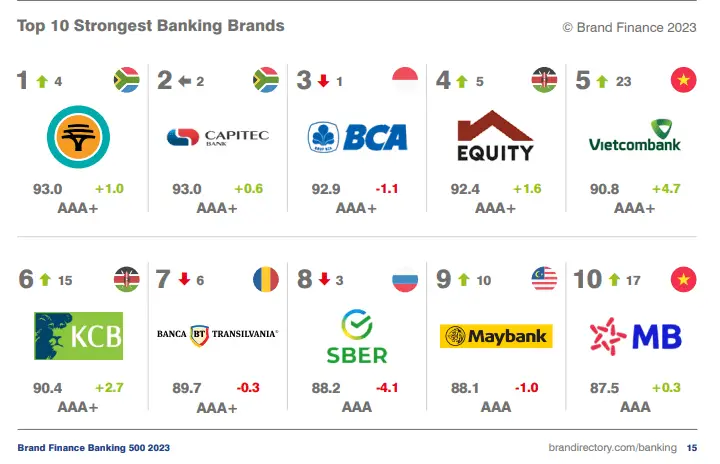

The report also ranked four African banks that include South Africa’s First National Bank and Capitec, and Kenya’s Equity Bank and Kenya Commercial Bank among the top 10 strongest banking brands globally

“In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 150,000 respondents in 38 countries and across 31 sectors,” the report says.

Chinese banking brands are subsiding in brand value with American brands quickly closing the gap. ICBC (brand value down 7% to US$69.5 billion) is the most valuable banking brand in the world, followed by China Construction Bank (brand value down 4% to US$62.7 billion) and Agricultural Bank of China (brand value down 7% to US$57.7 billion).

The report attributes the decline to the general slowdown of the Chinese economy caused by strict lockdown mandates and an ongoing housing crisis.

Growth of digital banks

According to the report, Silicon Valley Bank (brand value up 148% to US$2.8 billion) is the fastest-growing banking brand in the world, more than doubling in brand value this year.

The bank specializes in providing banking services for venture capital firms to support the start-up ecosystem. In 2021, the bank completed a merger with Boston Private and has rebranded to be called SVB Private. SVB actively invests in entrepreneurial ventures including fintech firms like Wise and new healthtech ventures that are disrupting the industry.

The value of Digital Banks in the report has also grown from US$795.6 million in 2022 to US$1,611.9 million in 2023 – an increase of 102.6 percent (US$816.3 million).

“Digital banks (also know as “neobanks”) have achieved success in the past few years by integrating the power of technology into banking. The fintech sector is growing globally with a number of service offerings in a competitive market. Digital bank brands like Tymebank and Discovery Bank in South Africa, Nubank (brand value up 110% to US$1.0 billion) in Brazil, and Maya Bank in the Philippines are disrupting the industry, according to our research these brands score highly in innovation and sustainability – two key drivers of customer choice,” the report explains.