- Equity Group has been given a life insurance license through its Equity Life Assurance (Kenya) Ltd

- The group said it will use the license to provide life insurance solutions to an underserved market

- Kenya’s insurance industry has continued to witness steady growth over the years, with the insurance market premiums currently being valued at approximately KSh 235 billion

Equity Group joins insurance sector

The Insurance Regulatory Authority (IRA) has issued a license to Equity Group to joins the insurance sector business under Equity Life Assurance (Kenya) Limited (ELAK).

Equity Group said the license will enable it to provide life insurance solutions to the underserved market and contribute towards the vision of Equity Group to transform lives and expand opportunities for wealth creation.

IRA said the new business entity is a fully-fledged business with separate structures and commercial arrangements in line with its regulations.

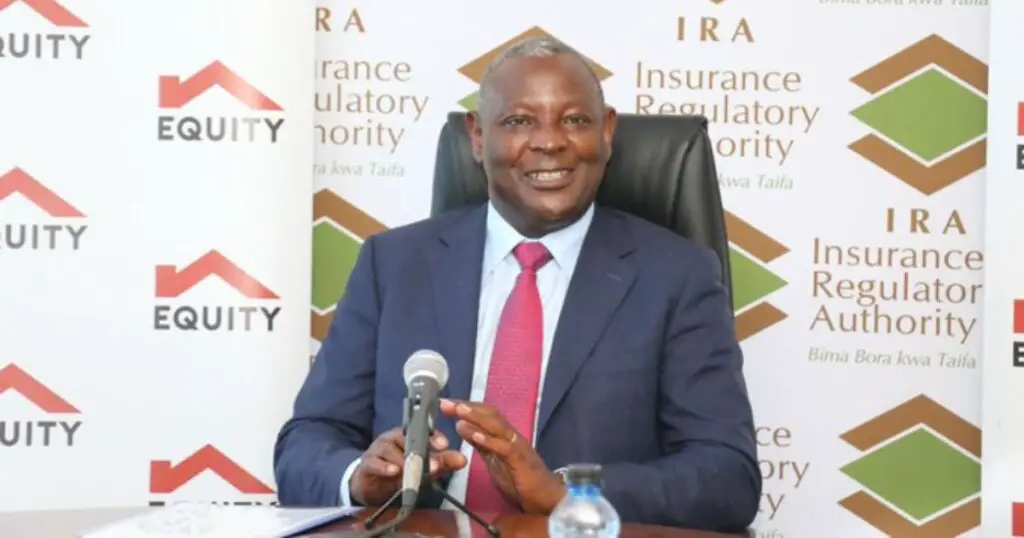

The Commissioner of Insurance and Chief Executive Officer (CEO) IRA Godfrey Kiptum reiterated that the diversification strategy and entry of Equity Group into the insurance market is proof that the insurance industry in Kenya continues to be attractive to investors.

“We continue to receive interests from foreign-based financial institutions ranging from brokers, insurers, re-insurance brokers and re-insurance companies looking for investments in the Kenyan Assurance market. This underscores the position of Kenya as a viable investment destination,” he said.

ELAK’s Managing Director and Principal Officer of ELAK Angela Okinda said the firm will provide products to most Kenyans who are signed to any insurance solution.

“Our commitment is to provide consumers with freedom and ease of access to insurance solutions, payment and placement of their insurance coverage, as well as support and advice during the life of the policy. ELAK will also ensure easy access to insurance solutions through multiple distribution channels. ELAK’s provision of insurance will be refreshingly different, innovative and very convenient,” she said.

Dr James Mwangi, Equity Group CEO and Managing Director said the licence comes when the economy is recovering from the impact of the COVID-19 pandemic.

He said the company plans to offer insurance to all categories of consumers and make insurance accessible, affordable and inclusive.

“We realised that the greatest threat to wealth creation is when disaster strikes and the family and entities have no fall-back plan except removing capital from their businesses to meet such expenses. The insurance business of ELAK will be based on simplicity, openness, transparency and trust,” he said.

Kenya’s insurance industry has continued to witness steady growth over the years, with the insurance market premiums currently being valued at approximately KSh 235 billion. The general business category, however, remains the sector’s key driver with long-term insurance premiums standing at KSh 102 billion, accounting for 43.4 per cent of the total premiums underwritten.

Data by Equity Bank shows that the insurance industry in Kenya is characterised by low penetration levels, currently estimated at 2.4 per cent.

What’s next for the insurance industry in Kenya?

This has been attributed to several factors, including poor or limited product portfolio, low or no awareness of insurance products, and low-income levels among the key consuming public.

Other factors include perceived low rate of returns for life insurance policies, cumbersome claim settlement procedures, lack of trust of insurance players, negative perception of providers/intermediaries and expensive premiums among others.

“The insurance business relies heavily on trust, and Equity has a well-defined history and support from the public, which is a key aspect for success in the sector. Kenya is ranked number 3 or 4 regarding insurance penetration in Africa, and many investors have taken an interest in the sector. We are happy to see a local player coming in to contribute to our growth,” Insurance Regulatory Authority Chairman Abdirahin Haithar Abdi said.

In a separate story, The Exchange Africa reported that Insurance premiums in Kenya went up by 19 per cent in the second quarter of 2021 to hit KSh 144.02 billion compared to KSh 121.04 billion in the second quarter of 2020.

IRA revealed that the general insurance business remained the largest contributor to industry insurance premiums, contributing 59.3 per cent of the total premiums at KSh 85.36 billion while long-term insurance premiums stood at Sh58.66 billion in the period under review.

According to the data, general insurance business underwriting results reduced significantly from a marginal profit of KSh 62.45 million in the second quarter of 2020 to a loss of KSh 1.46 billion in the second quarter of 2021 attributed to a high increase in loss ratios because of relaxation of restrictions that had been imposed on travel because of COVID-19 pandemic.

Claims incurred in the general insurance business amounted to Sh32.38 billion during the period under review, a 15 per cent increase from Sh28.08 billion reported in the second quarter of the previous year.

“The high premium volume classes of general insurance business contributed the largest proportions of incurred claims; medical (38.7 per cent), motor private (29.8 per cent) and motor commercial (22.8 per cent). Motor classes of insurance business comprised 52.7 per cent of total claims incurred compared to their contribution of 27.8 per cent of the total premium under general insurance business,” the report stated.

Why Kenya’s insurance sector is “rotten”